Rachel Reeves set to hammer motorists with hated pay-per-mile car tax changes in Budget

The Chancellor will deliver the Budget on Wednesday, November 26

Don't Miss

Most Read

Labour is planning to launch controversial new pay-per-mile car tax measures that could impact millions of drivers, despite the impact it would have on electric vehicle owners.

Reports suggest that the Chancellor is planning to introduce new pay-per-mile road pricing taxes to raise money for the Government.

According to The Telegraph, electric vehicle drivers will be hit with a new pay-per-mile tax, which is set to be announced in the upcoming Budget on November 26.

It is expected that the Government will levy a 3p per mile fee on top of other road taxes for electric vehicles.

The road pricing measures are set to be announced later this month, although they will be introduced in 2028, however, this is expected to be launched after a consultation.

Estimates suggest that electric vehicle owners will be charged an extra £250 a year once the measures are introduced.

The impact on electric car drivers could be severe, especially since EV drivers were required to pay tax for the first time this April, with the new standard rate requirements.

Owners of electric vehicles could also face additional charges when paying the Expensive Car Supplement if their vehicle costs more than £40,000.

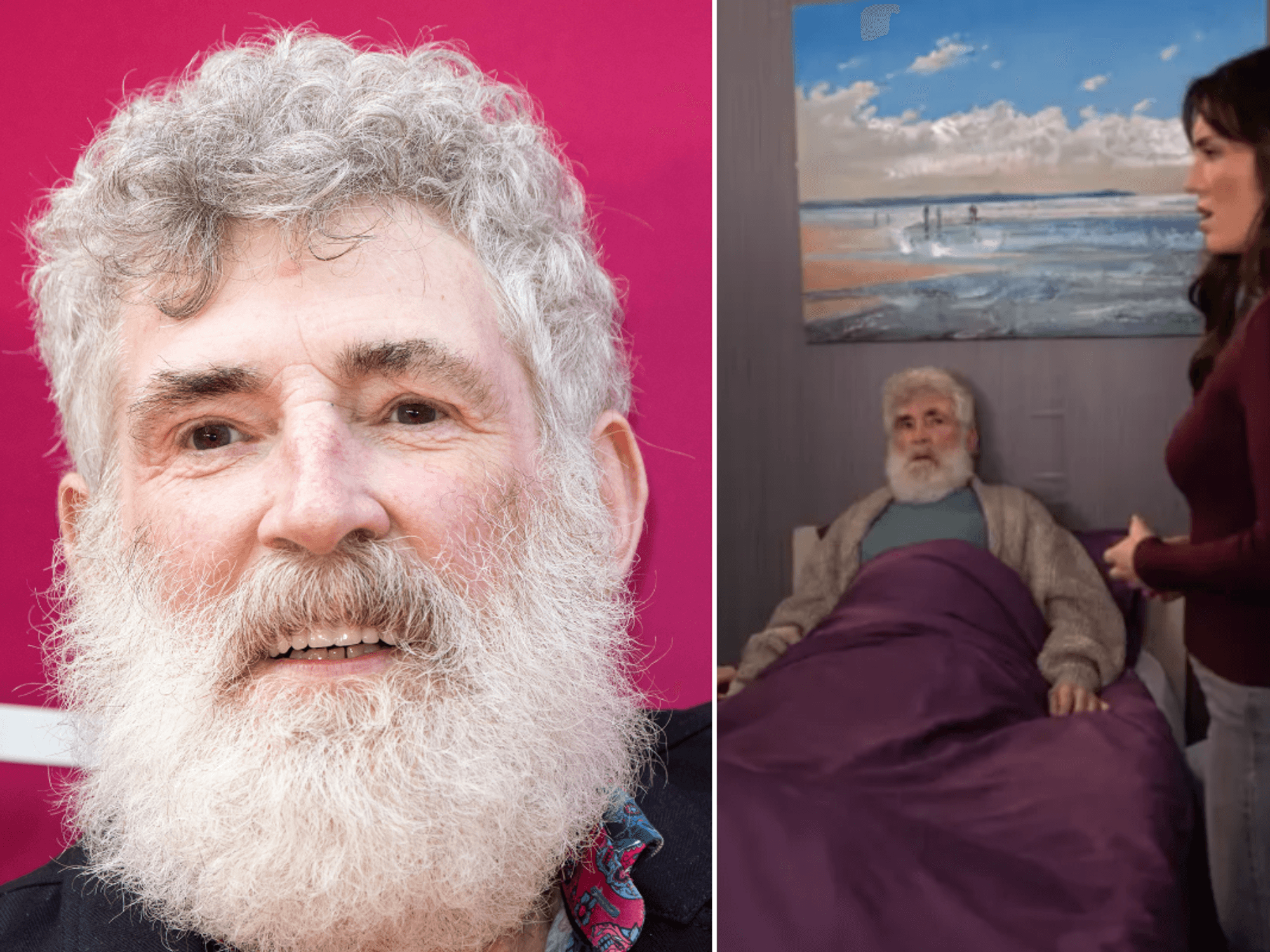

Chancellor Rachel Reeves is expected to give the green light to pay-per-mile car taxes

|GETTY

This is one of the largest changes made to the current tax regime, especially with the Treasury consistently denying that such a scheme would be introduced.

The move is expected to be introduced, considering the fall in revenue from fuel duty as more petrol and diesel motorists make the switch to electric vehicles.

Estimates suggest that petrol and diesel drivers currently pay an average of around £600 per year when paying for fuel.

However, the new rules could see many drivers angry, considering electric vehicles naturally attract a lower rate of tax, given the lower emissions they release.

LATEST DEVELOPMENTS

Reacting to the reports, Shadow Chancellor Sir Mel Stride said: "If you own it, Labour will tax it.

"It would be wrong for Rachel Reeves to target commuters and car owners in this way just to help fill a black hole she has created in the public finances," he told The Telegraph.

A form of pay-per-mile road pricing has been considered by multiple Governments in recent years as experts warn of serious losses when taking into account the rate of fuel duty paid.

Major organisations, including the Tony Blair Institute for Global Change, warned that the Government could face a shortfall of around £35billion if it failed to account for losses accrued when millions of drivers switch to electric vehicles.

The Ford Puma Gen-E is one of two Ford models eligible for the £3,750 Electric Car Grant incentive | FORD

The Ford Puma Gen-E is one of two Ford models eligible for the £3,750 Electric Car Grant incentive | FORDRoad pricing measures, such as pay-per-mile, have been controversial given the difficulties in issuing such measures, especially for those living in rural areas or even professional drivers.

Experts have hinted at supporting a pay-per-mile tax scheme for drivers, although issues have been raised regarding the outcome of such a scheme.

Some industry leaders have suggested giving rural drivers an additional allotment of "free" miles. This could see motorists receive 5,000 "extra" miles if they live in a rural area, since they live further away from typical goods and services.

A spokesperson from HM Treasury said: "The Chancellor makes tax policy decisions at fiscal events. We do not comment on speculation around future changes to tax policy.”