HMRC rule changes could have major impact on petrol, diesel and electric car drivers - 'Close the gap'

The new changes were introduced on September 1 as part of the HMRC's quarterly review of rates

Don't Miss

Most Read

Experts have praised the Government for making changes to HMRC rules, in addition to extending grants to help Britons get behind the wheel of electric vehicles.

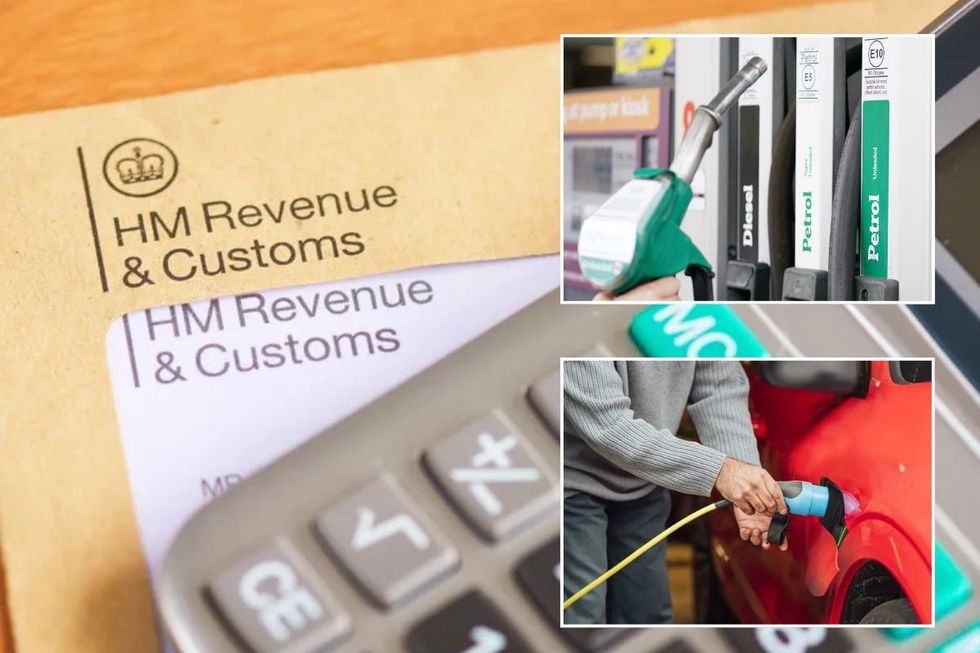

HM Revenue and Customs announced last month that it would be splitting up the advisory fuel rates for electric vehicles in a major policy change.

Advisory fuel rates are used to reimburse employees for business travel when they use their company cars, or if workers need to pay back the cost of fuel used for private travel.

The new rates were introduced on September 1 as part of HMRC's quarterly update, which takes place at the start of March, June, September and December.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

Experts have said the HMRC rule changes introduced on September 1 could benefit many businesses

|GETTY/PA

The latest update saw the advisory fuel rate for electric vehicles split into two separate categories - home charging and public charging.

This was done to differentiate the amount being paid by motorists, depending on how they operate their electric vehicles, especially as home charging becomes more popular for those with dedicated off-street charging options.

The new public charging advisory rate has been calculated using additional public charging price data from the Zapmap Price Index, as well as data from the Department for Energy Security and Net Zero (DESNZ) and the Office for National Statistics (ONS).

Prior to September, the flat electric rate per mile was seven pence. This has since been changed to eight pence for home chargers and 14 pence for public chargers.

Tom Rowlands, managing director of global EV solutions at Corpay, described the HMRC change as "positive news", adding that the distinction between costs would benefit many drivers.

He said: "For too long, drivers have been stuck with a flat rate that ignored the real price differences between plugging in at home and paying for public charging.

"Anyone who has tried to get a full charge at a motorway service station knows those costs climb fast, and this new structure goes some way to closing that gap."

The expert added that the Government's intention to extend the Plug-in Van and Truck Grant until 2027 was hugely beneficial for fleets and businesses looking to switch to zero emission vehicles.

LATEST DEVELOPMENTS:

Advisory fuel rates per mile from September 1, 2025

Petrol

Engines up to 1,400cc - Remains at 12 pence

Between 1,401cc and 2,000cc - Reduced to 14 pence

Over 2,000cc - Reduced to 22 pence

Diesel

Engines up to 1,600cc - Raised to 12 pence

Between 1,601cc and 2,000cc - Remains at 13 pence

Over 2,000cc - Raised to 18 pence

Liquefied Petroleum Gas (LPG)

Engines up to 1,400cc - Remains at 11 pence

Between 1,401cc and 2,000cc - Remains at 13 pence

Over 2,000cc - Remains at 21 pence

Electric

Home charger - 8 pence

Public charger - 14 pence

HMRC changed the advisory fuel rate rules for electric cars in the September update

| GETTYMr Rowlands said the changes show the Government is slowly adapting to the "realities fleets deal with every day".

He concluded: "The sooner reimbursement and grants reflect true costs, the easier it becomes for operators to commit with confidence to an electric future."

Advisory fuel rates for petrol and diesel are taken from the latest fuel prices published by DESNZ, while the LPG rate is taken from the UK average from the Automobile Association.

Electric car pricing data is also taken from car electrical consumption rates from the Department for Transport and annual car sales volumes to businesses.