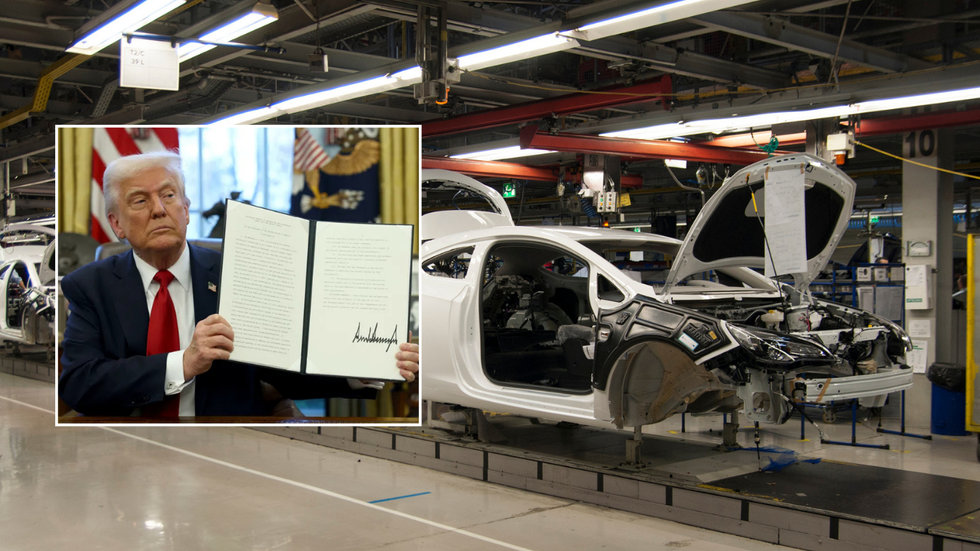

Trump’s tariffs cause major car brand to lose billions across supply chain impacting millions of jobs

General Motors expects to lose roughly $5billion due to the car tariff announced by Trump

Don't Miss

Most Read

Latest

General Motors has warned that it expects to take a near $5billion (£3.7billion) hit from President Donald Trump's controversial auto tariffs.

The US manufacturing giant said it now expects to offset "at least" 30 per cent of the tariff impact through "self-help" measures that include quickly adjusting its production and supply chain footprint.

Bracing for the impact of the tariff, GM has updated its adjusted earnings range to between $10billion (£7.5billion) and $12.5billion (£9.4billion), down from the earlier projection of $13.7billion (£10.3billion) to $15.7billion (£11.8billion).

The company said it is also reviewing its "entire footprint" as it adapts to the new trade policy environment, which could risk impacting the supply chain.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

General Motors is responsible for roughly one million jobs across its business

|GETTY

The impact includes an estimated $2billion (£1.5billion) in tariffs on finished vehicles from South Korea, where GM manufactures several value-priced models, including the popular Chevrolet Trax SUV.

In a letter to shareholders this week, CEO Mary Barra stated that despite the tariff challenges, GM's business remains "fundamentally strong" as it adapts to the new trade policy environment.

The company noted it gained almost two per cent of US market share year-on-year in the first quarter, with incentives remaining below the industry average and inventories staying low.

Barra also held discussions with Trump and his administration this week, which were seen as "very productive," praising the White House's recent move to temper tariffs on auto parts.

Barra said these actions advance "our shared goals of growing the US auto industry, which will be good for America in the long term".

In a letter to shareholders, Barra also expressed gratitude to Trump "for his support of the US automotive industry," particularly in helping US manufacturers.

"We have had continual discussions with the President and his team since before the inauguration," Barra wrote, noting the administration has "invested the time to understand what it takes to be successful in this capital-intensive and highly competitive global industry".

The company revealed it will also work with auto suppliers to boost their US-supplied content for GM vehicles, Barra indicated.

She noted that GM has "excess capacity" at manufacturing facilities in the US, making adjustments faster to implement at existing factories.

Trump's tariff policy includes a two-year grace period designed to encourage companies to move supply chains to the United States.

Under this policy, companies importing parts for vehicles assembled in the US would be able to offset 3.75 per cent of a vehicle's list price in the first year and 2.5 per cent in the second year.

However, Trump has not taken steps to mitigate a 25 per cent tariff on auto imports, which affects GM vehicles made in Canada and Mexico.

LATEST DEVELOPMENTS:

GM will face a $2billion hit from its manufacturing facilities in South Korea

|GETTY

After the two-year grace period, automakers will face a 25 per cent tariff on imported parts, raising concerns about vehicle affordability.

GM currently operates 50 US manufacturing plants and parts facilities across 19 states, including 11 vehicle assembly plants. "Almost one million people in this country depend on GM for their livelihoods, including our employees, suppliers, and dealers," Barra wrote.