Rachel Reeves axes luxury car benefit for thousands of drivers as welfare cuts aim to raise £1bn

WATCH: A new report reveals one in five cars is bought through a Motability scheme, which is exempt from VAT

|GB NEWS

The Chancellor confirmed that drivers on Motability schemes will lose their VAT exemptions from July 2026

Don't Miss

Most Read

Latest

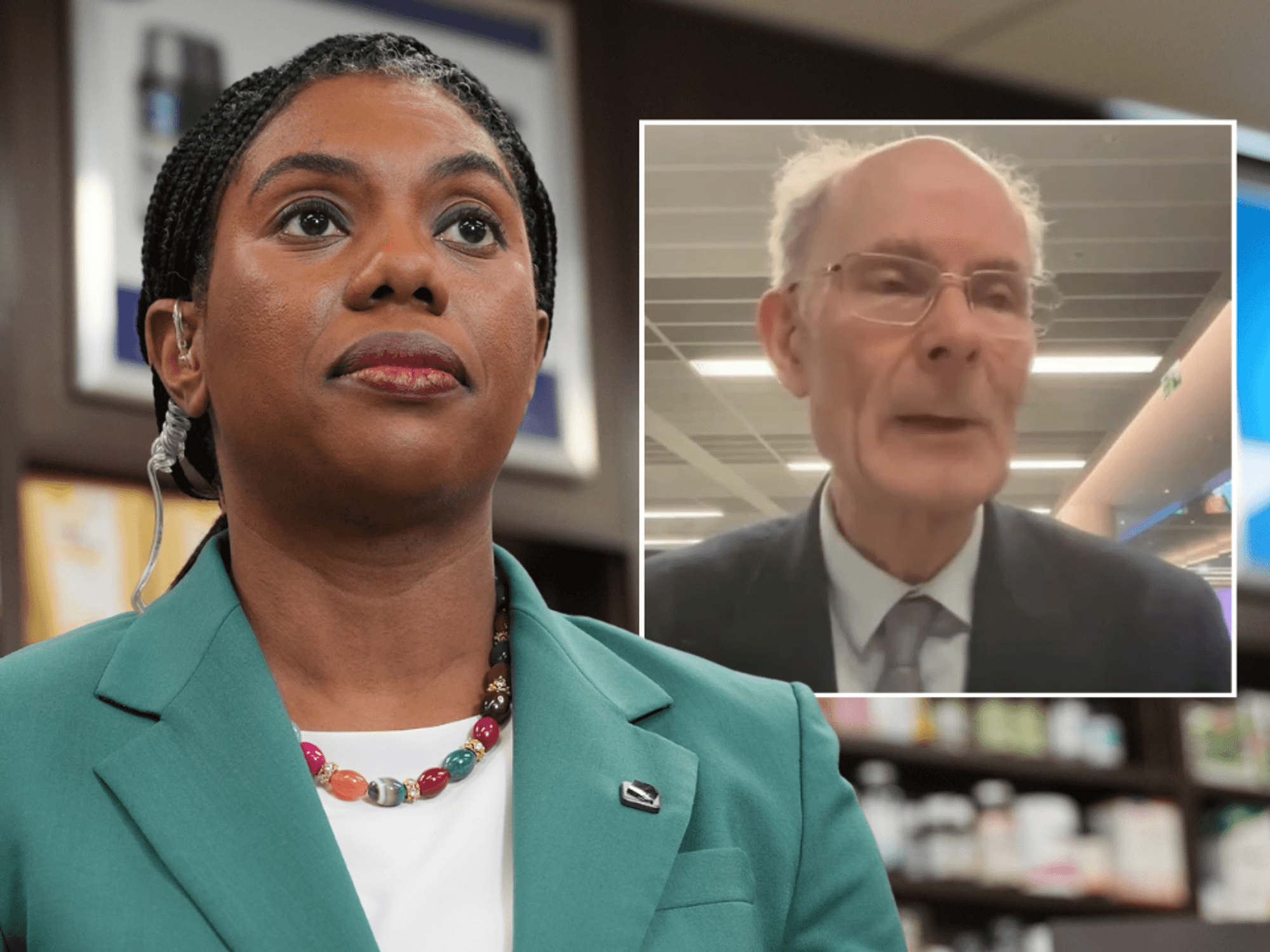

Chancellor Rachel Reeves has unveiled sweeping changes to the Motability scheme as part of the Autumn Budget, which could now see thousands of drivers taxed more next year.

The measures revealed yesterday by the Chancellor aim to target savings exceeding £1billion over five years through tax reforms and operational restrictions.

Rachel Reeves announced that VAT relief will be removed for top-up payments on more expensive vehicles, while Insurance Premium Tax will apply at standard rates to scheme insurance contracts.

Premium car manufacturers, including BMW, Mercedes-Benz, Audi, Alfa Romeo and Lexus already announced plans to be excluded from the programme, which currently serves approximately 860,000 disabled people across the UK.

TRENDING

Stories

Videos

Your Say

The reforms form part of wider welfare system changes aimed at ensuring the scheme focuses on its core purpose of supporting disabled people's independence while delivering better value for taxpayers.

From July 2026, new leases will no longer benefit from VAT exemption on advance payments made for higher-specification vehicles, with the standard 20 per cent rate applying instead.

Insurance Premium Tax will increase to the standard 12 per cent rate for car insurance arranged through the scheme, marking a significant shift from current exemptions.

However, vehicles specifically designed or substantially adapted for wheelchair or stretcher users will remain exempt from these tax changes, protecting those with the most complex mobility needs.

Chancellor Rachel Reeves has removed tax breaks for the Motability scheme in the Autumn Budget

| PA/MOTABILITYThe Treasury explained that the reforms will ensure that Motability "can continue to deliver for its customers" while removing subsidies for luxury vehicle provision beyond the scheme's core objectives.

Motability Operations confirmed that it would remove luxury vehicle brands from its offering to ensure the scheme remains focused on "practical, affordable mobility" for disabled users.

Overseas breakdown cover will be discontinued as part of the operational review, while lease mileage limits will be reduced to align more closely with commercial market standards.

Andrew Miller, CEO of Motability Operations, stated the changes would help manage rising costs that have affected the scheme since the pandemic, when strong vehicle resale values previously allowed for enhanced features and customer benefits.

LATEST DEVELOPMENTS

Luxury car brands have now begun removing the Motability scheme from their offering | MOTABILITY

Luxury car brands have now begun removing the Motability scheme from their offering | MOTABILITYThe organisation said it expects to complete its comprehensive review within six months, during which it will consult with customers about protecting essential services, including insurance, maintenance and breakdown assistance.

Current Motability customers will see no changes to their existing lease agreements, with payments remaining unchanged until contracts expire.

Motability Operations pledged to maintain core services including insurance, maintenance and breakdown cover while consulting customers throughout the transition period.

"We'll always get plenty of notice about any updates. We'll explain clearly what they mean for you," Mr Miller promised, acknowledging that changes could feel worrying for the scheme's users.

Motability helps people with disabilities lease cars | MOTABILITY

Motability helps people with disabilities lease cars | MOTABILITYIndustry experts have offered mixed responses to the reforms, acknowledging both fiscal pressures and concerns about maintaining support for disabled people.

Stuart Masson, editorial director of The Car Expert, noted that while focusing support on "locally built, reasonably priced models" could be positive, the scheme's target of 25 per cent UK-built vehicles by 2030 feels "underwhelming", given only seven per cent are currently British-made.

"Motability is vital for independence, but its rapid growth and inclusion of high-priced models have raised valid concerns about value for taxpayers," Mr Masson added.

Sue Robinson from the National Franchised Dealers Association confirmed the organisation would work with members "to understand the full implications for dealers and their customers" following the eligibility changes.