Stamp duty explained: Homebuyers could save £43,750 under Tory pledge to scrap levy - but there's a big catch

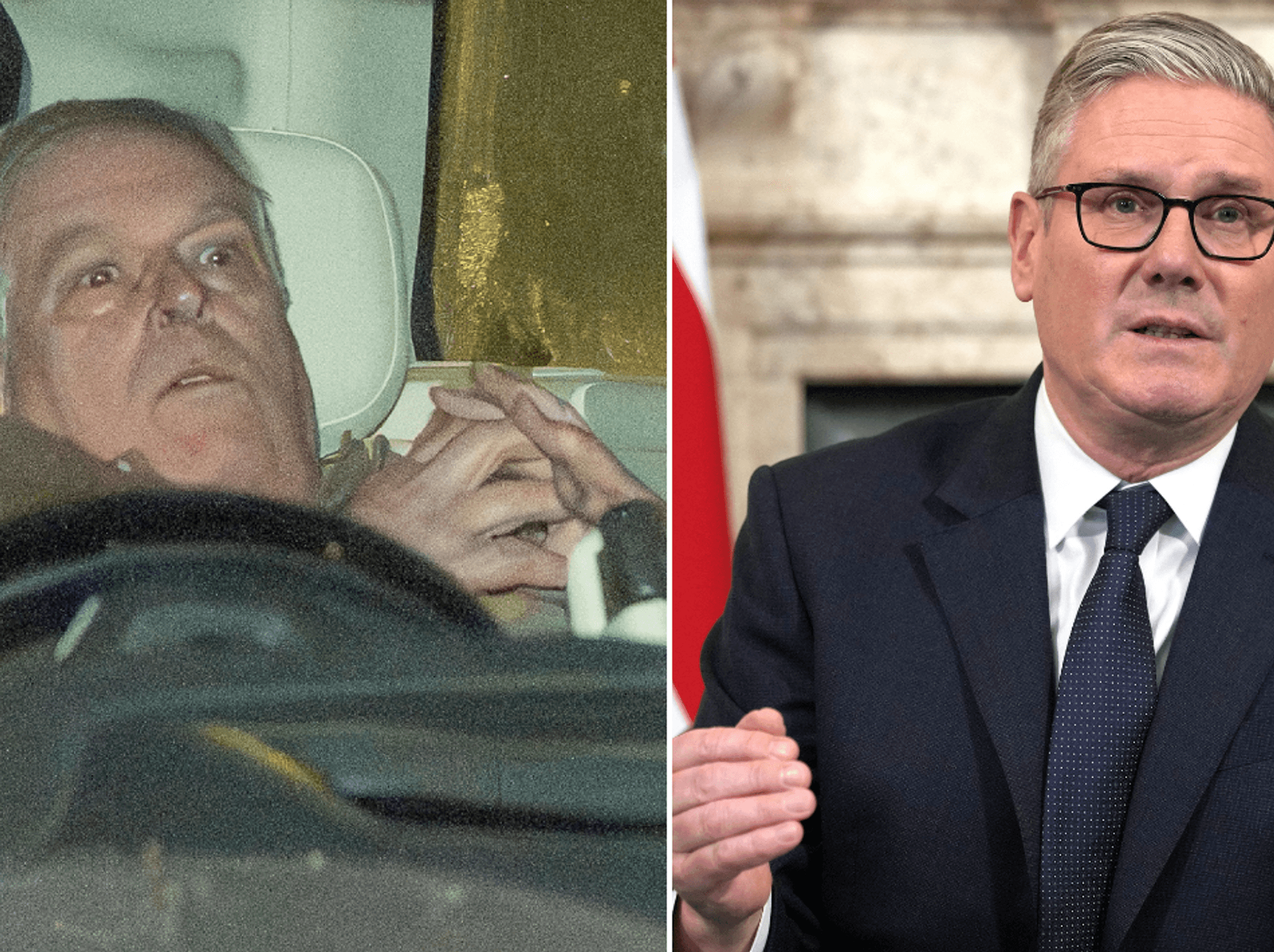

Kemi Badenoch unveils Conservative's plans to scrap stamp duty |

GBNEWS

Experts warn any plans to scrap stamp duty would also raise questions about lost Treasury revenue and possible tax rises elsewhere

Don't Miss

Most Read

Homebuyers could see savings of up to £43,750 under Conservative plans to abolish stamp duty on primary residences, as revealed by Kemi Badenoch at the party conference in Manchester.

The Conservative leader pledged to eliminate the property tax for main homes if her party wins the next election, though the levy would remain for additional properties and non-UK resident purchases.

The proposal would cost the Treasury an estimated £9billion annually, with approximately £4.5billion currently collected from main home transactions.

Ms Badenoch argued the measure would create "a fairer and more aspirational society" and help unlock homeownership dreams across all generations.

Commenting on the announcement Peter Stimson, director of mortgages at MPowered, told GB News: "The savings could and would be significant but mainly for larger properties given that stamp duty rates increase with property values."

TRENDING

Stories

Videos

Your Say

The current stamp duty framework requires buyers in England and Northern Ireland to pay tax on properties exceeding £125,000

| GETTYThe policy forms part of broader Conservative economic plans, with the party claiming nearly £50billion in spending cuts by 2029 would fund both tax reductions and deficit management.

What is stamp duty?

Homebuyers in England and Northern Ireland pay stamp duty land tax on properties costing more than £125,000, while first-time buyers are exempt on the first £300,000 of their purchase price.

In 2023-24 the tax brought in £8.6billion for the Treasury, and with the property market picking up, revenues are forecast to rise above £10billion in the current financial year.

Total stamp duty collections reached an estimated £13.88billion in 2024-25, though the majority came from second homes and investment properties rather than primary residences.

The tax operates on a tiered system, with rates escalating based on property values. This means wealthier buyers face proportionally higher charges on expensive homes.

How much could I save if stamp duty were abolished?

The financial benefits vary dramatically based on property values, with more expensive homes yielding substantially larger savings.

Purchasers of £500,000 properties who aren't first-time buyers would keep £15,000 in their pockets under the proposed changes.

For those acquiring £1million homes, the savings jump to £43,750, whilst buyers of £2million properties would benefit from a remarkable £153,750 reduction in costs.

Latest Development

Ms Badenoch argued the measure would create "a fairer and more aspirational society"

| GB NEWSMr Stimson explained the policy particularly favours "more affluent voters who are in the Tory heartlands" given the progressive nature of current stamp duty rates.

He said: "Abolishing stamp duty would clearly be popular BUT its needs to be remembered that First Time Buyers (FTBs) do not pay stamp on the first £300,000 of a property.

"So this could be argued is clearly aimed at more affluent voters who are in the Tory heartlands. It is especially beneficial for the wealthy given how stamp duty is staggered."

The staggered structure means wealthy purchasers would see the most significant financial advantages, with savings escalating sharply as property prices increase beyond the first-time buyer threshold.

Industry experts have cautioned that eliminating stamp duty could trigger unwanted house price inflation

| GETTYIndustry experts have cautioned that eliminating stamp duty could trigger unwanted house price inflation across the property market.

Whilst this would clearly be popular and give the property market a 'shot in the arm,' Mr Stimson warned "there is one potential consequence which may be unwelcome to buyers."

He said: "Every time we have seen government tinker with stamp duty, prices have risen, taking them even further away from average people."

Sarah Coles, head of personal finance at Hargreaves Lansdown, questioned whether the policy would prove transformative for buyers.

She said: "Having a tax bill when you buy a home doesn’t make the process any easier, but it’s not necessarily the biggest barrier someone faces when they buy and sell.

"Take someone downsizing, for instance, from a £750,000 property to a £300,000 one. In England and Northern Ireland, they’d pay £5,000 in stamp duty.

"It’s a fraction of what they’re likely to pay in estate agency fees, and sits along a huge range of costs from conveyancing to removals. It begs the question of whether removing the cost of the tax is a gamechanger.

Ms Coles emphasised that stamp duty sits alongside numerous other costs including conveyancing and removals, asking whether eliminating the tax represents a genuine "gamechanger" for prospective buyers facing multiple financial hurdles.