Labour to use 'jiggery-pokery' tax tactics in Autumn Budget amid hike warning: 'Out of their depth!'

Political Commentator blasts Labour as 'completely out of their depth' |

GB NEWS

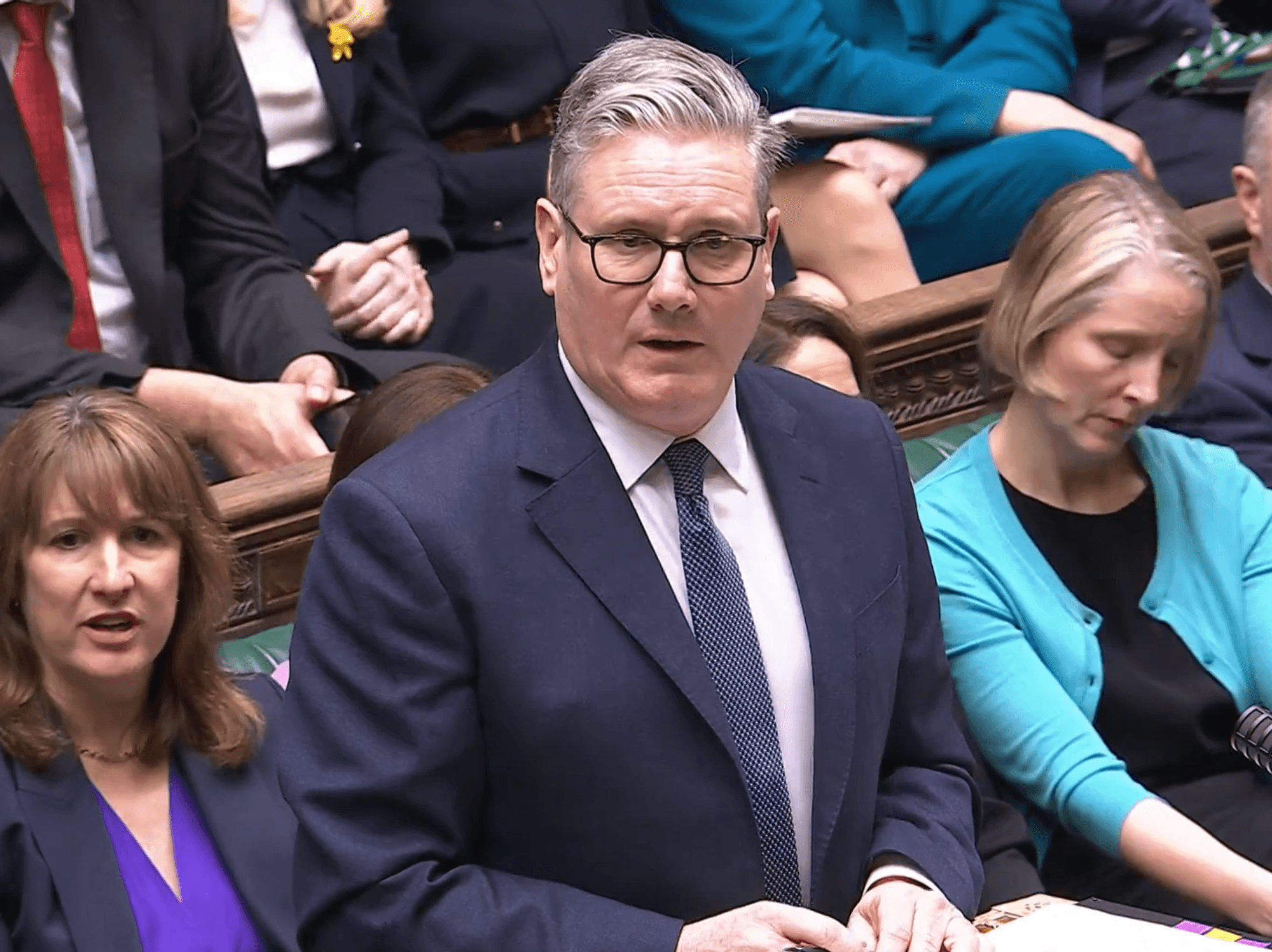

Chancellor Rachel Reeves refused to rule out further tax rises in the next Budget

Don't Miss

Most Read

Trending on GB News

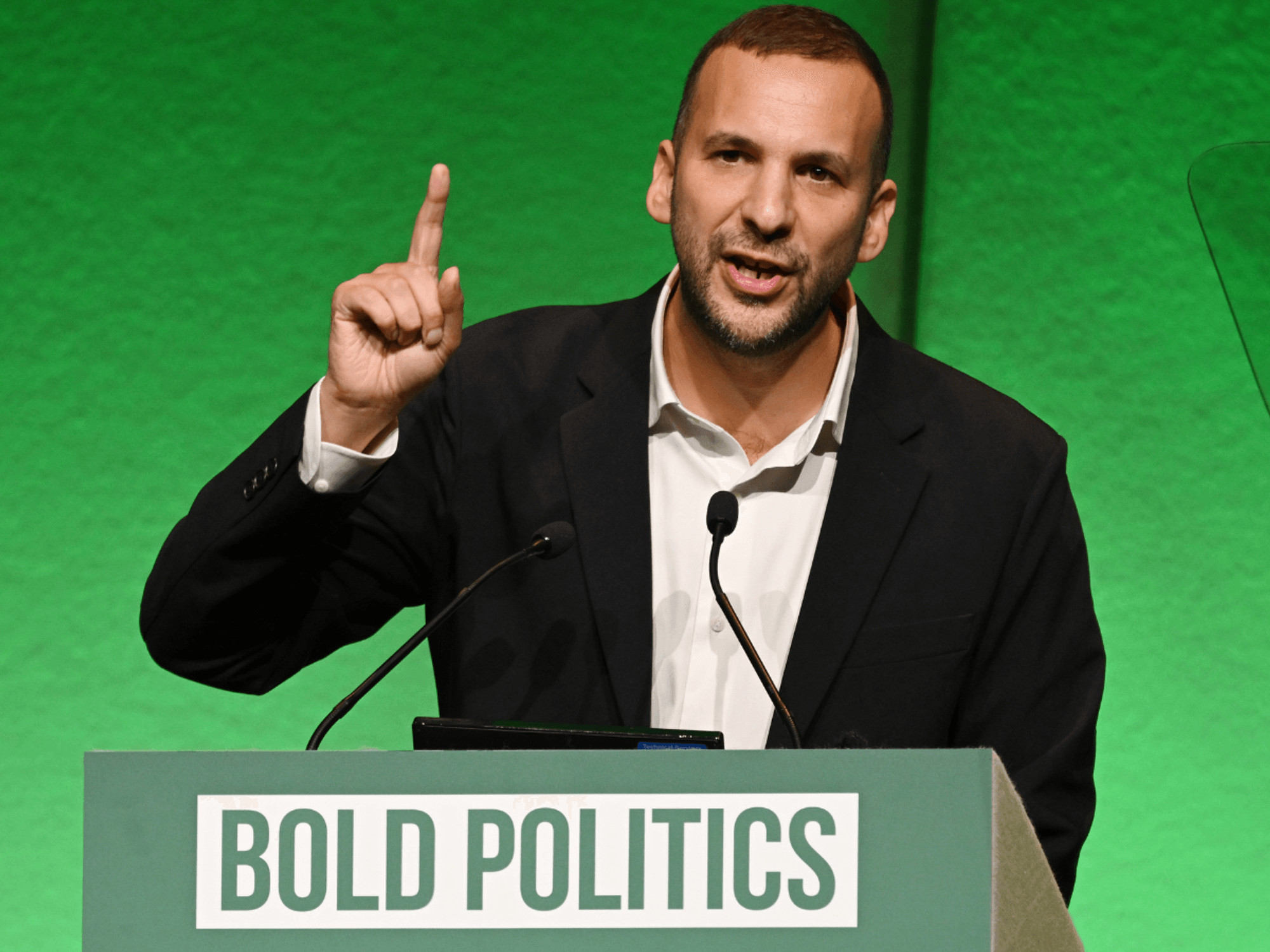

Political commentator Dr Mike Jones has warned that Labour will resort to "jiggery-pokery" with the tax system in the Autumn Budget, predicting potential rises of up to £40billion following the Government's retreat on benefits reforms.

Speaking to GB News, Dr Jones said taxes would have to increase due to flatlining productivity and less optimistic economic growth forecasts than Labour had anticipated.

He told GB News: "There's going to be a fiscal black hole for two reasons. Firstly, productivity has continued to flatline.

"Economic growth forecasts aren’t as optimistic as the Labour Party had expected. And, obviously, Labour has turned away from welfare reforms.

Dr Mike Jones has warned that Labour will resort to 'jiggery-pokery' with the tax system

|GB NEWS

"My personal view is that they won’t necessarily raise income tax, but they will freeze thresholds. There will also be targeted levies possibly on corporation tax, possibly on pensions.

"But there will be a lot of jiggery-pokery going on with the tax system. Ultimately, though, taxes will have to go up, unfortunately.

LATEST DEVELOPMENTS:

"Rachel Reeves has already raised taxes. In her October Budget last year, she increased them by about £40billion, which is the highest amount since the 1990s. The Labour Party are completely out of their depth.

"They haven't properly cut total managed expenditure and now the British taxpayer is going to pay the price."

The expert added that he "does have sympathy" for the Chancellor as she is "stuck between a rock and a hard place."

He said: "Her backbenchers are living in cloud cuckoo land. They really don’t pay attention to the bond markets, total managed expenditure, or the tax burden that’s been imposed on the UK. I mean, it’s at a 70-year high.

"So, yes, on a personal level, I feel sorry for her. But her tax-and-spend policies have imposed immense hardship on the British people farmers, pensioners, small business owners."

Chancellor Rachel Reeves has declined to rule out fresh tax increases, acknowledging that the Government's U-turn on its flagship welfare reforms was "damaging".

The Chancellor warned there would be "costs to what happened" after the Government abandoned plans to restrict eligibility for personal independence payment (PIP) following a backbench rebellion on Tuesday.

Chancellor Rachel Reeves refused to rule out further tax rises

| PA"It's been damaging. I'm not going to deny that," Reeves told reporters, adding that a review led by disability minister Stephen Timms would now determine the way forward.

The original welfare proposals were expected to save up to £5billion annually.

The Times reported that Reeves told Cabinet on Tuesday that any "low-hanging fruit" tax rises were off the table and that addressing the shortfall would be a "big challenge".

Institute for Fiscal Studies economist Ben Zaranko has warned that tax rises could match or exceed those implemented in last October's Budget, potentially reaching £20-40billion.

More From GB News