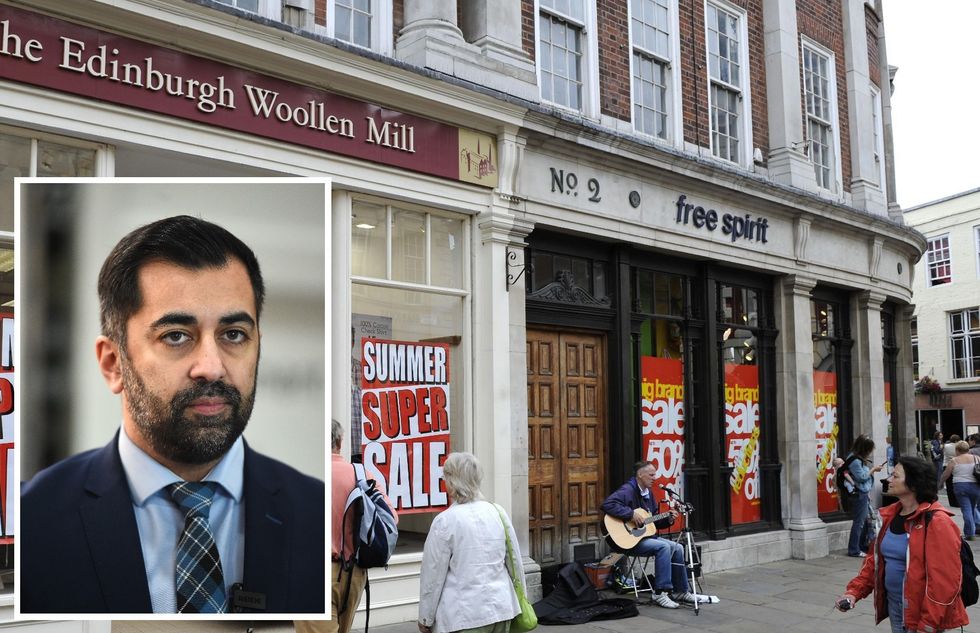

Cash-strapped SNP to punish high street businesses with biggest tax hike since 1999

The tax hike will impact 22,120 business premises in Scotland, including 4,550 shops

Don't Miss

Most Read

Latest

The SNP has been criticised after it emerged that the Scottish government plans to increase businesses taxes to their highest level since devolution.

This comes despite Humza Yousaf promising a "new deal" for business when he took over as First Minister last year.

Firms in Scotland are facing a 6.7 per cent increase of the intermediate and higher property rates - this is the biggest increase to the tax since 1999.

The increase will impact 22,120 business premises in Scotland, including 4,550 shops.

The SNP has been criticised after it emerged that the Scottish government plans to increase businesses taxes to their highest level since devolution

|PA

It also includes other sectors such as factories, cinemas, theatres, hotels, offices and pubs, putting them at risk of being forced to close their doors.

Tory MSP Liz Smith warned that the move would "hobble" business competitiveness in Scotland.

She warned: "The SNP government, thanks to UK funding arrangements, has all the money needed to fund the business rates relief that the rest of the UK gets.

“When Tom Arthur says he can’t pass that on to hard-pressed businesses because it would short-change the NHS, councils and other essential services, he’s openly admitting the SNP can’t manage public finances.

“All those things are entirely in their control, and Scottish firms are paying the price for their incompetence. That hobbles our competitiveness, and the enormous rises now piled on to try to sort the black hole in the SNP’s budget put Scottish companies at a huge disadvantage and stymie growth.”

The tax hike would add £10,000 to the bill of a large shop on Princes Street in Edinburgh, with a rateable value of £275,000.

David Lonsdale, the director of the Scottish Retail Consortium, also criticised the plan, warning: "Scottish retail sales have fallen in real terms in each of the past six months and the economic outlook is uncertain, yet the government seems determined to load new statutory costs on to businesses occupying medium-sized and larger premises.

"It will push up the cost of operating stores and place a question mark over the viability of some shops, undermining efforts at high street and town centre rejuvenation.

"The magnitude of this hike is starkly at odds with Scottish government promises to ‘use business rates to boost business’."

LATEST DEVELOPMENTS:

But a Scottish Government spokesman said: "In 2024-25, the basic property rate for non-domestic properties with a rateable value up to and including £51,000 will be frozen, delivering the lowest such rate in the UK for the sixth year in a row.

"The budget also ensures that over 95 per cent of non-domestic properties continue to be liable for a lower property tax rate than anywhere else in the UK. The Small Business Bonus Scheme offering up to 100 per cent relief from non-domestic rates ... will be maintained, the most generous relief of its kind in the UK."