Sarah Pochin questions why Labour 'slipped out' farm tax changes 36 hours before Christmas

Sarah Pochin questions why Labour 'slipped out' farm tax changes days before Christmas |

GB NEWS

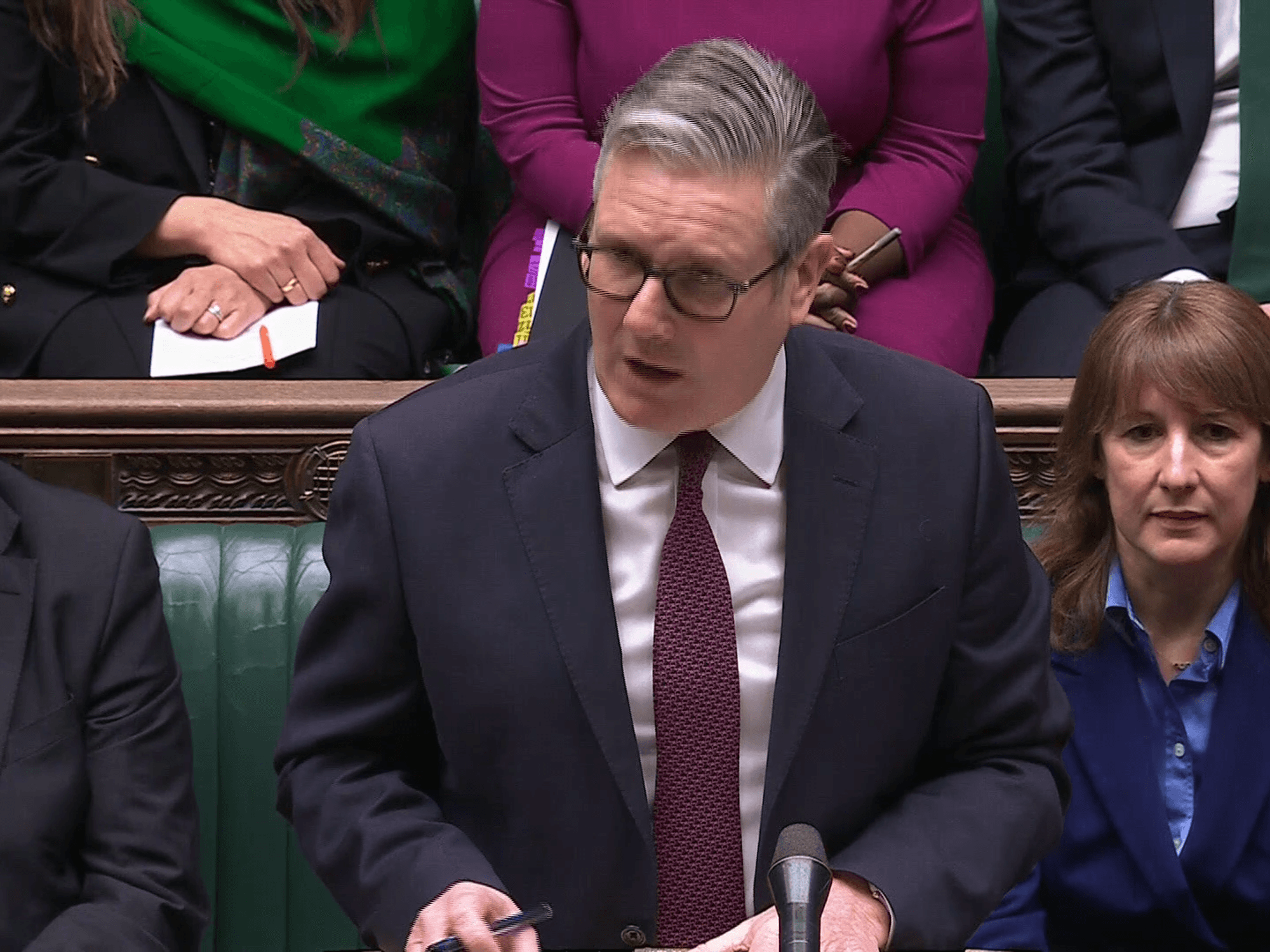

The Reform UK MP said farmers had endured more than a year of anxiety and uncertainty, accusing Sir Keir Starmer of failing to understand the pressure the policy

Don't Miss

Most Read

Trending on GB News

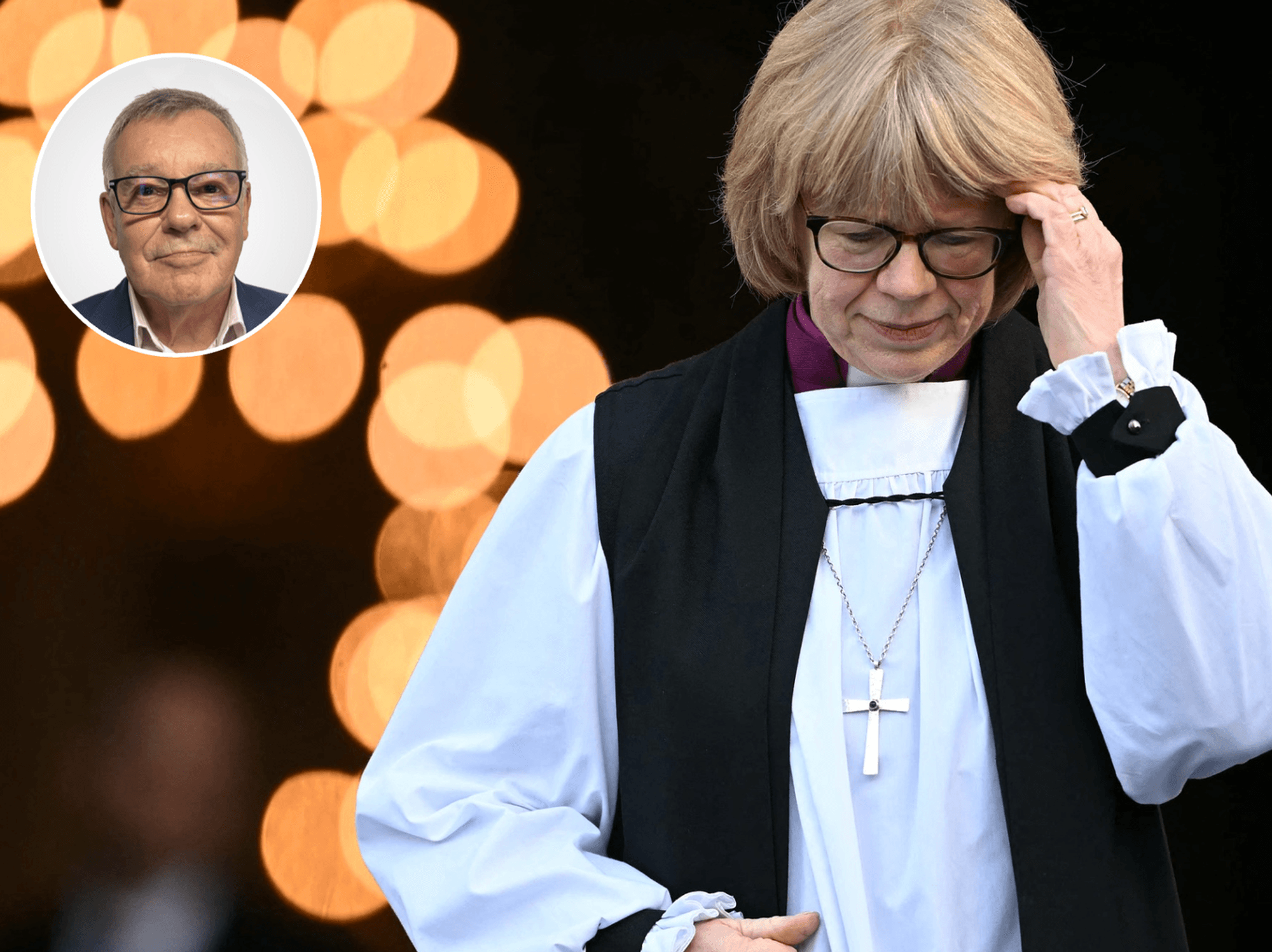

Sarah Pochin has questioned why Labour chose to quietly announce changes to the family farm tax just days before Christmas, describing the move as “ill thought through”.

The Reform UK MP said farmers had endured more than a year of anxiety and uncertainty, accusing Sir Keir Starmer of failing to understand the pressure the policy placed on working family farms.

Mrs Pochin told GB News: "Well, it’s interesting about what is being slipped out two or three days before Christmas, isn’t it?

"I mean, on the subject of the farmers, they’ve had 14 months of anxiety and huge stress. I’ve had my local farmers come and talk to me about it.

TRENDING

Stories

Videos

Your Say

"I had a farmer in tears, really heartbreaking stories. And it was unnecessary. It was an ill thought through policy.

"But coming back to what happens two or three days before Christmas, I mean, since Parliament closed on Thursday, we’ve had a leak of the Islamophobia definition.

"Now we’ve had this come through, no end of things are starting to be slipped out just before Christmas because they think the press is on a wind-down, the media is on a wind-down, opposition are on a wind-down.

"I don’t know why they’ve decided to do this. But what I would say is, I welcome it, but it is only a partial U-turn, and there should never be an attack on British farming.

Sarah Pochin shared her thoughts on Labour's climbdown

|GB NEWS

"It is the bedrock of our society. I want to see British food on British tables."

The comments came just hours after the Government confirmed it will raise the inheritance tax threshold for Agricultural and Business Property Reliefs from £1million to £2.5million from April 2026.

The announcement follows months of sustained pressure on Labour from farmers and business groups after changes set out in last year’s Budget.

Ministers said the decision came after listening to concerns over reforms to Agricultural Property Relief and Business Property Relief introduced in 2024.

LATEST DEVELOPMENTS

A 'save our farms' banner at the farmer protests in London | GETTY

A 'save our farms' banner at the farmer protests in London | GETTY

They added that the revised threshold is intended to shield more farms and businesses, while preserving the principle that the largest and most valuable estates should not receive unlimited inheritance tax relief.

By increasing the threshold, far fewer farms and business owners are expected to face higher inheritance tax bills, with the reforms now more narrowly targeted at the largest estates.

Under the revised plans, the number of estates claiming Agricultural Property Relief — including those also receiving Business Property Relief — affected in 2026–27 is set to fall from 375 to 185.

Ministers said the changes will substantially reduce the number of families impacted, with many expected to see their inheritance tax liabilities cut by hundreds of thousands of pounds.

Environment Secretary Emma Reynolds said: "Farmers are at the heart of our food security and environmental stewardship, and I am determined to work with them to secure a profitable future for British farming.

"We have listened closely to farmers across the country and we are making changes today to protect more ordinary family farms.

"It’s only right that larger estates contribute more, while we back the farms and trading businesses that are the backbone of Britain’s rural communities."

More From GB News