Rachel Reeves' Budget will have us all tearing our hair out. But there is one silver lining - Nigel Nelson

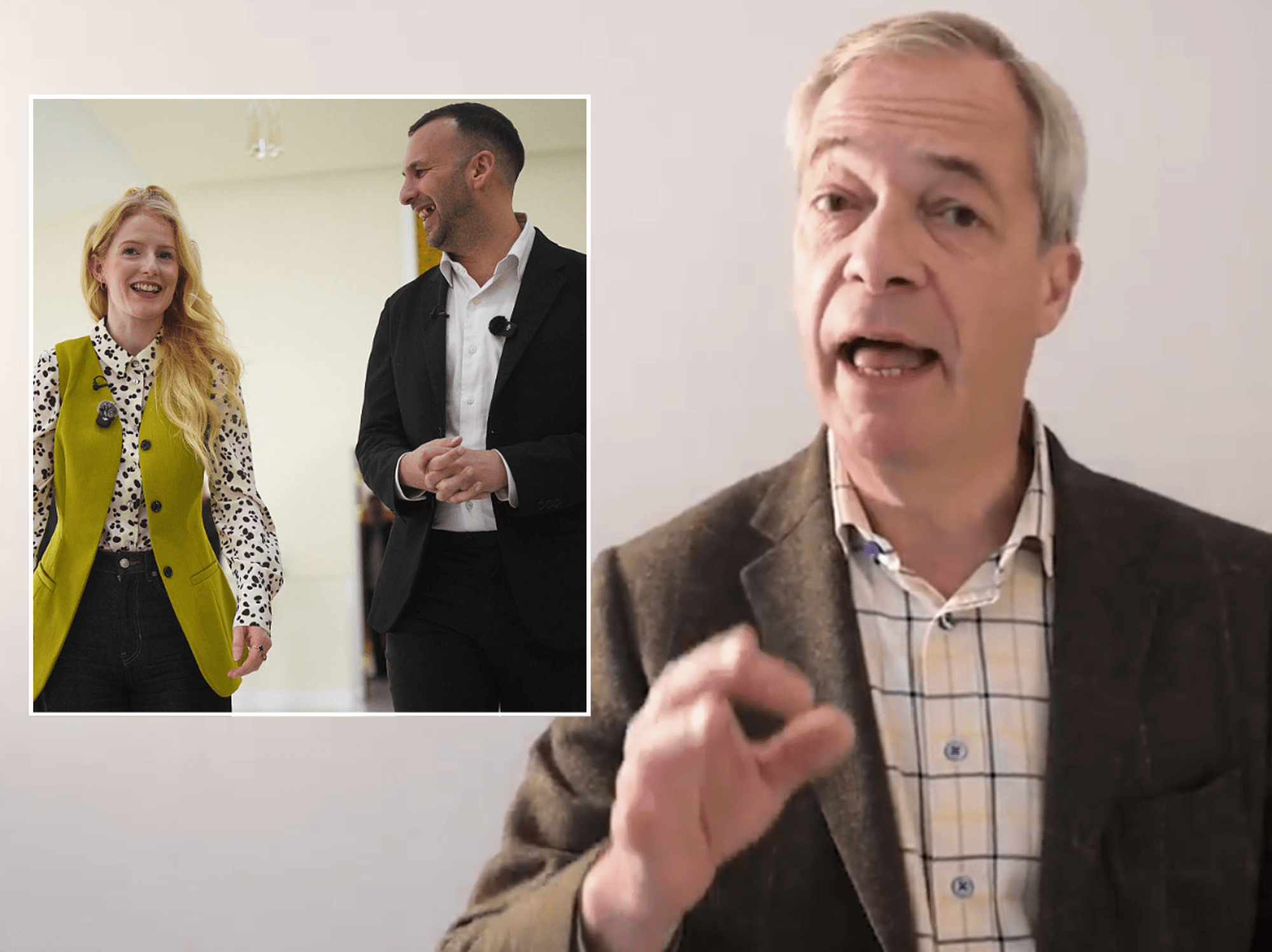

GB News Political Correspondent Olivia Utley explains what taxes Rachel Reeves may raise in the upcoming budget and the political impact of it on the Labour Government. |

GB

Cutting national insurance is the way to go, writes Fleet Street's longest-serving political editor

Don't Miss

Most Read

Trending on GB News

My seat up in the House of Commons press gallery looks straight down onto the tops of the heads of prime ministers when they speak from the despatch box.

This perch allowed me to monitor the progress of David Cameron’s bald spot over the years, and read Gordon Brown’s briefing notes written in very large, black print for his one good eye.

It also means I am an expert on chancellors’ hairstyles as they unveil budgets. And I’ll be checking out Rachel Reeves’ locks when she delivers hers later this month.

She promises the kind of event which will have us all tearing our hair out. There has been much speculation over which taxes will rise, much of it, I suspect, encouraged by the Treasury to muddy the waters. So many tax hikes have been mooted that the Chancellor could fill her £20billion black hole several times over.

Labour leftie MPs favour a wealth tax. And it has some merit. A two per cent levy on the 20,000 people in this country worth more than £10million would raise £24billion.

Critics say they would just up sticks and leave, making Britain poorer. But then they said the same thing when Ms Reeves gave rich non-doms a whacking.

Some did pack their bags, but according to early HMRC payroll figures, 60,000 stayed. Which means the Chancellor is on track to hit her £10billion target over two years.

We won’t know exactly how successful this has been until non-doms file their 2024-5 tax returns, and like the rest of us, they have until the end of January to do that.

The wealthy are wealthier than they have ever been, with the 200 families with the most bunce now worth £700billion compared to £42billion in 1989 when the Sunday Times Rich List was first published.

Rachel Reeves' Budget will have us all tearing our hair out. But there is one silver lining - Nigel Nelson |

Rachel Reeves' Budget will have us all tearing our hair out. But there is one silver lining - Nigel Nelson | Getty Images

Back then, the Queen was in first place. Now the King is 238th. But Ms Reeves has already indicated she will leave the fattest fat cats alone.

Which doesn’t give her many good choices. I have said repeatedly that I think it was a mistake to rule out increases in income tax, VAT and employee National Insurance in Labour’s election manifesto.

It meant she had to squeeze particular groups of taxpayers to fill her coffers – farmers and parents with kids at private schools. They feel understandably aggrieved at being singled out while their neighbours get away Scot free.

There are suggestions she will hit gamblers, and that’s worth a punt at the bookies. A rise in general betting duty, a winnings tax or harmonising the charge on in-person and online slot machine games are all a fair bet.

After all, gambling is a luxury. Smokers are taxed at 80 per cent and beer drinkers at 30 per cent, so why, the argument goes, should gamblers get off lightly?

The Resolution Foundation think tank says a Sugar and Salt Tax of £4/kg on sugar and £8/kg on salt would raise £3.5billion – and save a few lives into the bargain. It would also be inflationary, so higher odds on this one.

In an unusual pre-Budget speech to soften us up for tax rises and calm the markets, the Chancellor said she wanted to spend more on reducing NHS waiting lists, the national debt and the cost of living.

She added: “We will all have to contribute to that effort. Each of us must do our bit for the security of our country and the brightness of its future.”

Note the “all” and the “each of us”. Not specific groups any more, but all of us. And that, of course, means income tax. If Ms Reeves raised it by 2p and cut NI by the same amount, she could hoover up £6billion and claim she has spared “working people”. Better-off pensioners and landlords don’t pay NI and would cop the extra income tax.

But the Chancellor would have a bucketful poured over her for breaking a manifesto commitment, and shadow Chancellor Mel Stride wonders whether she’s winding us up, so we breathe a sigh of relief when it doesn’t happen.

Should she go ahead, there is a silver lining to this storm cloud – it's the easiest tax to cut just before the next General Election.

Our Standards: The GB News Editorial Charter

More From GB News