Rachel Reeves is edging this country towards an economic doom-loop, says Jacob Rees-Mogg

Jacob Rees-Mogg: The country is heading towards an economic doom loop |

GB NEWS

GB News host and former Tory minister Jacob Rees-Mogg has painted a bleak picture of what is to come for Britain

Don't Miss

Most Read

Trending on GB News

Rachel Reeves gave her main platform speech at the Labour Party conference today.

The Chancellor promised to end youth unemployment, give every school a library, save British steel, raise wages, and invest in rail and the NHS with a free Terry’s chocolate orange for everyone at Christmas.

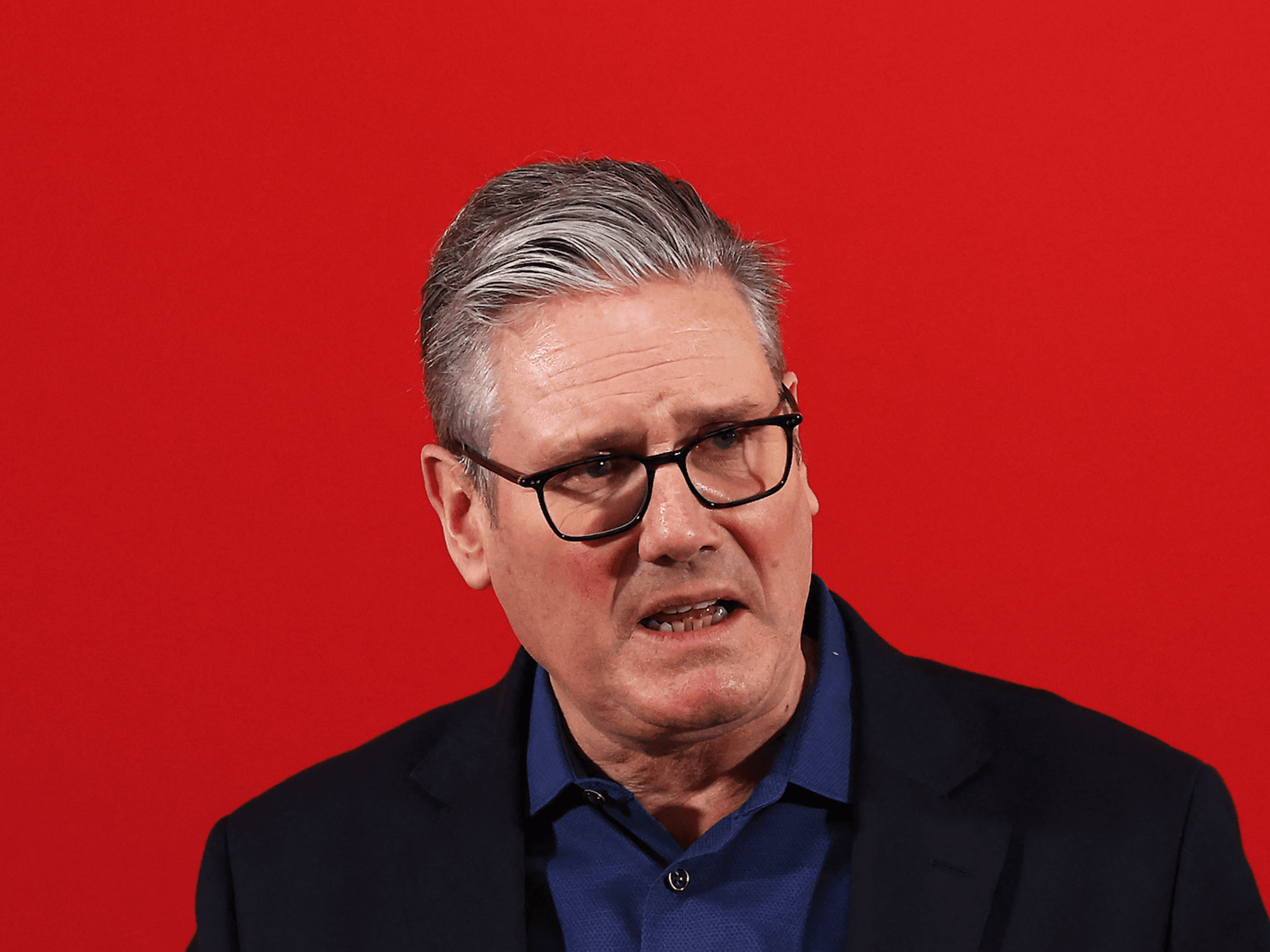

Jacob Rees-Mogg has hit out at the Chancellor

|GB NEWS

But Britain is in serious economic trouble. Productivity is low, growth is stagnant, and Government debt is at a record high.

The country is edging toward an economic doom-loop, and the Government has no clear way out.

TRENDING

Stories

Videos

Your Say

Spending billions without the means to fund promises has consequences.

Inflation and interest rates on Government debt have been rising and may continue to rise.

The Chancellor claims wages have risen more in ten months than in fourteen years under the Tories – but inflation means real wages are not keeping up.

Subsidies for steel, investments in rail, and breakfast clubs are essentially trivial, elastoplast measures. They do not fix the deeper problems: falling productivity, shrinking industry, and growing reliance on borrowing.

Jacob fears Rachel Reeves is set to unleash tax hikes

| GB NEWSEvery pound spent must strengthen the economy and boost productivity.

Public sector productivity is falling.

Health alone has lost £22 bn worth of productivity since 2019. Overall losses could reach £40 bn. The private sector underperforms too, as high-productivity industries close and energy-intensive sectors shrink, replacing domestic production with imports.

Without major changes, productivity is unlikely to improve.

UK productivity grew 2.2 per cent annually before 2008. From 1997 to 2024, it averaged a meagre 0.7 per cent. Forecasts now show it rising from 100 in 2019 to 106 by 2029, with annual growth of only 1.25 per cent.

Labour’s vision relies on slogans: “Have faith,” and “We’ll deliver.” But slogans do not create jobs or stop debt from rising.

Continuing to promise more than the Government can deliver will mean higher taxes, stagnant growth, and rising debt.

Higher taxes always backfire.

History shows that as rates rise, people work less, invest less, or those with capital simply leave.

Today we learn that a quarter of wealthy individuals are considering leaving Britain as a result of Labour’s tax raids – and fears of more in November’s budget.

Arthur Laffer argued through his famous Laffer curve that setting tax rates too high will reduce revenue. High income tax discourages work and drives people out of the country.

Capital Gains Tax receipts have fallen for two years after successive reductions in the tax-free allowance. Owners of shares and second homes are avoiding selling, as replacement assets must perform much better to justify the tax.

Ireland collects three times as much business tax per person – a direct result of lower business rates.

Revenue from alcohol duty on spirits has also fallen after the last budget raised rates.

Short-term gains from higher National Insurance come at the cost of fewer jobs, lower investment, and higher long-term spending pressures. Further hikes on property, savings, or carbon risk the same cycle.

Britain needs a Government that faces economic reality.

It must cut waste and focus on growth, manage the economy responsibly and make investments that last.

More From GB News