China's economy hit by huge new blow as credit rating slashed by major agency

The downgrade comes as China tries to move away from its crumbling property sector

Don't Miss

Most Read

Latest

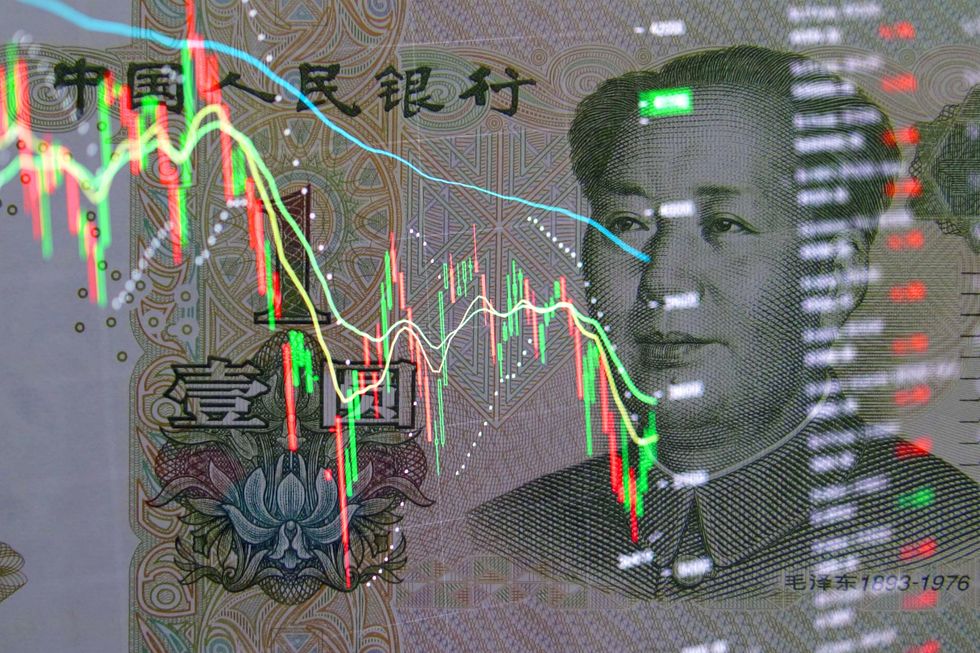

A ratings agency has slashed China’s debt outlook from stable to negative, adding that Beijing will continue to grow its financial woes as the country looks to move away from its dependence on the property sector.

Fitch said that it had revised its credit rating to reflect the “increasing risks to China’s public finance outlook” as the country “contends with more uncertain economic prospects”.

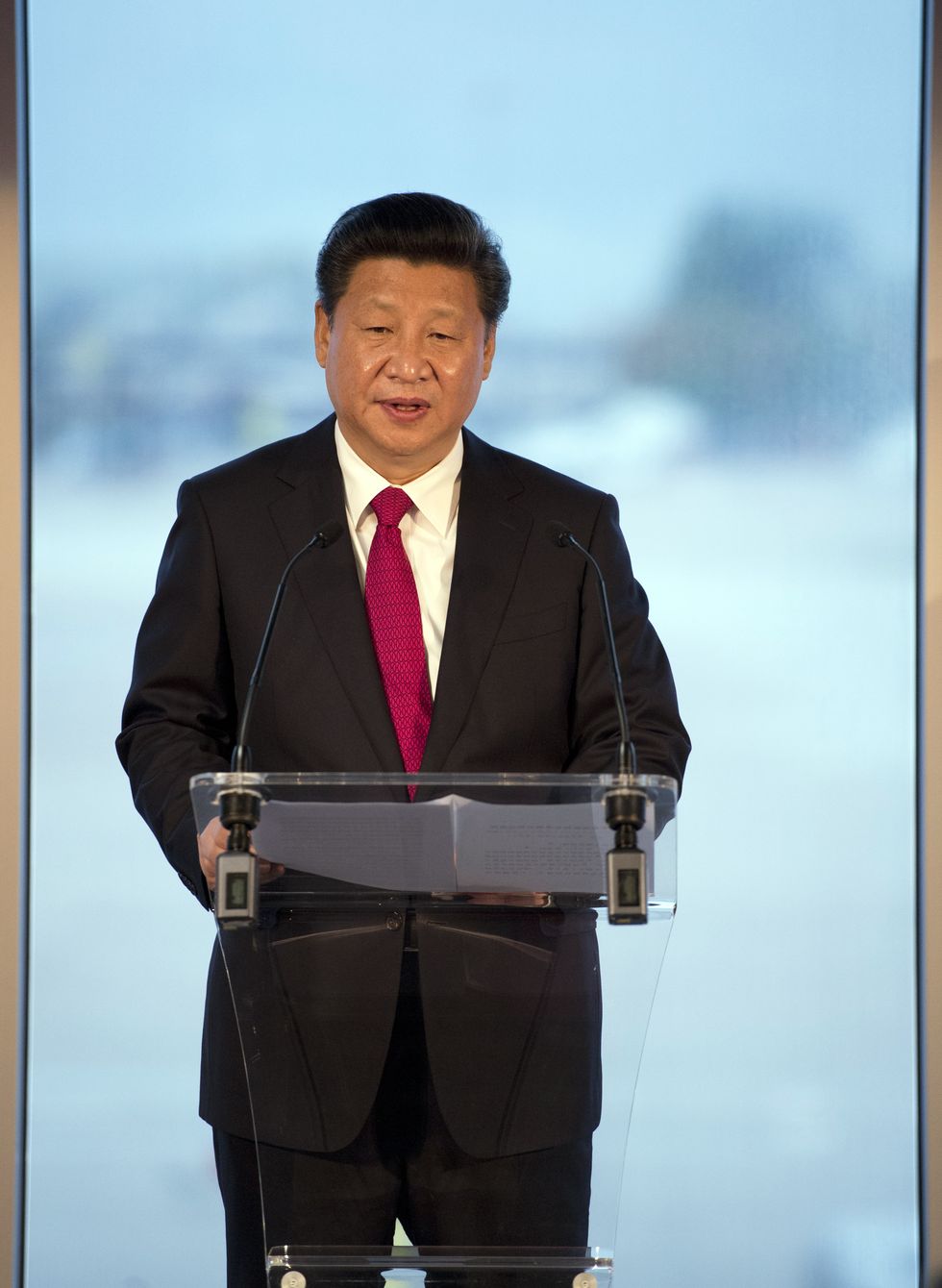

The downgrade comes amid an ongoing crisis in the country’s property market, which has been facing a huge squeeze since 2021 when the government introduced measures to curb the amount of money large developers could borrow.

Two of the biggest developers, Evergrande and Country Garden, have a collective debt of $500billion. The former was recently ordered to liquidate by a Hong Kong court.

A major credit agency has slashed China's rating, in another blow to Beijing's economy

|Getty

Fitch said that China’s economic prospects were doubtful as they try to move away from “property-reliant growth”.

It added: “Wide fiscal deficits and rising government debt in recent years have eroded fiscal buffers from a ratings perspective.”

The agency predicts that the general government deficit will rise to 7.1 per cent of gross domestic product in 2024, increasing from 5.8 per cent in 2023.

Although it lowered its outlook from “stable”, which indicates a downgrade, Fitch confirmed China’s issuer default rating was an A+.

LATEST DEVELOPMENTS:

It comes as Chinese markets have suffered a $7trillion fallout since 2021.

Beijing responded to the downgrade, stating that Fitch had failed to account for the role of fiscal policy in shoring up growth, which helps to steady debt burdens.

“I think the agency got the logic backwards,” said Hao Hong, chief economist at Grow Investment Group. “There are good debts and bad debts. At this stage, if the government expands its fiscal budget deficit then it will actually improve the economic outlook.”

Gary Ng, Asia-Pacific senior economist at Natixis, commented on the downgrade.

Chinese markets have suffered a $7 trillion fallout since 2021

| PAHe said: “Fitch’s outlook revision reflects the more challenging situation in China’s public finance regarding the double whammy of decelerating growth and more debt.

“This does not mean that China will default any time soon, but it is possible to see credit polarization in some LGFVs (local government financing vehicles), especially as provincial governments see weaker fiscal health.”

The US-based agency’s announcement mirrored a similar notice by Moody’s Investors Service in December, when they downgraded Beijing’s ability to repay borrowing from a stable outlook to a negative one.

It claimed the ripple effects from a crisis in the property sector would undermine efforts to revive China’s economy. Moody’s warned Beijing would need to bail out local and regional governments and state-owned enterprises which were struggling with ever-increasing debts.