China economic collapse like '2008 global crash on STEROIDS' as warning issued that crisis will get 'much worse'

It comes as the country's real estate sector was "too debt-reliant"

Don't Miss

Most Read

Latest

A top asset management firm has warned China's economic crisis is going to "get much worse."

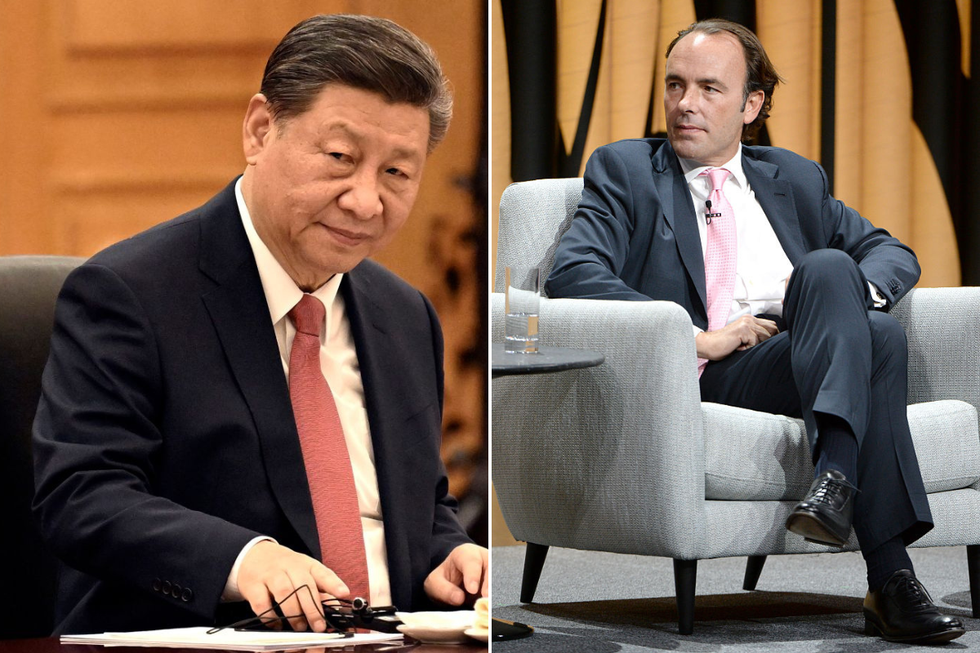

Hayman Capital founder Kyle Bass has warned that President Xi's overreliance on real estate has sent its economy tumbling toward 2008-era financial conditions.

It comes as Chinese markets have suffered a $7 trillion fallout since 2021.

Over the last few months, Beijing authorities have publicised efforts to stem these outflows, though confidence has yet to pick up.

Hayman Capital founder Kyle Bass has slammed President Xi's economy

|Getty

Speaking on CNBC, he said: "This is just like the US financial crisis on steroids.

"They have three and a half times more banking leverage than we did going into the crisis. And they've only been at this banking thing for a couple of decades."

He said that the years of double-digit growth China enjoyed prior to the pandemic were made possible by an unregulated real estate market, adding that the market was leaning too heavily on debt to expand.

He said: "The basic architecture of the Chinese economy is broken."

LATEST DEVELOPMENTS

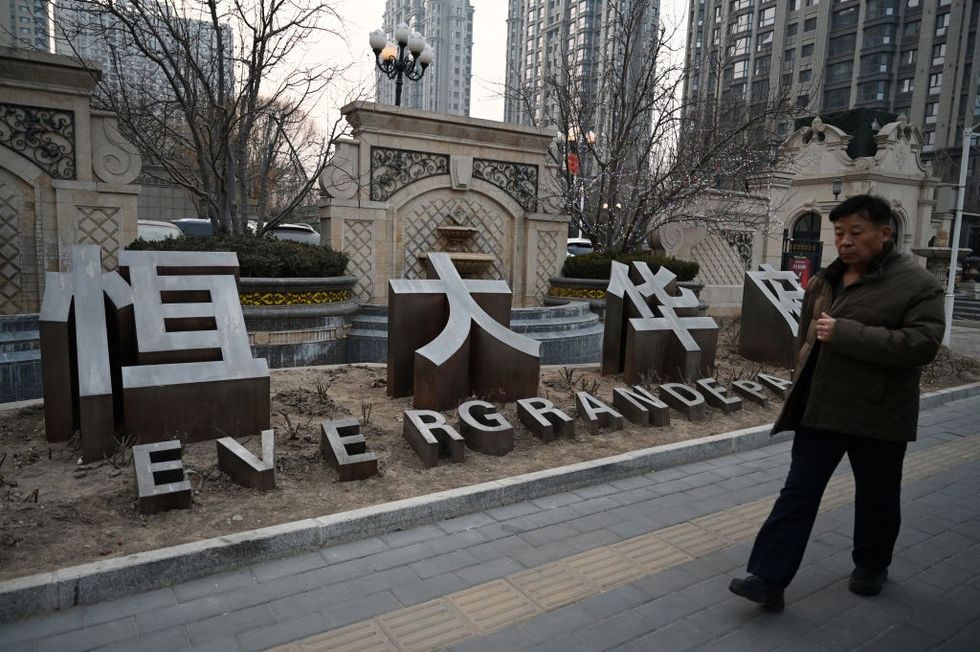

A Hong Kong court on January 29 ordered the liquidation of China's property giant Evergrande

|Getty

In 2021, China’s economy was equivalent to 75 per cent of America’s GDP, whereas now, it has fallen to 65 per cent.

He pointed out that every public or listed Chinese developer is currently in default.

Two of the biggest, Evergrande and Country Garden, have a collective debt of $500 billion. The former was recently ordered to liquidate by a Hong Kong court.

Bass added: "China is going to get much worse no matter how much their regulators say we're going to protect individuals from illicit short selling. Imagine regulators blaming a 15-year swoon on their stock market on short sellers."

Meanwhile, European leaders have warned companies of the risks of relying too heavily on China and urged them to diversify their business away from what they refer to as a "partner, competitor and systemic rival."

According to the head of foreign trade at the German Chamber of Industry and Commerce (DIHK) the US is set to overtake China as Germany's most important trade partner by 2025.

Deliveries to China fell by almost nine per cent to roughly €97billion, with cars and chemical products particularly down, while imports fell by almost a fifth, to just under €156billion.