China's economic credit rating SLASHED as problems grow for Xi Jinping

Chinese President Xi Jinping listens during a roundtable meeting with World leaders attending the Asia-Pacific Economic Cooperation (APEC) Leaders' Week

|GETTY

Beijing is struggling with a number of fiscal problems, including in its housing market

Don't Miss

Most Read

China’s economic credit rating has been cut as financial problems for Xi Jinping grow.

Credit rating agency Moody’s downgraded Beijing’s ability to repay borrowing.

It claimed the ripple effects from a crisis in the property sector would undermine efforts to revive China’s economy.

Moody’s warned Beijing would need to bail out local and regional governments and state-owned enterprises which were struggling with ever-increasing debts.

WATCH NOW: Gordon Chang discusses China's economic woes

The rating agency downgraded its outlook for Chinese sovereign bonds from stable to negative on Tuesday.

It also sent a signal to potential lenders about an increased risk of a default by Beijing.

China’s finance ministry said it was “disappointed” with Moody’s decision, claiming the economy was bouncing back.

However, Moody’s claimed intervention could pose “broad downside risks to China’s fiscal, economic and institutional strength”.

LATEST DEVELOPMENTS:

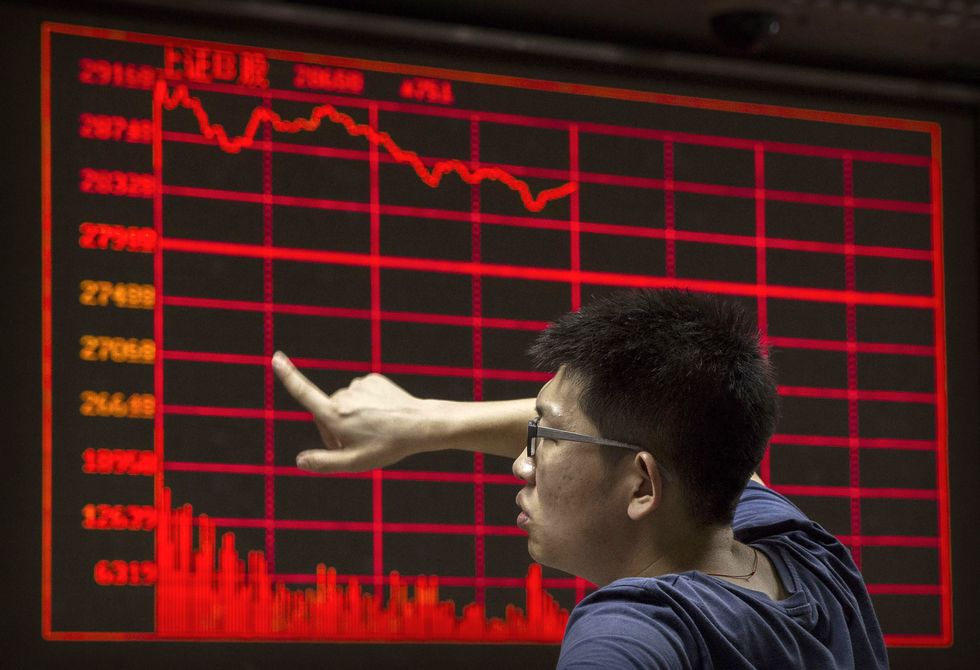

A Chinese day trader reacts as he watches a stock ticker at a local brokerage house

|GETTY

It added: “The outlook change also reflects the increased risks related to structurally and persistently lower medium-term economic growth.”

Moody’s also argued changes in the property sector represent “a major structural shift in China’s growth drivers”.

Weaker demographics due to an ageing population have been identified as a threat to China’s growth.

Beijing’s economy is estimated to grow at a four per cent annual pace in 2024 and 2025.

New apartment building construction site in Tongzhou

|GETTY

However, the figure is well below the six per cent to seven per cent average witnessed in the decade prior to the pandemic.

Moody’s move underscores deepening global concerns about the level of debt in the world’s second-largest economy.

China’s credit rating was kept at A1, meaning “upper medium grade”.

But shares in China dipped on Tuesday due to its financial frailty.

Hong Kong’s Hang Seng index dropped 1.9 per cent and the Shanghai Composite fell by 1.7 per cent.