China launches desperate attempt to save economy with £220billion project

It comes as China's economy fell to its lowest level since 2019 at the start of the week

Don't Miss

Most Read

Xi Jinping is planning to launch a desperate £200billion project in a bid to save China's economy.

It comes after Chinese premier Li Qiang demanded authorities bring in "forceful" measures to control the economy.

Earlier this week, the Chinese stock market slumped to a five-year low.

China's CSI 300 Index has lost a fifth of its value over the last nine months reaching its lowest level since the start of 2019 this week. Meanwhile, the NASDAQ Golden Dragon China Index also falling for a sixth day in a row.

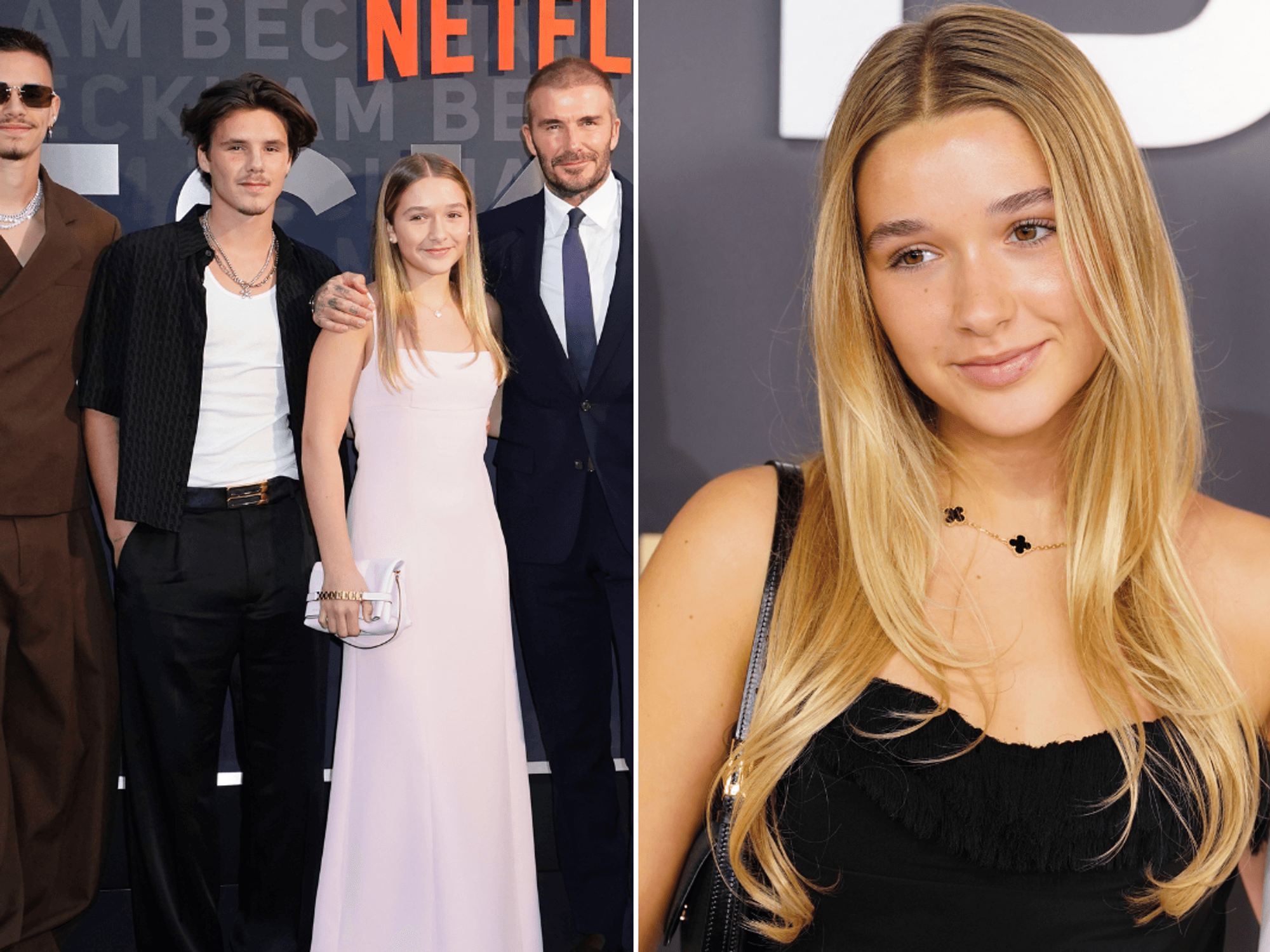

Xi Jinping is planning to launch a plan worth billions to help China's economy

|Reuters/Getty

Low confidence from investors began back in 2021 when property giant Evergrande collapsed. Li held a meeting with the Chinese cabinet on Monday in a plan to boost the investment value of listed companies, reports Bloomberg.

The report said Chinese authorities were considering mobilising about two trillion yuan (approximately £220billion) to stabilise a slumping stock market.

It comes as China's State Council said it needed to improve macro policy in order to boost the country's economic recovery from the Covid pandemic.

The country's stock market did see an initial jump when restrictions were lifted. However the bounce was not maintained and the economy continued to underperform.

LATEST DEVELOPMENTS

Evergrande collapsed in 2021

|Reuters

A struggling property market and low consumer confidence might not be bolstered by the measures announced this week, said Julius Baer commodity analyst Carsten Menke.

Economist at 22V Research Michael Hirson told Bloomberg that China’s problems are deep-rooted.

Hirson said: "The biggest challenge that equity markets face is macroeconomic rather than technical.

""In an environment of weak private sector demand and prolonged deflation, it is hard to excite investors about the outlook for Chinese companies to grow revenue and profits."

China is also facing a demographic crisis as its birth rate plummets and working-age population shrinks. The country's population dropped by two million last year and more than a fifth of its population is now aged 60 or over.

In a bid to boost the market, last year China’s $1.24trillion sovereign wealth fund bought exchange traded funds (ETFs) and bank shares.

Another 733billion yuan (£81billion) was also fed into the financial system by The People’s Bank of China.