JP Morgan CEO warns high inflation is echo of 1970s as he rubbishes 'Goldilocks' economic scenario

Jamie Dimon has cautioned that a recession could happen

Don't Miss

Most Read

The CEO of JP Morgan has warned that the current high inflation rate echoes back to the 1970s, a period marked by widespread unemployment.

Jamie Dimon has cautioned that interest rate cuts are not guaranteed, due to rising prices, stagnant growth and massive government spending.

He mirrored the current financial outlook with the 1970s, a time when staggering inflation and energy crises battered the US.

Dimon, who is regarded by many as a cautionary voice on Wall Street, said that a recession could happen.

JP Morgan CEO warns that high inflation mirrors the 1970s

|Getty

His comments echoed statements made by other economists and firms, including Wells Fargo, who said that a recession could take place this year.

Speaking to Fox Business Network, Dimon shared his thoughts on potentially decreasing interest rates: “I'm a sceptic. I think because of fiscal spending and other factors.

“I look at a lot of things - forget about economic models - $2trillion of fiscal deficit, the infrastructure and IRA act, the green economy, the remilitarization of the world, the restructuring of trade, are all inflationary.

“That looks a little more like the 1970s to me.

LATEST DEVELOPMENTS:

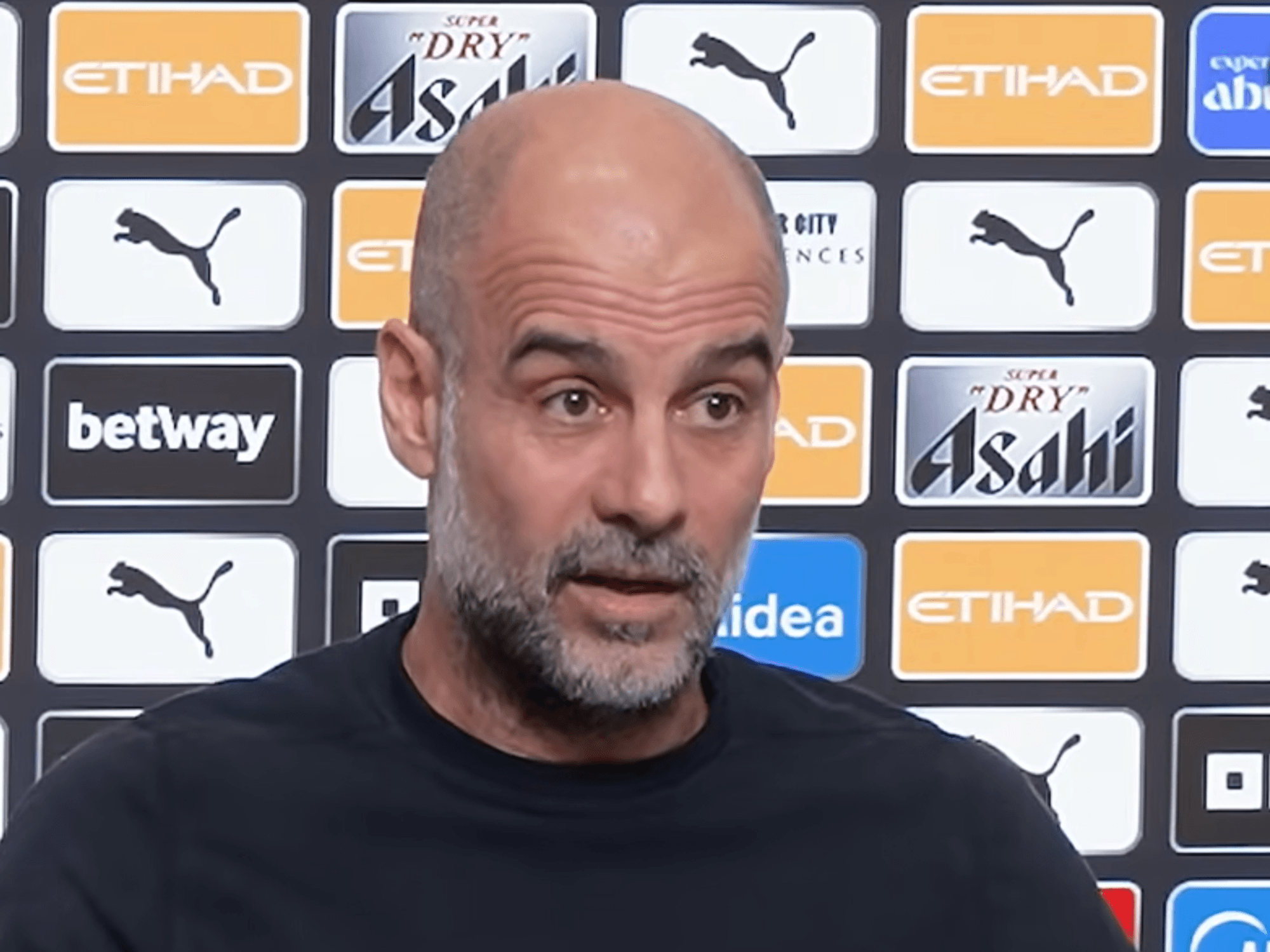

Dimon is regarded by many as a cautionary voice on Wall Street

|Getty

“So I think there's a chance here that people should be prepared that inflation comes down but then bounces around three [per cent] and maybe even bounces up a little bit and those implied curves will change. Are people ready for that? I'm not sure.”

Deutsche Bank also made similar predictions back in October, harkening back to the period of high unemployment 50 years ago, known as “The Great Inflation”.

Two major oil production shocks triggered by wars in the Middle East caused prices to skyrocket.

The “striking number of parallels” are mainly based in inflation rates. In June 2022, they were at a high of 9.1 per cent, however have since gone down to 3.1 per cent as of November 2023.

As a result of the inflation, interest rates were hiked from near-zero to between 5.25 and 5.5 per cent, the highest they’ve been for over 20 years.

Dimon also pointed out that extra Covid money will soon run out

| PexelsDimon also pointed out that additional Covid economic relief that was keeping consumers afloat is starting to dwindle.

“Credit is normalizing, but it's still lower. Stock prices are up. The consumer is in good shape. But the extra money that they got during Covid, trillions of dollars, that's kind of running out… It runs out this year.

“The government has a huge deficit which will affect the markets. But I'm a little sceptical in this kind of Goldilocks scenario.

“It might be [a] mild recession or heavy recession,” the CEO added.

“I think they did the right thing to raise rates. I think it was a little late, and I think they're doing the right thing just to wait and see what happens... It takes a while to see the full effect of that... but all of those factors may very well push us to recession, as opposed to a soft landing.”