Family-run dealership boss tells Nigel Farage how his business was ‘destroyed overnight’ in debanking saga

Kevin Mackie ran Mackie Motors until its collapse in 2021

Don't Miss

Most Read

Trending on GB News

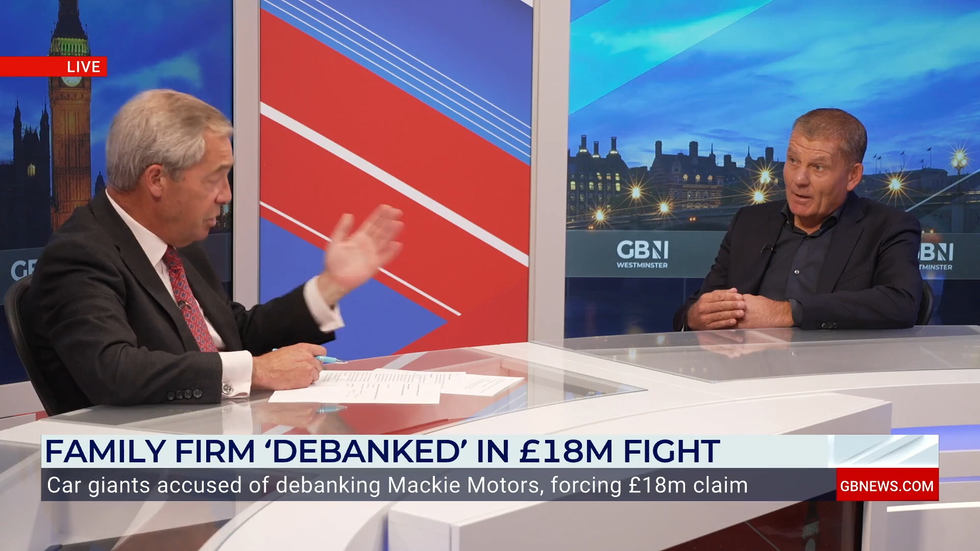

A former car dealership director has revealed to Nigel Farage how unfounded money laundering accusations led to the overnight destruction of his family enterprise, resulting in 75 redundancies.

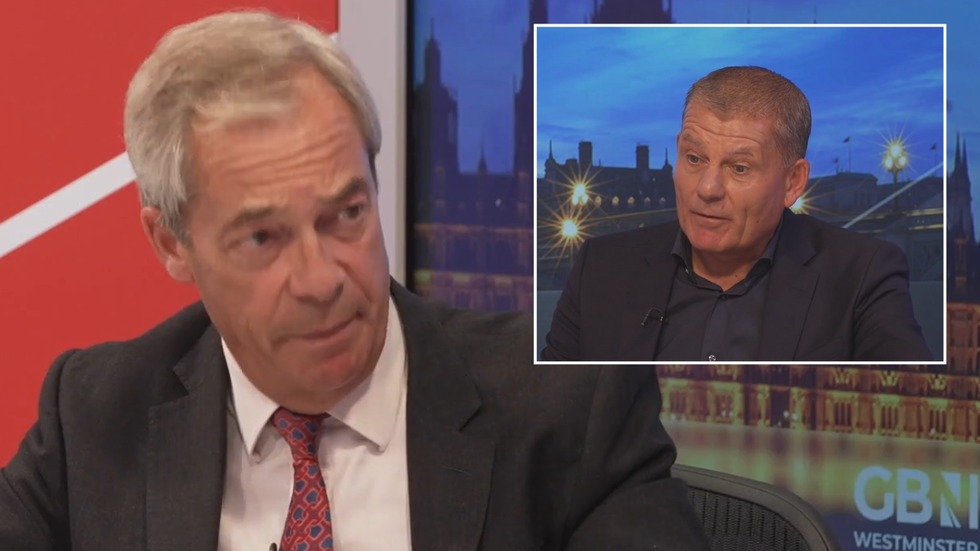

Kevin Mackie, who ran Mackie Motors until its collapse in 2021, appeared on GB News to discuss his experience of being "debanked" after financial services provider RCI filed a suspicious activity report.

"In November 2021, we were heading for record sales and profits. Then, overnight, our supply chain was cut off. Nobody would speak to us," Mr Mackie told Farage during the interview.

The businessman explained that his company had operated successfully since the 1970s, earning national recognition and three international accolades from Renault in Paris before the sudden termination.

Mr Mackie spoke to Nigel, who has also been the victim of debanking

|GB NEWS

The enterprise had been established by Mackie's parents during the 1970s and developed into an award-winning operation employing 75 staff members. The company held franchise partnerships with Renault, Dacia and Nissan spanning four and a half decades.

Everything changed when RCI Financial Services submitted a suspicious activity report to the National Crime Agency on 23 November 2021. The allegations centred on a loan arrangement that had been fully authenticated by the company's auditors.

LATEST DEVELOPMENTS

- Suella Braverman 'ashamed' to have Keir Starmer as PM after Lord Mandelson scandal

- Michael Knowles: ‘Charlie Kirk would have been President - what happens next is terrifying’

- US Ambassador to UK urges for 'political rhetoric be dialled down' following Charlie Kirk killing

"They explained the structure to RCI Bank three times. Everything was transparent – we had done nothing wrong," Mr Mackie stated during his television appearance.

Despite the transparency of the financial arrangements, the dealership received its termination notice on 9 December, providing just seven days' warning without any justification for the decision.

Kevin Mackie spoke to Nigel Farage about his debanking saga

|GB NEWS

The suspicious activity report filed by RCI triggered immediate consequences for the dealership. Access to essential operational systems for ordering parts, processing sales and delivering aftersales support was severed by RCI, Nissan and Renault.

"I pleaded with them: 'Tell me what you need, I'll provide any information.' But they refused to engage. They wouldn't even let me be present during a stock audit," Mr Mackie recounted.

Despite the serious allegations prompting the business termination, the National Crime Agency never initiated contact with Mackie or conducted any investigation into the claims.

"They've never once contacted me. No investigation, no questions. If there'd been wrongdoing, I'd have heard. But there was nothing," he told Nigel.

Nigel Farage uncovered a debanking scandal after being told his Coutts account would be closed | PA

Nigel Farage uncovered a debanking scandal after being told his Coutts account would be closed | PAThe dealership ultimately repaid all money owed to RCI, with no discrepancies found during audits.

The termination left the business unable to function, with sales staff working on commission and technicians relying on bonuses suddenly without vehicles to sell or service.

"With no cars to sell or repair, the business collapsed. In the end, I had to do a fire sale to try and protect jobs," Mackie explained.

He attempted to salvage the situation by arranging for another dealer to take over operations, but the absence of supply chain access made survival impossible.

The company maintained accounts with Bank of Scotland, Santander Finance and Northridge Finance, none of which had raised concerns about the loan structure. However, once flagged as under investigation, securing new banking relationships became impossible.

"Once you're flagged as being 'under investigation,' even wrongly, nobody will deal with you," Mr Mackie noted.

Mr Mackie expressed frustration with the regulatory framework during his GB News appearance, describing his attempts to seek help from authorities.

"I even went to the FCA about money owed to us by RCI. They told me to go to the police. The police told me to go back to the FCA. The FCA then told me to try Citizens Advice," he revealed.

The former dealership director characterised the Financial Conduct Authority as failing in its duty to protect businesses, stating they had provided "no help whatsoever."

Nigel highlighted the broader implications, noting that European-origin money laundering regulations force banks to file reports over minimal suspicions, with staff facing potential seven-year prison sentences for non-compliance.

"Tens of thousands are submitted every year, and the overwhelming majority are false. But businesses like yours are destroyed in the process," Nigel observed.