DWP benefit fraudster fined £200 after falsely claiming Universal Credit

grills Work and Pensions Secretary, Pat McFadden MP, over reports suggesting that in some circumstances, Brits are better off on benefits than they are working if they don't earn over |

GB NEWS

The Labour Government has promised to crackdown on those claiming benefit support from the DWP, including Universal Credit, under false pretenses

Don't Miss

Most Read

Trending on GB News

Britons claiming Universal Credit are being reminded they could face being slapped with hundreds of pounds in fines if they attempt to defraud the Department for Work and Pensions (DWP).

Earlier this past week, a 64-year-old woman from Aylsham was been ordered to pay £365 after admitting to benefit fraud at Norwich Magistrates' Court.

Susan Pegg, who resides on Wade Close, entered a guilty plea to dishonestly withholding information from the Government department about changes to her financial situation that affected her Universal Credit eligibility.

The court imposed a £200 fine on Pegg, along with £165 in costs. Universal Credit claimants are required to inform the DWP of any alterations to their circumstances.

A benefit fraudster has been fined £200

|GETTY

Those receiving Universal Credit, which supports people on low incomes, cannot hold more than £16,000 in combined savings, money and investments.

Ms Pegg's failure to disclose her savings meant she continued receiving payments she was not entitled to claim.

The case highlights ongoing efforts by authorities to tackle fraudulent benefit claims across the country, which Labour ministers have made their mission in recent months.

The Government has recently introduced the Public Authorities (Fraud Error and Recovery) Act, granting the DWP enhanced capabilities to detect fraudsters and recover overpaid benefits.

Benefit fraud graphic | GETTY

Benefit fraud graphic | GETTYMinisters expect the legislation to deliver £1.5billion in savings for taxpayers by 2029/30 through improved data access, modern investigative tools and strengthened enforcement powers.

According to the Government, this aggressive measure will ensure policies such as the abolishment of the two-child benefit cap on Universal Credit, is paid for.

The DWP will gain the ability to obtain information from banks to verify whether claimants are receiving correct payments, though the department will not be able to view account details or monitor spending habits.

As it stands, the Government hopes to save up to £14.6billion up to the end of 2030/31 from fraud, error and debt activity, which includes investment to deploy up to 3,000 additional DWP staff and strengthen our data, analytics and investigative capability.

Andrew Western, minister for Transformation, explained: "It is right that as fraud against the public sector evolves, the Government has a robust and resolute response.

"The powers granted through the Bill will allow us to better identify, prevent and deter fraud and error, and enable the better recovery of debt owed to the taxpayer. A benefits system people can trust is essential for claimants and taxpayers alike – through this Bill that’s exactly what we’ll deliver."

Cabinet Office Minister Josh Simons added: "Previous Governments have sat back and accepted that fraud is inevitable. We will not. We are transforming the state’s defences against those who seek to defraud the taxpayer and restoring fairness.

"This new law gives the Public Sector Fraud Authority and government departments the powers and tools to proactively pursue and recover billions of pounds lost to criminals and error.

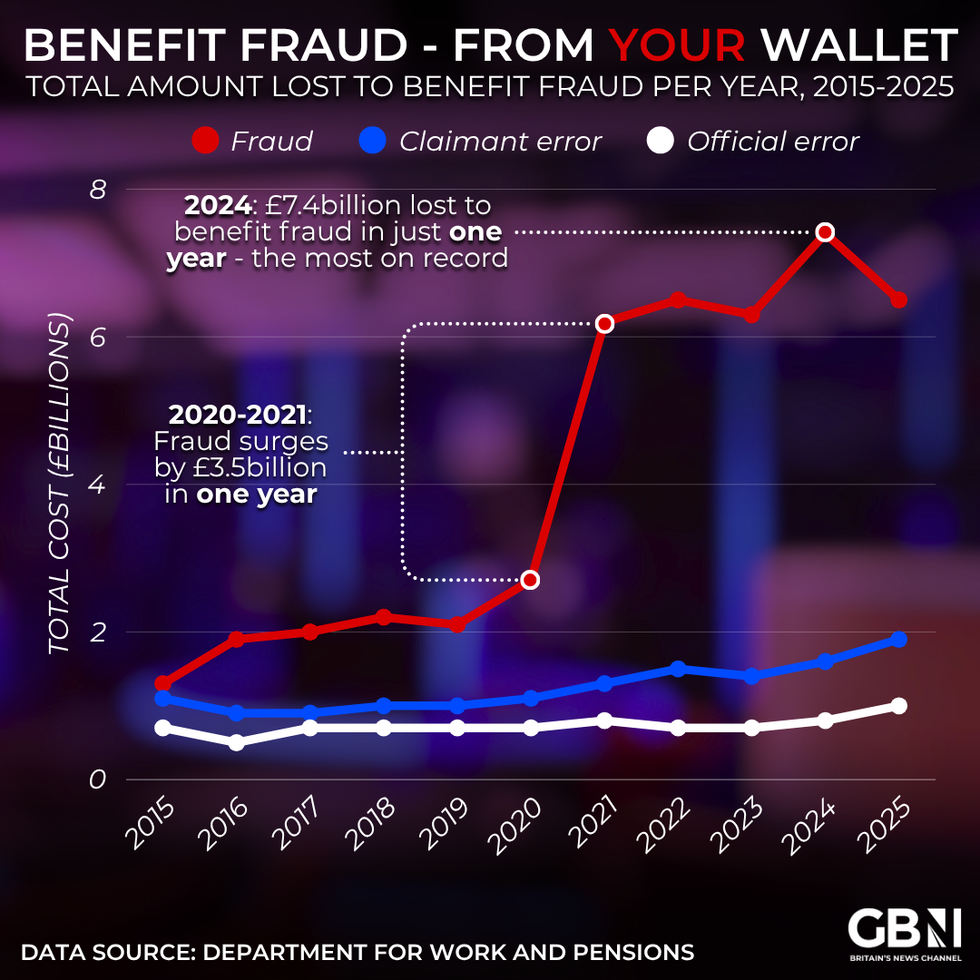

Benefit fraud - from your wallet: Total amount lost to benefit fraud per year | GB NEWS

Benefit fraud - from your wallet: Total amount lost to benefit fraud per year | GB NEWS"We are ensuring there is no hiding place for those who cheated the taxpayer during the pandemic, doubling the time limit for bringing a civil claim to twelve years."

In June, annual DWP accounts found that the benefit fraud-and-error rate slipped to 3.3 per cent in 2024-25, down from 3.6 per cent the previous year.

At the time, Permanent Secretary Sir Peter Schofield shared he was "pleased" the overpayment rate for Universal Credit payments had "reduced by over a fifth compared to last year".

Despite this, he asserted that the DWP still had to "go further" to bring benefit fraud figures down to pre-Covid pandemic levels.

More From GB News