City minister issues clear warning to banks after NatWest chief's resignation

Andrew Griffith and Dame Alison Rose (inset)

|PA

Andrew Griffith MP and Number 10 back Dame Alison Rose’s resignation

Don't Miss

Most Read

Latest

The City Minister has supported the overnight resignation of the NatWest chief, and hinted that her defenestration could spell widespread change in the banking industry.

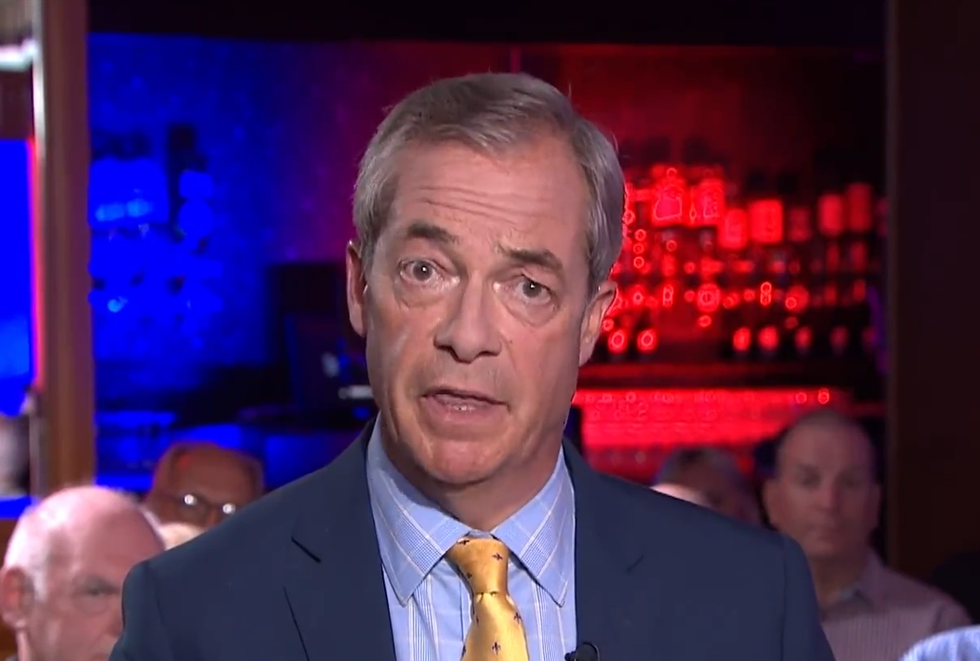

NatWest boss Dame Alison Rose had been pressured to resign after losing the confidence of Government ministers over the leaking of an inaccurate story about Nigel Farage’s finances.

The timing of the resignation came after City Minister, Andrew Griffith, had publicly announced a meeting with bank leaders to discuss “lawful freedom of expression,” scheduled for Wednesday morning.

Reacting to the resignation, Griffith tweeted a response to GB News: “It is right that the NatWest CEO has resigned.

Andrew Griffith during day three of the Conservative Party annual conference at the International Convention Centre in Birmingham on 4 October, 2022.

|PA

“This would never have happened if NatWest had not taken it upon itself to withdraw a bank account due to someone’s lawful political views.

“That was and is always unacceptable.

“I hope the whole financial sector learns from this incident. Its role is to serve customers well and fairly - not to tell them how or what to think.”

Meanwhile, a Number 10 source said the Prime Minister "was concerned about the unfolding situation" but believes "Alison Rose has done the right thing in resigning."

On Tuesday, Griffith published a letter he had written to some of the UK’s biggest banks.

The MP for Arundel & South Downs’ letter expressed the “fundamental right” that “people should be able to exercise lawful freedom of expression without the fear of having their bank account closed.”

In the letter, sent out on Monday, Griffiths reiterated the “unequivocal” Government stance that banks “should not be terminating contracts of payment account facilities on grounds relating to users’ exercising of their right to lawful freedom of expression or beliefs.”

Griffith’s letter set out reforms drawn from the Government’s statutory review of the Payment Services Regulations 2017.

Banks must now “require that payment account providers must provide at least 90 days’ notice when choosing to terminate a contract” and “improve transparency for users in receiving a clear understanding why their payment account contract has been terminated.”

The Economic Secretary to the Treasury added that the Government intends to enact these reforms via secondary legislation through the powers granted in the Financial Services and Markets Act 2023.

In a statement released in the early hours of this morning before the markets open, NatWest Group chairman Sir Howard Davies said that an agreement had been reached for the chief executive to step back from her role "by mutual consent".

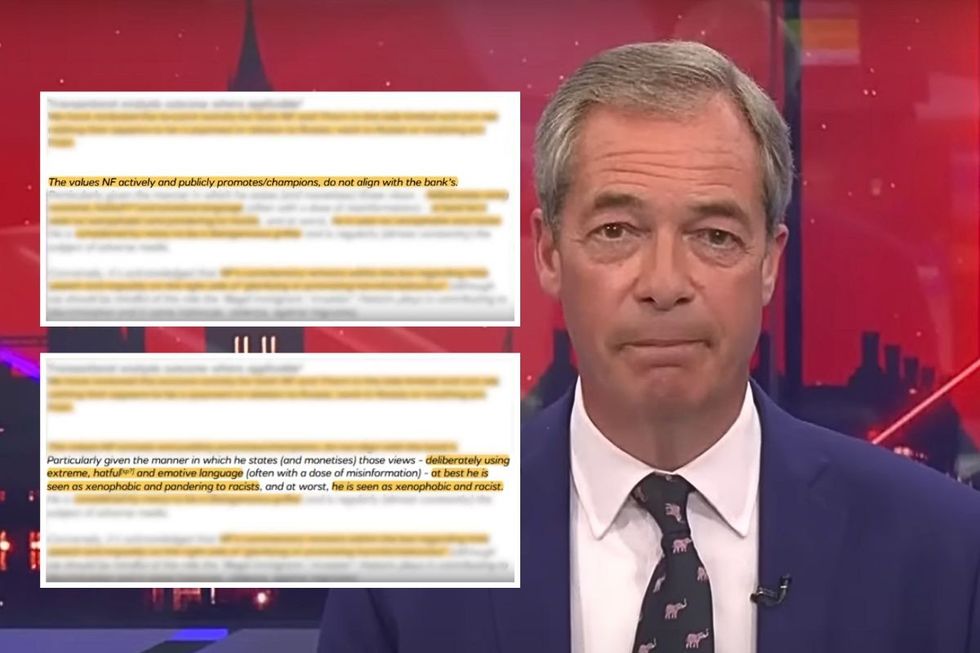

Nigel Farage has shared the documents which explain why his bank account was shut | GB News

Nigel Farage has shared the documents which explain why his bank account was shut | GB NewsLast night Rose admitted to a “serious error of judgment” when she discussed Farage’s relationship with private bank Coutts, owned by NatWest Group, with a BBC journalist.

Initially the NatWest board had said it was standing by their beleaguered leader.

Pressure mounted on Rose when it became clear that Government ministers had “serious concerns” over her conduct.

Confirming her departure, Davies said: “The Board and Alison Rose have agreed, by mutual consent, that she will step down as CEO of the NatWest Group. It is a sad moment.

“She has dedicated all her working life so far to NatWest and will leave many colleagues who respect and admire her.”

COUTTS LATEST:

- Nigel Farage calls for NatWest board members to quit following Alison Rose's resignation

- Disgraced NatWest boss Dame Alison Rose QUITS overnight after company held emergency meeting over Farage Coutts leak

- Jeremy Hunt ‘concerned’ by NatWest chief after ‘de-banking’ of Farage

- BBC's apology to Nigel Farage in full - read the whole letter sent to GB News Presenter

(Right to Left) President at Mastercard UK & Ireland, Kelly Devine, NatWest CEO and Rose Review author, Alison Rose and Dame Caroline Dinenage MP, at the 'Enabling Entrepreneurship' in Bishopsgate London on 15 June 2022.

|PA

In a statement of her own, Rose said: “I remain immensely proud of the progress the bank has made in supporting people, families and business across the UK, and building the foundations for sustainable growth.

“My NatWest colleagues are central to that success, and so I would like to personally thank them for all that they have done.”

Paul Thwaite, the current chief executive of the company’s Commercial and Institutional business, will take over Rose’s responsibilities for an initial period of 12 months, pending regulatory approval.

The scandal emerged after Nigel Farage obtained evidence from Coutts through a data request that contradicted a BBC News story, which claimed that the account closure was due to Farage’s failure to meet a £1million borrowing requirement.

Nigel Farage addressing his apology from NatWest | GB News

Nigel Farage addressing his apology from NatWest | GB NewsThe BBC and its business editor Simon Jack subsequently apologised, adding the reporting had been based on information from a “trusted and senior source”, but it turned out to be “incomplete and inaccurate”.

Reacting to Rose's resignation this morning, Farage said that there was no choice but for her to resign.

He told GB News: "The first rule of banking is you have to respect the privacy of the customer. You also have to respect the GDPR regulations.

"They were both broken, very clearly, by the boss of NatWest."

Farage has called for the NatWest board to resign en masse in order to “overhaul” the culture at the bank.