Virgin Money increases savings interest rates after Bank of England base rate decision

Savings accounts are continuing to benefit from previous hikes to interest rates from the Bank of England

Don't Miss

Most Read

Virgin Money has increased the interest rate of one of its most popular savings account in a boon for customers.

Earlier this week, the bank bolstered the savings rate of this one-year fixed rate E-bond which now pays 5.11 per cent.

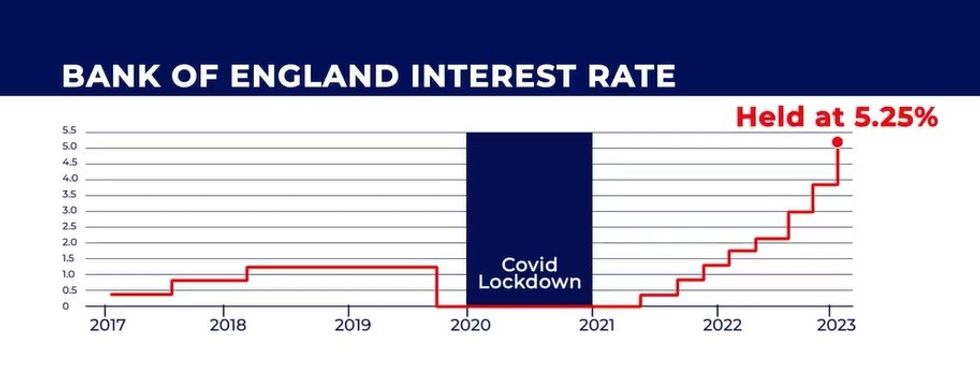

This comes shortly after the Bank of England chose to keep interest rates at their current level of 5.25 per cent.

Savers have benefited from the central ban’s decision to hike and maintain the base rate a relatively high level.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The lender is raising interest rates on popular savings accounts

|GETTY

Customers of Virgin Money can open the savings account for as little as £1 with the maximum investment amount being £1million.

Access to the E-bond is not permitted but further additions may be allowed while the issue remains open.

Anyone interested in opening this account can do so online, where they can also manage. The minimum applicant age is 16.

This particular savings account has been awarded an “excellent” product rating from Moneyfactscompare.

James Hyde, a spokesperson for the organisation, broke down the state of savings interest rates in the UK.

He explained: “Average fixed savings rates fell in the Autumn for the first time in a couple of years, with swingeing reductions continuing in the following months.

“Meanwhile, the average easy access rate has barely shifted at all since peaking in November. On October 1 2023, the average one-year fixed bond paid 2.27 per cent more than the average easy access account – in just four months the gap has narrowed to just 1.45 per cent.

“Even among the best-paying accounts, on October 1 the most lucrative one-year fixed bond paid 1 per cent more than the market-leading easy access account: whereas now the top-paying easy access account pays 0.04 per cent more than the best one-year fixed deal.”

LATEST DEVELOPMENTS:

The Bank of England has held the base rate at 5.25 per cent | GB NEWS

The Bank of England has held the base rate at 5.25 per cent | GB NEWSAccording to Moneyfactscomare, the average one-year fixed, easy access, one-year fixed cash ISA and easy access ISA savings accounts have the same interest rates on average compared to yesterday.

The average one-year fixed savings rate is 4.61 per cent, whereas the one-year fixed cash ISA comes to 4.51 per cent.

In comparison, the average interest rate for easy access savings accounts is 4.51 per cent as of today. An easy access ISA has a rate of 3.33 per cent.

The Bank of England will announce any further changes to the base rate following the next Monetary Policy Committee (MPC) on March 21, 2024.