Millions face 'invisible pay cut' under Rachel Reeves tax hike on pensions: 'What's the point?'

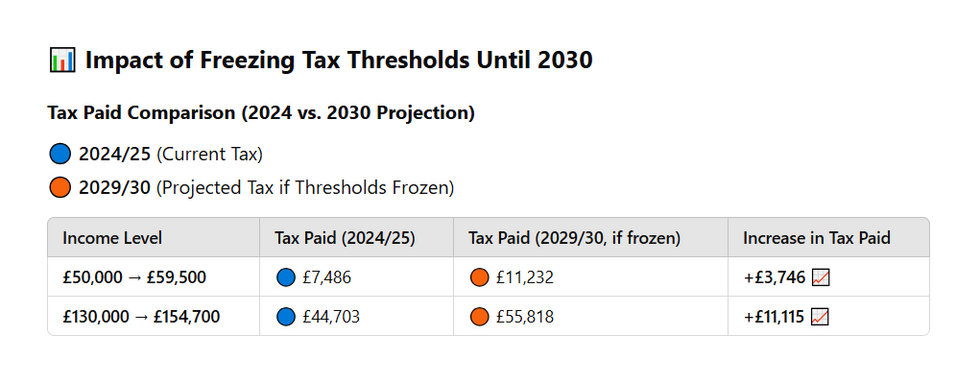

The Chancellor has unveiled reforms to pension salary sacrifice rules, as well as frozen tax thresholds until 2031

Don't Miss

Most Read

Chancellor Rachel Reeves is targeting the "backbone of the workforce" with her stealth taxes on pension savings and earnings, analysts warn.

Mid-career professionals earning between £45,000 and £55,000 are facing mounting pressure from two key measures in the 2025 Budget, according to recruitment industry experts.

Frances Li, the founder and director at Biscuit Recruitment, warns that the combined effect of a new pension salary sacrifice cap and extended income tax threshold freeze is fundamentally altering how workers approach their careers.

"The Autumn Budget didn't raise headline tax rates, but it quietly reshaped how employees will earn, save and progress," Ms Li said.

Millions face an 'invisible pay cut' under the Chancellor's plans

|GETTY / PA

"People will feel the impact not only in their payslips, but in how they make career decisions, especially those at key career inflection points."

The changes are particularly affecting those in their late 20s through to their 40s who have been diligently building retirement savings.

From April 2029, the government will restrict National Insurance exemptions on salary sacrifice pension arrangements to just the first £2,000 annually.

Contributions beyond this threshold will attract standard NI charges for both employees and employers, eliminating the tax efficiency that many workers have relied upon.

Ms Li explained: "The cap on salary-sacrificed pension contributions above £2,000 will hit a specific group.

"Not the ultra-high earners, but the professionals in their late 20s, 30s and 40s who are doing the responsible thing and saving for retirement."

These workers now confront an uncomfortable dilemma between securing their financial future and maintaining adequate monthly income.

"The income tax threshold freeze to 2031 may bring in billions, but it risks dampening progression," she said.

What could frozen tax thresholds mean for you? | GBN

What could frozen tax thresholds mean for you? | GBN"We're already hearing candidates ask: What's the point of progressing if most of the gain goes to tax?"

She describes the freeze as functioning like "an invisible pay cut" that is creating reluctance among skilled professionals approaching higher tax bands.

The recruitment expert warns that if this cautious mindset becomes more widespread, both job mobility and innovation across the economy could suffer.

Workers earning in the £45,000 to £55,000 range may discover that accepting a promotion leaves them only marginally better off after accounting for tax, National Insurance and the new pension contribution limits.

Workers have been taking advantage of workplace salary sacrifice schemes

| GETTY"When people feel their effort is absorbed before it reaches them, ambition naturally slows," Ms Li added.

The Labour Government has justified the salary sacrifice cap as a measure to make pension tax relief "fairer and more sustainable," arguing that higher earners have disproportionately benefited from National Insurance savings.

According to Office for Budget Responsibility (OBR) forecasts, the change is expected to generate approximately £4.7billion in additional revenue during 2029/30, falling to around £2.6 billion the following year.

The changes to salary sacrifice rules will come into effect from 2029 while the tax threshold will continue until at least 2031.

More From GB News