Tax-free savings under threat as new calls grow to cap Cash ISA limit to £10,000 to boost economy

Proposed ISA changes could limit cash savings and redirect billions into UK stocks to revive market growth

Don't Miss

Most Read

Savers could soon see big changes to how they use their ISAs under new reform proposals.

A shake-up of the current system is being considered in a bid to boost the UK economy and encourage more investment.

A City think tank has proposed sweeping reforms to Individual Savings Accounts that could channel up to £10 billion annually into the London stock market.

New Financial's plan would maintain the current £20,000 ISA allowance but introduce a £10,000 cap on cash savings. The remaining £10,000 would need to be invested in UK equities or other investments "as a quid pro quo for the unusually generous tax relief on Isas."

The proposals also include abolishing stamp duty on shares held within ISAs, which could provide additional incentive for equity investment.

The reforms come as the Government prepares to launch a consultation on ISAs, which currently provide approximately £8 billion in annual tax relief to 12 million savers.

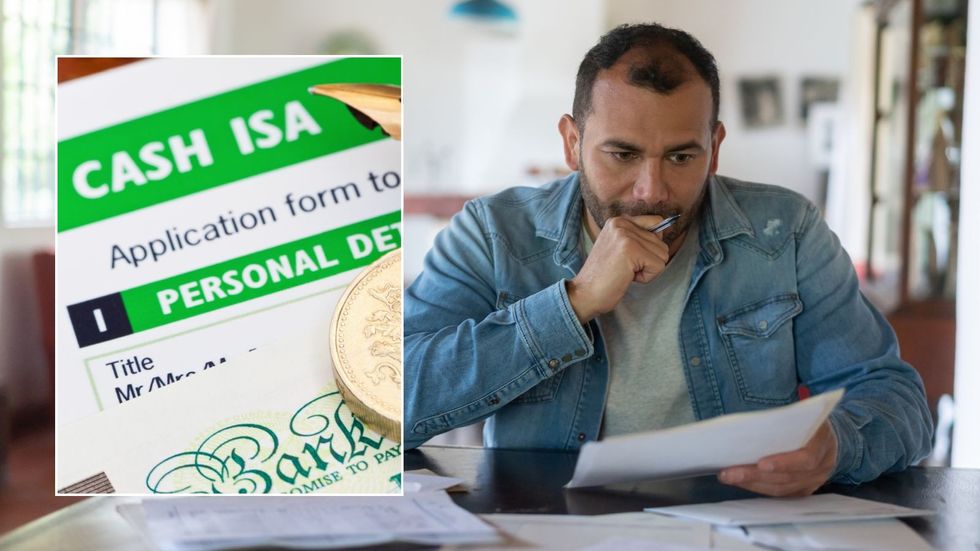

ISAs are useful tools for those looking to save more than the personal savings allowance threshold without having to pay tax | GETTY

ISAs are useful tools for those looking to save more than the personal savings allowance threshold without having to pay tax | GETTYNew Financial has outlined four specific proposals for reforming the ISA system. The first would create a mandatory UK investment ISA, capping cash contributions at £10,000 whilst requiring the remaining allowance to be invested in UK equities.

The think tank notes that 80 per cent of cash ISA savers contribute less than £10,000 annually. Their calculations suggest that capping cash ISAs at this level could encourage the 700,000 people who save more to invest an additional £3.8 billion yearly.

Another proposal involves simply renaming ISAs as "investment and savings accounts" to encourage share investment over time. The fourth option would create a single ISA product with a £10,000 cash cap, with remaining contributions qualifying for tax breaks only if invested in shares, though not exclusively UK shares.

Reeves has indicated support for improving investment returns whilst maintaining current ISA limits.

| GETTYReeves has indicated support for improving investment returns whilst maintaining current ISA limits. "I'm not going to reduce the £20,000 Isa limit, but I do want people to get better returns on their savings, whether that's in a pension or in their day-to-day savings," she stated.

The chancellor emphasised that it was "really important that we support people to save" as the Government prepares its consultation on ISA reform.

Currently, only six per cent of the adult population contributes to stocks and shares ISAs, highlighting the ongoing debate about encouraging greater equity investment amongst British savers.

The consultation is expected to examine how the ISA system, which provides £8 billion in annual tax relief, can better serve both savers and the broader economy.

New Financial argues that whilst the proposals would affect only a small minority of ISA savers, they "could have a significant impact on the future financial security of the millions of people in the UK and deliver a much-needed boost to the UK economy".

The think tank's calculations suggest that combining the £10,000 cash cap with the abolition of stamp duty on ISA-held shares could generate up to £10 billion in additional investment for the stock market.

Specified adult childcare credits, for instance, can be claimed for free if someone is caring for a family member | GETTY

Specified adult childcare credits, for instance, can be claimed for free if someone is caring for a family member | GETTYThe think tank's calculations suggest that combining the £10,000 cash cap with the abolition of stamp duty on ISA-held shares could generate up to £10 billion in additional investment for the stock market.

With 12 million people currently using ISAs but only 6 per cent of adults investing in stocks and shares versions, the reforms aim to shift savings behaviour towards equity investment whilst preserving tax benefits for the vast majority who save less than £10,000 in cash annually.

More From GB News