Pound drops after Bank of England boss signals at further interest rate cuts ahead

GB News

Governor Andrew Bailey suggests scope for further reductions as inflation pressures ease

Don't Miss

Most Read

Sterling suffered losses following dovish remarks from Bank of England Governor Andrew Bailey, who indicated that further monetary easing lies ahead.

The currency declined by 0.60 per cent against the American dollar during Wednesday's trading session, whilst approaching its weakest levels since July against the euro.

The pound-dollar pair retreated to 1.3462, whilst sterling traded at 1.1450 against the single currency, near its July low.

Markets interpreted Mr Bailey's newspaper interview as signalling a more accommodative stance from Threadneedle Street.

Mr Bailey said: "People are being quite cautious. That affects spending so that has an effect on the state of the economy.

"People aren’t going out as much, they’re not shopping as much, they’re not going out to restaurants as much and so on."

He eluded to there being scope for a "further journey down" for rates.

His comments prompted selling of sterling as traders recalibrated expectations for monetary policy.

The Governor expressed optimism about the inflation trajectory, anticipating that price pressures would reach their peak imminently before moderating throughout the coming year.

Sterling fell after Bank of England Governor Andrew Bailey signalled more monetary easing ahead

|PA/Google Finance

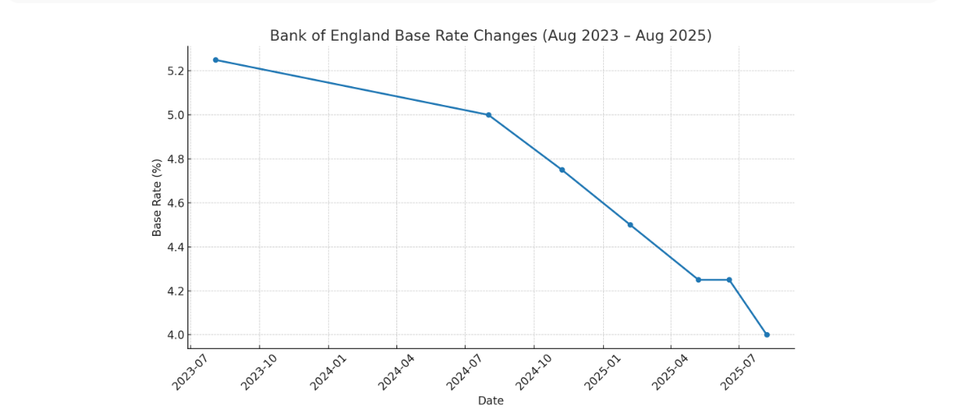

The Bank of England has brought interest rates down in recent years | CHAT GPT

The Bank of England has brought interest rates down in recent years | CHAT GPT Currency strategists anticipate continued pressure on sterling as the Bank's easing cycle accelerates.

Roberto Mialich, senior global currency strategist at UniCredit, said: "Quarterly rate reductions would have a more negative impact on sterling."

UniCredit projections suggest the euro-pound exchange rate could climb to 0.95, implying sterling would fall to 1.05 against the single currency.

This would place the pound at the lower boundary of its historical trading range.

On Thursday, Reform UK's deputy leader Richard Tice criticised the Bank of England's fiscal decision-making ahead of a meeting with the Governor - citing that a change of course could prevent Chancellor Rachel Reeves from having to raise taxes in her forthcoming budget.

Mr Tice said: "We shouldn't be paying interest on quantitative easing, and we shouldn't be doing quantitative tightening, which is triggering tens of billions of taxpayers' losses."

LATEST DEVELOPMENTS:

Tice and Farage spoke on Thursday ahead of their meeting with Andrew Bailey

| PAWhen asked if Governor Bailey, who had previously been coined as "hopeless" by Reform UK's Nigel Farage, was standing in the way of Britain becoming a global crypto leader, Mr Farage said:

"The whole of the City for centuries has moved forwards with innovation, seen new products and been at the front of the line, and here we are with a massive global development, and it seems to me that the Bank are turning their back on it completely. It's madness."

Daniel Vernazza, UniCredit's chief international economist in London, expects the Bank to implement two further reductions this year, in November and December.

Mr Vernazza said: "We see the Bank Rate ending next year at 2.75 per cent, which we see as broadly neutral."

Several currency analysts anticipate sterling weakness will persist in the months ahead as rate cut expectations intensify.