REVEALED: Sunak's stealth tax raid to catch 900,000 pensioners as surprise bill hits

Rishi Sunak froze the personal allowance during his time as Chancellor with Jeremy Hunt subsequently extending it until 2028

Don't Miss

Most Read

Latest

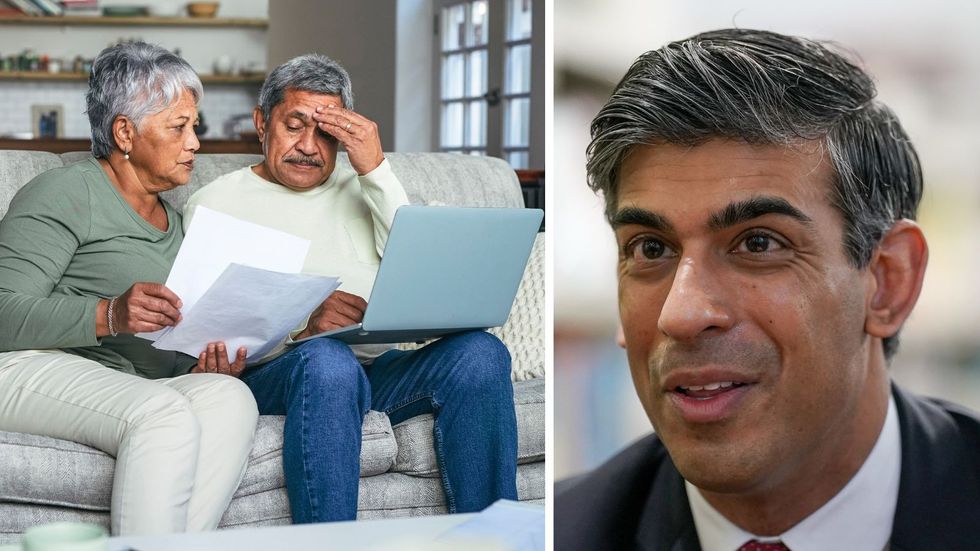

Up to 900,000 pensioners will be slapped with a surprise income tax bill next year because of Rishi Sunak’s ongoing stealth tax raid, analysis shows.

The ongoing six-year freeze on tax thresholds, combined with larger than usual increases to the state pension, will force hundreds of thousands of people claiming marriage allowance to pay tax on their state pension for the first time.

The marriage allowance is a form of tax relief which allows a low earner to transfer part of their personal allowance to their spouse or civil partner.

This would take their personal allowance from £12,570 to £11,310 and it could reduce the other person’s tax by up to £252 in this tax year.

What do you think about the ongoing tax threshold freeze? If you'd like to share your story, please get in touch by emailing money@gbnews.uk.

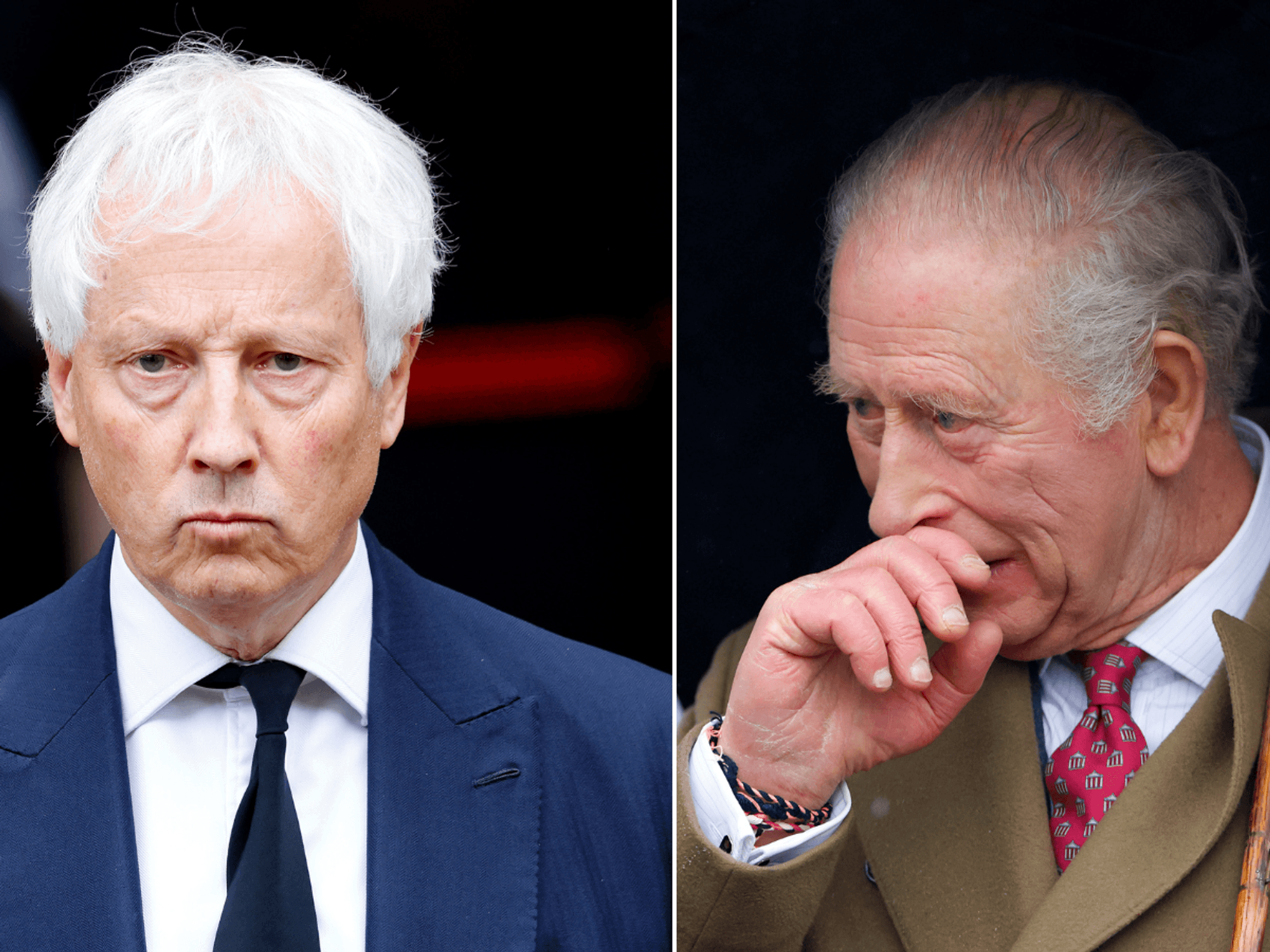

Rishi Sunak announced a freeze to income tax thresholds when he was Chancellor, and Jeremy Hunt subsequently extended it

|PA | GETTY

It can mean the lower earner ends up paying more tax but it may mean the couple pays less tax overall.

Some 900,000 of the 2.28 million people (40 per cent) currently claiming marriage allowance are pensioners, according to a Freedom of Information request.

The state pension is set to rise by 8.5 per cent in April, taking the full new state pension to £11,502 per year.

It means for the first time, the full new state pension will be worth more than 90 per cent of the personal allowance, leaving couples claiming marriage allowance with a small tax bill.

Pensioners are set to be affected further over the coming years until 2028 as the state pension continues to rise under the triple lock but income tax thresholds remain unchanged.

Sir Steve Webb, pensions minister between 2010 and 2015, said: “Large rises in the state pension coupled with freezes in tax allowances are dragging large numbers of pensioners into the tax net.”

Sir Steve, now a partner at consultants LCP, added: “Extra complexity arises for 900,000 pensioners using the marriage allowance, many of whom need to make a decision about whether to stop sharing their tax allowance now that they are becoming taxpayers in their own right.”

Baroness Ros Altmann, who was pensions minister between 2015 and 2016, warned many may not be aware they are set to be taxed, and called for an increase to thresholds.

LATEST DEVELOPMENTS:

She told the Telegraph: “The trouble is many won’t know that they might need to pay some tax and they won’t find out quickly. But eventually they will just be hit with a bill.

“What I’d like to see is HMRC and the Department for Work and Pensions connecting the dots to each other. And if there is a small tax bill to be paid, it is paid automatically without you having to do anything.

“That’s not the kind of money that many pensioners just have lying around, especially those who rely on just the state pension and nothing else. Something is not working. We need to raise the tax threshold to try and ensure that people who are not living on generous, huge pensions don’t face the complexities involved in paying tax.”

A Treasury spokesperson said: “Pensioners whose sole income is the new state pension and who have not deferred or receive protected payments do not pay any income tax, and this year we provided the biggest ever cash increase to pension payments, a 10.1 per cent rise.”