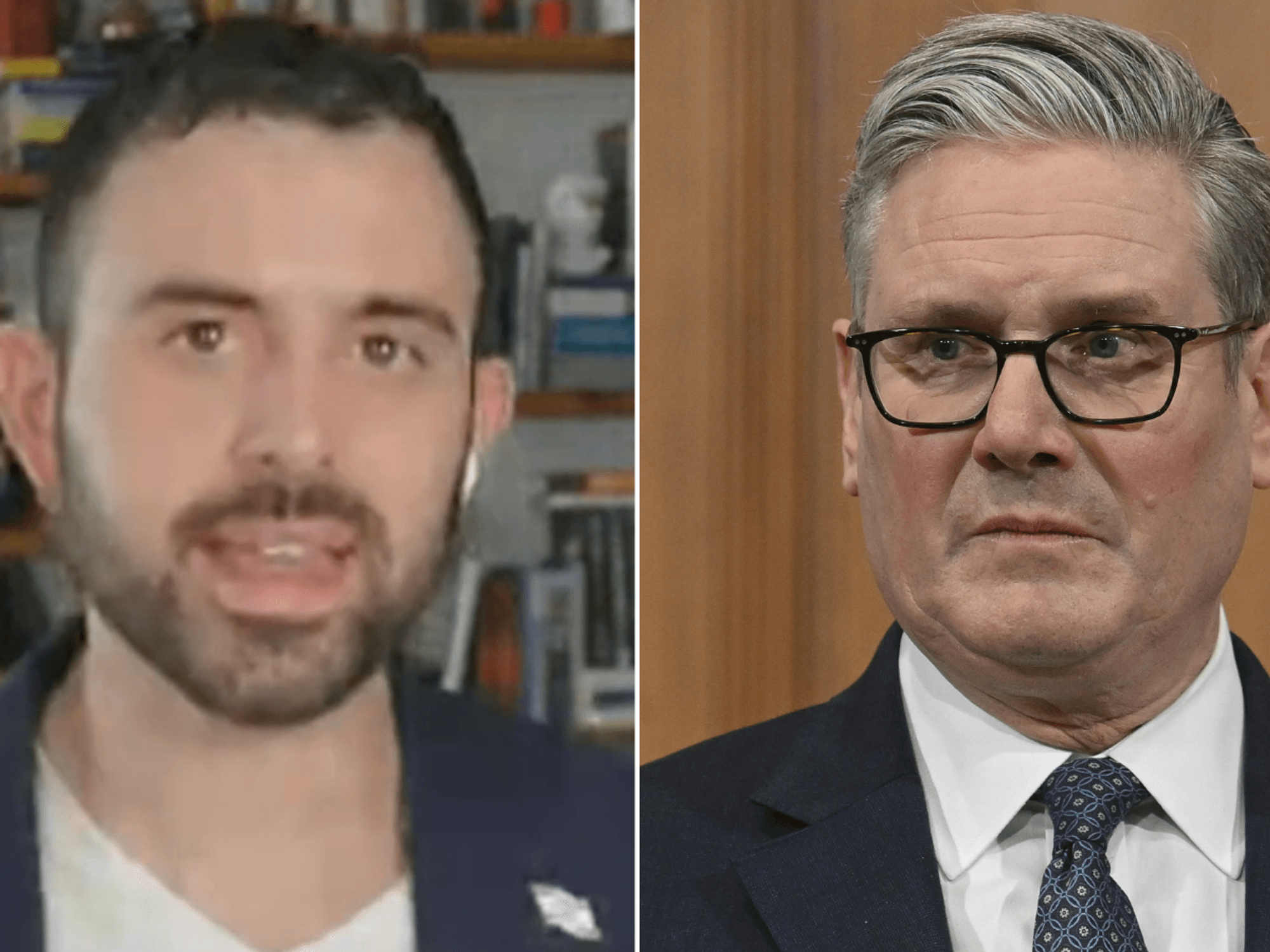

HMRC alert: State pension 'stealth tax' hits 8.5 million pensioners in blow to retirees: 'Sunak is a liar!'

More state pensioners are finding themselves paying tax

|GETTY

Pensioners across the UK are losing more money to HMRC as a result of

Don't Miss

Most Read

Latest

The number of Britons over the retirement age paying tax on their state pension has increased substantially over the past year, according to new figures published by HM Revenue and Customs (HMRC).

Data from the tax authority found annual figures for the number of people paying income tax on their retirement payments jumped by 660,000, from 7.85 million to 8.51 million.

More pensioners are finding themselves pulled into higher tax brackets due to the impact of fiscal drag, when allowances are frozen at a time when incomes are on the rise.

Chancellor Jeremy Hunt has reiterated his intention to keep the current tax thresholds frozen until at least 2028 with the Labour Party refusing to commit to ending the freeze if it wins next week's General Election.

Fiscal drag has been referred to as a "stealth tax" with more people finding themselves losing their hard-earned cash to HMRC under the policy decision from the Treasury.

Last night (June 27), Prime Minister Rishi Sunak claimed older Britons would be slapped with a "retirement tax" for the first time if Sir Keir Starmer's party wins the keys to 10 Downing Street.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Both young and older Britons are paying more taxes due to fiscal drag

| GETTYHowever, Sunak's claim that a future Labour Government would make sure “the state pension will be subject to a retirement tax" has been widely fact-checked for being inaccurate.

As it stands, pensioners are forecast to start paying tax solely on their state pension by the 2027-28 tax year as the payment is expected to exceed the personal savings allowance, which is currently set at £12,750.

Under the triple lock, which both Labour and the Conservative Party have promised to keep in place, state pensions are guaranteed to rise annually by either the rate of inflation, average earnings or 2.5 per cent; whichever is higher.

Thanks to Hunt's decision to freeze tax allowances, more older households are finding themselves pulled into higher tax brackets with lower-income pensioners now facing losing money to HMRC as they are more likely to solely rely on the state pension.

Ahead of voters heading to the polls on July 6, the Tories have floated introducing a "triple lock plus" which would ensure the tax-free allowance on pensions rises every year in line with whatever the triple lock is.

However, analysis has suggested that pensioners will only save £28 a month in retirement income if this policy is eventually put in place. Labour, who are leading the polls and expected to have a majority Government, have not said they will keep this policy in place.

Research conducted by former pensions minister Sir Steve Webb found that nearly 2.5 million people will still pay tax on their state pension even if the "triple lock plus" is introduced.

Webb explained: "These new figures from HMRC are very timely and help to inform the debate about pensioners and tax.

"They show that a combination of frozen tax thresholds and significant increases in the state pension means the number of pensioners paying tax has continued to soar.

"But this is a continuation of a long-term trend which has seen the number of over 65s paying tax rise by around 4 million since 2010/11. For a pensioner in Britain, being an income taxpayer is now the norm rather than the exception."

LATEST DEVELOPMENTS:

- Pension warning as hidden costs could mean you need an extra £200,000 in your pot for a 'comfortable retirement'

- Pensioners to be £150 a year 'better-off' after election - but younger Britons to lose £540 annually

- Pensioners face missing out on £11,000 boost in retirement savings under 'volatile' proposal

Pensioners have struggled amid the rise in the cost of living | GETTY

Pensioners have struggled amid the rise in the cost of living | GETTYReacting to the new HMRC figures, economics commentator Chris Giles said: "The state pension has, of course, always been taxable... and will be in future whoever wins the election."

Voters have also taken to social media to share how they have been affected by this "stealth tax" on pensions with many calling out the "lies" of the country's Prime Minister.

One social media user stated: "My dad along with over one million others pays tax on his state pension - so Sunak is a liar."

Another added: "Sunak is saying this knowing that it only applies to people who live on the state pension and have no other sources of income. If you have a total income over the personal allowance you already pay tax as a pensioner. He is being deliberately dishonest."

A Government spokesperson said: "Our triple lock resulted in the biggest state pension increase in history last year.

"We are delivering a further increase of 8.5 per cent in April, making the basic State Pension £3,700 higher than in 2010. This is significantly above inflation which is forecast to fall below the two per cent target in the second quarter of this year, according to the independent OBR.

"We are also curbing inflation to help everyone’s money go further, boosting Pension Credit – worth on average £3,900 a year for pensioners on the lowest incomes – and have made more than 11.9 million Pensioner Cost of Living payments to help with essential costs this winter."