State pension payment top-up to cost Britons £923 a year as Rachel Reeves launches 'secret exit tax'

Looming changes to National Insurance rules could impact your state pension entitlement

Don't Miss

Most Read

Latest

Britons living abroad will need to pay £900 a year in tax to HM Revenue and Customs (HMRC) if they want to claim the full, new state pension under changes announced by Chancellor Rachel Reeves's in this week's Budget.

Expats face a fivefold increase in voluntary National Insurance payments with the cost set to surge from £182 to £923 annually when the changes take effect on April 9 2026.

According to the Chancellor, the reforms target a system that enabled individuals with limited UK connections to enhance their state pension entitlements at minimal expense.

Foreign nationals who had worked in Britain for just three years could access the scheme. The Treasury's measures will affect both British citizens residing overseas and foreign workers who previously held UK employment.

The Chancellor has unveiled changes to National Insurance contributions which could affect your state pension entitlement

|GETTY / PA

The changes represent a significant tightening of National Insurance contribution rules for those living outside Britain. Under the current arrangements, overseas residents can make class two voluntary National Insurance contributions at £3.50 weekly.

UK residents without worker status must pay the higher class three rate of £17.75 per week. The Budget reforms will require all overseas contributors to pay class three rates.

Additionally, the minimum qualifying period increases from three to ten years of either continuous UK residence or National Insurance payments.

Individuals require 35 years of contributions for the full state pension of £230.25 weekly, equating to £11,973 annually. A minimum of ten years' contributions is necessary to receive any state pension benefits.

What has the impact of the state pension triple lock been on the public's finances | OBR

What has the impact of the state pension triple lock been on the public's finances | OBR During her Budget statement, the Chancellor said: ""And taxpayers’ money should not be spent on pensions for people abroad… …who only lived here for a couple of years and may never have paid a penny of tax.

"The Conservatives let thousands of people living abroad buy their way into the state pension for £3.50 a week… …debasing the purpose of our pension system."

Despite her attempts to improve the state pension regime, Ms Reeves's reforms have divided pension and savings experts.

Sir Steve Webb, former pensions minister and current partner at Lane Clark and Peacock, stated: "It has long been an anomaly that people outside the UK have been able to fill gaps in their state pension record at exceptionally low cost."

He noted substantial anecdotal evidence of widespread exploitation of the system, particularly when historical gaps could be filled dating to 2006-07.

"To some extent, then, the horse may have bolted on this one but it's reasonable enough to say that people outside the UK should be treated no more favourably than those living in the UK who want to top up their pensions."

Becky O'Connor, the director of Public Affairs at PensionBee expressed contrasting concerns, describing the changes as "a secret exit tax" potentially designed to discourage younger workers from emigrating.

She warned: "This may have the effect of dissuading expats from continuing to pay the additional contributions at all, which could mean they get less state pension overall when they become eligible for it."

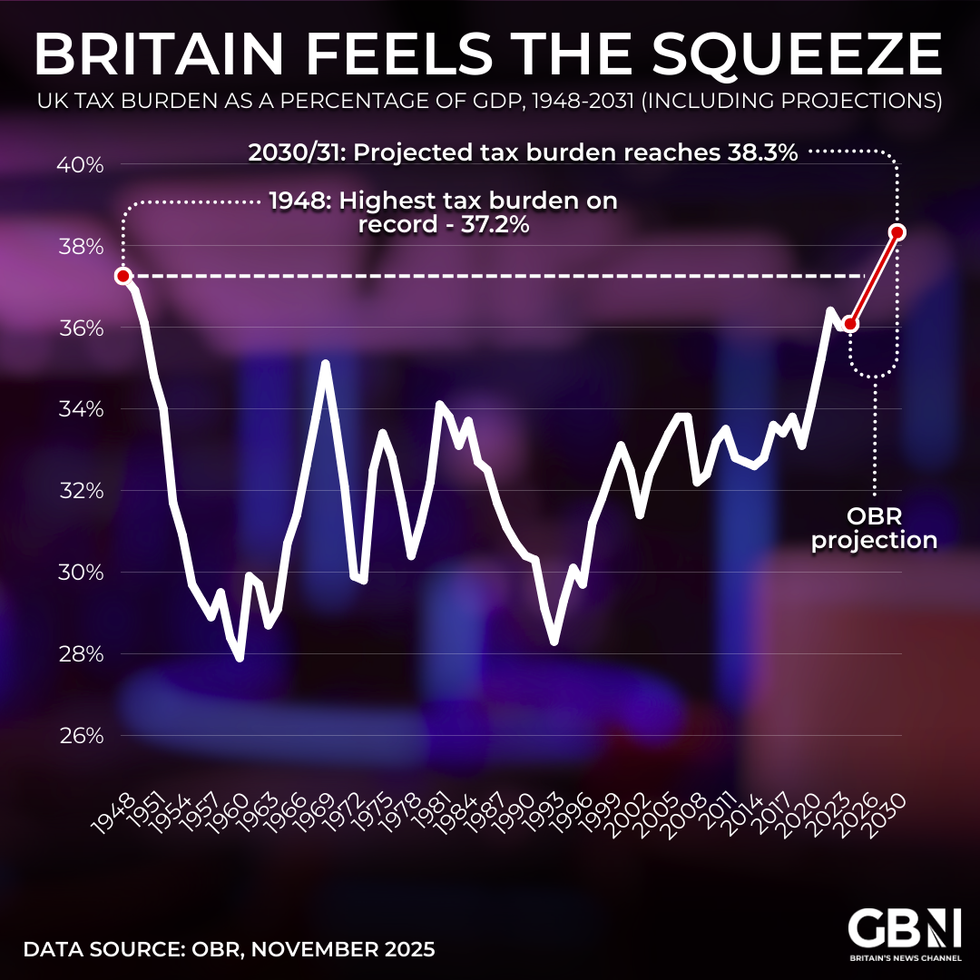

£26billion in tax raids has seen the UK's tax burden projected to rise to a post-war record 38 per cent of GDP by 2030, according to the OBR | GB NEWS/OBR

£26billion in tax raids has seen the UK's tax burden projected to rise to a post-war record 38 per cent of GDP by 2030, according to the OBR | GB NEWS/OBRThe Treasury announced plans for a comprehensive review of voluntary National Insurance contributions, with a consultation document expected early next year.

However, Mr Wwebb cautioned that this broader examination could result in substantial cost increases for UK residents, noting that the current system offers "a generous subsidy to those who top up".

Other pension policies announced by the Chancellor included the £2,000 per year cap on tax-free salary sacrifice contributions.

Once this threshold is crossed, workers will begin to pay National Insurance on their pension contributions.

More From GB News