State pension hack could see future retirees ‘create larger payments’

UK issued 'crisis' warning as state pension age set to increase to 71

|GB NEWS

People are entitled to the state pension once they reach state pension age, which is currently 66, but it doesn’t have to be claimed then

Don't Miss

Most Read

Britons are being reminded they can delay the date they start claiming the state pension in order to “create larger payments”.

Experts are sharing ways in which households could bolster their pension income in light of new concerns about the future cost of retirement.

Earlier this month, the Pension and Lifetime Savings Association (PLSA) revealed the annual cost of having a moderate income in retirement has jumped by £8,000 a year before tax.

On top of this, Now: Pensions highlighted that it would take women an extra 19 years of work to bridge the pension gap with men, with the former having £136,000 less in retirement savings on average.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

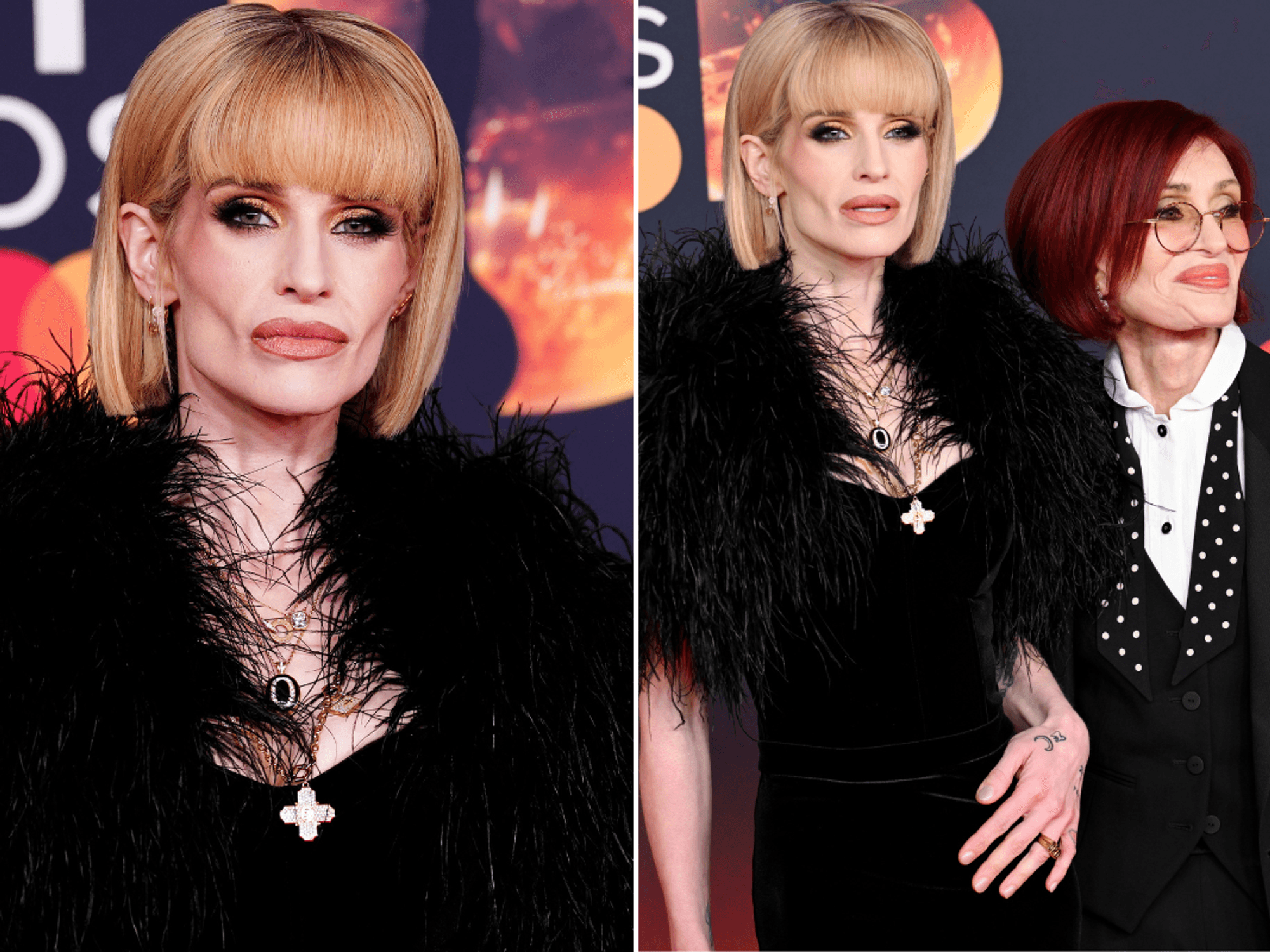

Britons are looking for ways to boost their retirement income

|GETTY

Speaking to GB News, personal finance expert Danny Hendrick from Easy Paye outlined why postponing retirement plans past the age of 66 could be beneficial.

He explained: “Delaying the start date of your pension payments will create larger payments when they do start. This is an especially good idea for those with good health as they are likely to have longer life expectancies.”

How much does deferring state pension increase sum by?

Someone on the new state pension will see payments increase every week they defer, as long as they defer for at least nine weeks if they are eligible to claim on or after April 6, 2016.

Payments increase by the equivalent of one per cent for every nine weeks a claimant defers which is a rate hike of just under 5.8 per cent every 52 weeks.

Any extra amount is paid to claimants with their regular state pension. Anyone who is eligible for the retirement benefit before April 6, 2016, can get their extra sum either as a lump sum or higher weekly payments.

Mr Hendrick also suggested pensioners may decide to compare the benefits of annuities and lump-sum payments.

He added: “Part-time work after retirement can be a great contribution to one’s overall quality of life for several reasons.

“Not only will you have an extra income source, but you can also find a greater sense of purpose and social engagement.”

LATEST DEVELOPMENTS:

Deferring retirement plans could boost peoples' pension pot

| GETTYRecently, The International Longevity Centre warned the state pension age would need to be increased to 71 by 2050 to “maintain the status quo” due to changing life expectancy and the cost of maintaining the triple lock.

If such a proposal was introduced, it may not be possible for future retirees to wait past state pension age to start claiming retirement support. Despite this, the personal finance expert highlighted there are other ways to increase retirement income outside of retiring past the state pension age.

Mr Hendrick added: “Flexible roles that involve community or incorporate your passion can be a great way to enhance the overall quality of your life.

“Various investment options like bonds and options can also add value to your portfolio, creating a potential for extra income throughout the years. While diversification is key, keep other options in mind like the length of investments and estimated or agreed return.”

With investing, capital is at risk and the value of investments can go down as well as up.