Blow to homeowners as mortgage interest rates ‘rising’ amid ‘volatility’ in the property market

Homeowners and buyers have been hoping for a reduction in mortgage rates in the near future

Don't Miss

Most Read

Latest

Mortgage rates are “rising” amid volatility in the property market, experts are warning homeowners and prospective homebuyers.

The average two-year fixed homeowner mortgage rate on the market on Tuesday was 5.70 per cent across all deposit sizes, according to financial information website Moneyfacts.

This represents a slight jump from an average interest rate of 5.69 per cent earlier in the week.

Similarly, the average five-year fixed homeowner mortgage rate came to 5.28 per cent yesterday, a slight rise from Monday.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Mortgage rates are 'rising', according to experts

|GETTY

Based on Moneyfacts’ data, many high street banks and building societies had fixed mortgage rates priced under four per cent. This included Santander, Nationwide, Halifax, HSBC UK and NatWest.

However, as of yesterday, the financial information website revealed only a handful of lenders were offering rates this low, including HSBC UK and Danske.

This comes shortly after Santander confirmed it would be increasing the residential and buy-to-let mortgage rates across its new business and product transfer ranges.

For product transfers, selected residential fixed rates would increase by up to 0.20 percentage points but the lender did not announce any changes to tracker rates.

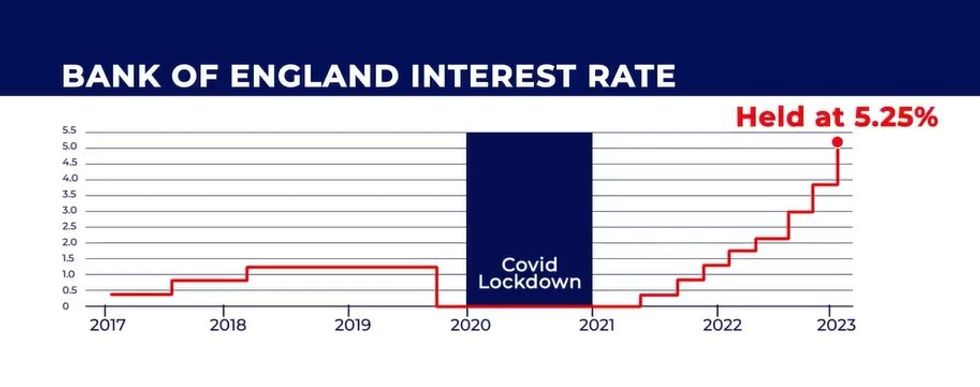

Homeowners and buyers have been saddled with record high mortgage repayments over the past year due to the Bank of England’s decision to raise the base rate.

Interest rates have gone up to 5.25 per cent in order help mitigate the impact of inflation on the economy.

Analysts are betting on the central bank slashing the base rate in the latter half of 2024 but some are warning the UK’s recession woes could be prolonged if this does not happen fast enough.

Rachel Springall, a spokesperson for Moneyfacts, said: “The swap rate market (which is used by lenders to price their loans) has been notably volatile over the past month, and rises are having an impact on fixed rates.

LATEST DEVELOPMENTS:

The Bank of England base rate is at a 15-year high of 5.25 per cent | GB NEWS

The Bank of England base rate is at a 15-year high of 5.25 per cent | GB NEWS“The average two-year fixed mortgage rate appears to be rising more than longer-term rates for now, so it’s possible short-term fixed pricing will remain a key focus for lenders reviewing their margins in the coming weeks.

“As always, its vital borrowers seek (the) advice of a mortgage broker to review their options.”

A Santander spokesperson said: “Santander continually reviews its rates based on a number of factors, such as wider market conditions including swap rates.

“We offer a range of competitive mortgage deals with five-year deals starting from 4.17 per cent and two-year deals starting from 4.53 per cent.”