Skipton Building Society launches new savings account offering 5.04 per cent interest rate

Skipton Building Society has launched a new savings account

|PA

Skipton Building Society’s new savings product includes a 1.24 per cent uplift for the first year

Don't Miss

Most Read

Skipton Building Society has launched a new savings account which pays a 5.04 per cent interest rate for the first 12 months.

The account is easy access, meaning savers can withdraw their money without notice or charge.

The building society said this “bumper” rate, which includes a 1.24 per cent uplift for the first 12 months, means the new savings product is in the top three easy access savings accounts currently on the market.

The new Bonus Saver can be opened with just £1.

Skipton Building Society says the account can be opened via all channels, such as in-branch, online or by phone

|PA

The maximum amount savers can deposit in this account is £85,000.

Skipton’s Bonus Saver can be opened in branches as well as by phone and online.

Maitham Mohsin, head of savings at Skipton Building Society, said: “With savings rates steadily on the rise, the Bank of England’s decision in September not to raise its Base Rate hints that we may be at the peak of rates.

“But despite that, in an exciting development, we’re introducing a new product featuring a strong variable interest rate.

“At over five per cent, and being easy access, Bonus Saver is a really simple, zero pressure route into getting your money working hard.

“It’s a bit like a current account in that way. You can access your money quickly and easily, move it if you need to, but you’ll also enjoy a healthy return on your cash while it’s stowed away.”

Skipton Building Society last week warned that there are seven million current accounts with £10,000 or more earning zero per cent interest.

The building society said it means £255billion of Britons’ money sees no return whatsoever.

According to their calculations, if a person deposited £10,000 in this Bonus Saver, the 5.04 per cent rate would return £504 in the year.

LATEST DEVELOPMENTS:

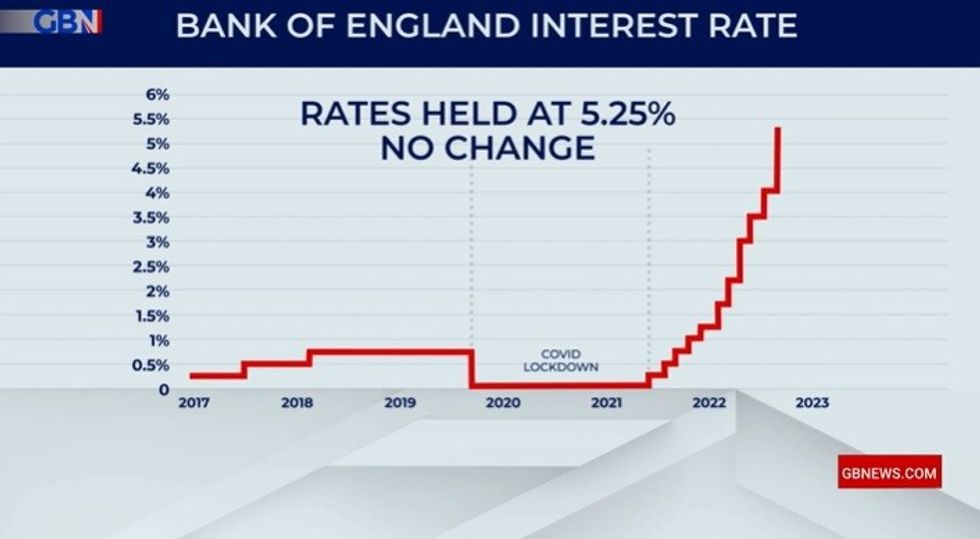

The Bank of England has hiked the base rate 14 times in a row, but the rate was held this month

|GB NEWS

Savers from a range of banks and building societies have been able to benefit from improved savings rates of late, following 14 consecutive hikes to the Bank of England base rate.

The base rate was maintained at 5.25 per cent this month, for the first time the rate has gone unchanged since the first of 14 increases in December 2021.

Savings expert and CEO of My Community Finance, Tobias Gruber, said savers should "act now" to take advantage of high interest rates "while they're still here".

He added: “To get the best return on your savings, compare your options across traditional high street banks, building societies, online banks and credit unions.

"Similar to how you’d switch car insurance providers to find the best price, you need to apply the same principle to your savings."