Savings alert: Britons urged to make one check or risk losing £100s ahead of Bank of England interest rate decision

Savers urged to be careful of tax on savings interest |

GB News

Millions face cash erosion as Bank of England decision and inflation loom

Don't Miss

Most Read

Millions of savers could lose hundreds of pounds if they fail to check their interest rates before the next Bank of England decision.

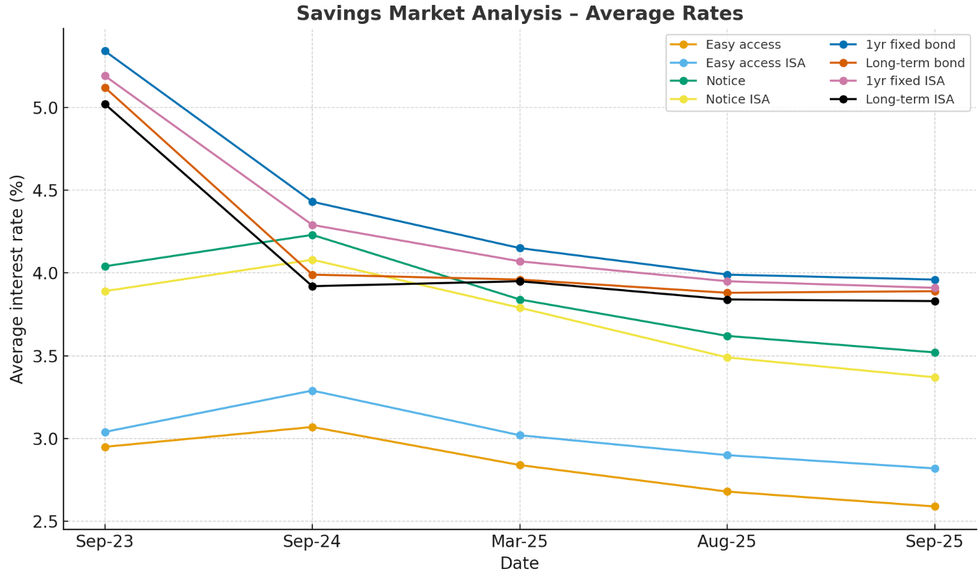

Fresh data from Moneyfacts shows that only 26 per cent of savings accounts beat the Bank’s current base rate of four per cent.

That means three-quarters of savers are stuck in accounts paying less than inflation, leaving their hard-earned deposits shrinking in real terms.

The warning comes just weeks before the next inflation and Bank of England updates.

Finance experts say savers who fail to act could be hundreds of pounds worse off each year.

Average easy access accounts pay just 2.59 per cent.

That means a saver with £10,000 would earn £259 a year compared with £400 if their money tracked the base rate.

The shortfall of £141 grows rapidly for larger sums.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Bank of England data shows savers moved £4.3billion into fixed-term deposits in July, three times the month before

| GETTYSomeone with £50,000 in savings is missing out on more than £700 annually.

Moneyfactsgroup finance expert Rachel Springall said: "The vast majority of savers will see their pots eroded in real terms."

She added: "This will be incredibly demoralising for savers who use their interest to supplement their income, and in fact, the situation has been dire for many years."

Even fixed-rate deals are struggling to keep pace.

A saver with £10,000 would earn £259 a year compared with £400 if their money tracked the base rate.

|CHAT GPT

One-year bonds are averaging just 3.96 per cent, while their ISA equivalents pay 3.91 per cent.

Easy access ISAs are down at 2.82 per cent and notice accounts stand at 3.52 per cent.

This fall comes despite record choice, with 2,289 savings products now available including 662 cash ISAs.

But average returns have plunged from 4.29 per cent in September 2023 to today’s 3.46 per cent.

Ms Springall warned: "Savers are casualties of base rate cuts."

Households already struggling with high living costs are being hit hardest.

Many savers have not checked their rates in years, leaving money languishing in underperforming accounts.

There are still ways to protect cash.

Fixed-rate bonds and notice accounts offer stronger returns, while cash ISAs guarantee tax-free savings.

The Bank of England reduced interest rates to help stimulate the economy.

| GETTY/PABank of England data shows savers moved £4.3billion into fixed-term deposits in July, three times the month before.

Ms Springall urged: "Those who have yet to utilise their ISA allowance would be wise to do so, especially if savers fear a cut to the allowance could be announced."

She also warned: "The Personal Savings Allowance could be reviewed or abolished in the future by the Government."

Experts are clear.

Anyone who does not check their interest rate before the next inflation and Bank of England decisions risks being quietly robbed of hundreds of pounds a year.

More From GB News