Savers hit with 'unfair' 25% tax charge as Britons 'punished' under ISA rules

ISAs are popular savings product for individuals looking to avoid paying tax on their returns

Don't Miss

Most Read

Latest

Savers using ISA products are being hit with an "unfair" 25 per cent tax charge which should be potentially reformed, according to analysts.

Fresh Government research has revealed that nearly half of Lifetime ISA holders opened accounts to purchase property, whilst a similar proportion aimed to boost retirement savings. The HMRC study surveyed both current account holders and eligible non-users.

The findings demonstrate strong customer satisfaction, with 96 per cent reporting straightforward account setup processes. Additionally, 87 per cent found withdrawing funds simple.

Nearly four in five respondents indicated the government bonus proved crucial or significant when purchasing their first property. However, merely seven per cent pursued dual objectives of homebuying and retirement planning.

Britons who withdraw from their ISA account early could be hit with a 25% tax charge

|GETTY

The research exposed that 11 per cent accessed funds early, incurring the 25 per cent penalty charge, though 86 per cent understood this consequence beforehand.

Despite positive feedback, significant barriers prevent wider adoption. The research identified eliminating the withdrawal charge as the reform most likely to attract new account holders.

The Treasury Committee's recent report echoed these concerns, criticising the product's complexity. The committee suggested modifications to both the early withdrawal charge and the maximum property purchase price could enhance the scheme's attractiveness.

Current restrictions include contribution bonuses ending at 50 and withdrawal access blocked until 60, except for first-home purchases.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Savings rates continue to be competitive | GETTY

Savings rates continue to be competitive | GETTY The research indicated half of account holders specifically wanted retirement savings options, yet age limits restrict new accounts to those between 18 and 39.

Rachel Vahey, head of public policy at AJ Bell, praised the product's effectiveness whilst highlighting necessary improvements.

Ms Vahey said: "Lifetime ISA account holders have given the tax wrapper a resounding thumbs up, showing the product can help younger generations realise their home ownership dreams."

She emphasised the unfairness of the current penalty system: "Even the best-laid plans often go awry and it is unfair to punish people with an exit charge that goes beyond simply recovering the Government-funded bonus."

MEMBERSHIP:

- EXPOSED: Bombshell report blows lid on the staggering number of Channel migrants who pretend to be children

- REVEALED: The five biggest scandals that have rocked Labour since sweeping to power as Angela Rayner on brink

- Reform's Doge unit has uncovered a £1.2bn money pit. Labour must be terrified about May 2026 - Ann Widdecombe

Ms Vahey advocated returning to pandemic-era rules where penalties matched only the original bonus received.

She noted that those making early withdrawals often faced financial difficulties.

The Government pledged to examine ISA reform options during the Spring Statement, with further confirmation at the Mansion House speech.

Officials promised to streamline ISAs whilst promoting greater uptake of stocks and shares accounts.

LATEST DEVELOPMENTS:

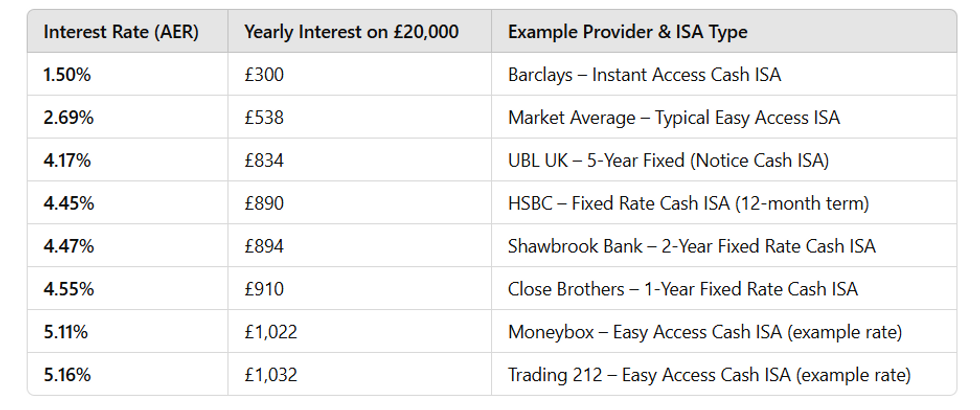

Examples of tax free Isa earnings in the UK if you had £20,000 in the Isa | GBN

Examples of tax free Isa earnings in the UK if you had £20,000 in the Isa | GBNAJ Bell has advocated for merging cash and stocks and shares ISAs into one tax wrapper to decrease complexity and boost investment participation.

The firm's research suggests excessive complexity drives savers towards cash rather than potentially more suitable investments.

Ms Vahey highlighted particular concerns about self-employed workers missing opportunities.

She added: "Many people choose to supercharge their savings plans in the middle and latter stages of their career and Lifetime ISAs are an especially convenient retirement saving option for self-employed workers in particular."

More From GB News