Santander pledges to become 'digital bank with branches’ amid wave of closures across UK

Branch closures are set to continue this year but Santander has today reiterated its commitment to still have branches despite the push to online banking

Don't Miss

Most Read

Santander has pledged to continue operating branches across the UK despite the industry shift to online banking.

The retail bank’s executive chair Anna Botin stated the group has “embarked on a global transformation to become a digital bank with branches”.

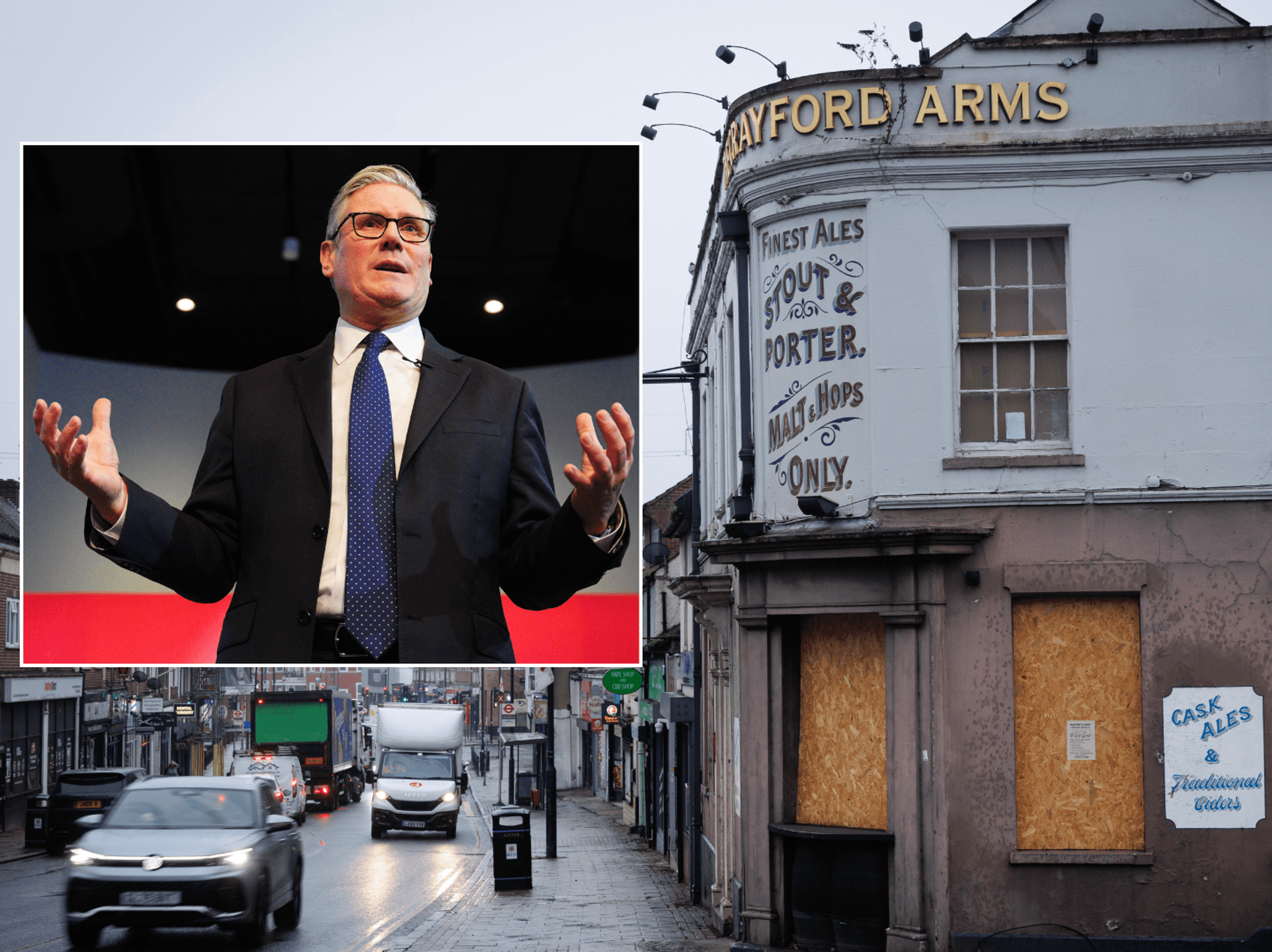

This comes amid the ongoing trend of bank branch closures which have hit the country’s high streets in recent years.

Ms Botin made the comments about branches during the bank’s annual meeting in Madrid earlier today.

Currently, the bank has 444 branches in the UK which serve around an estimated 14 million customers.

Last year, Santander closed six of its branches but has no plans to close sites in 2024, according to its website.

Have you been impacted by bank branch closures? Get in touch by emailing money@gbnews.uk.

Santander has said it is still committed to physical branches despite the push to digital

|GETTY

In today’s financial statement, Santander stated it expects to beat its record high 2023 earnings later this year.

The Spanish-owned bank said it plans to hand out more than €6billion (£5.2billion) to shareholders in 2024.

According to the banking group, this is part of its transformation to become a “digital bank with branches”.

During the meeting, Santander confirmed it is on track to meet its 2024 targets, having added two million customers this year.

This increase is set to bolster the banking group’s income by about 10 per cent over the first quarter, compared with last year.

In 2023, the bank posted a record €11.1billion (£9.5 billion) profit which was helped by higher interest rates.

Central banks, including the Bank of England, have raised base rates in the fight against inflation which has pushed up the cost of borrowing.

Thanks to this, Santander reported a record amount returned to shareholders through dividends and share buybacks of €5.5billion (£4.7 billion).

However, the banking group revealed that it is confident it will be able to beat this record by the end of this financial year.

Ms Botin said: “I am very confident that we will deliver a considerably better performance in 2024 than 2023, which was already a record year, and will meet our 2024 targets.

“That being the case, cash dividends and share buybacks against 2024 results would amount to over €6billion £5.2 billion).”

LATEST DEVELOPMENTS:

The bank's chief executive pledged to keep branches part of Santander's business

|GETTY

The latest commitment from Santander to continue operating physical branches will be a win for its customers who prefer in-person banking.

In recent months, the rise of bank branch closures has led many experts to share their concern over the lack of access to cash services.

Based on data from consumer watchdog Which?, around 5,791 branches have closed since January 2015.

This is the equivalent of around 54 a month and is expected to continue throughout 2024, however Santander will not be participating in this growing trend.