Older savers caught in 'retirement squeeze' as nearly half fear funds will run out

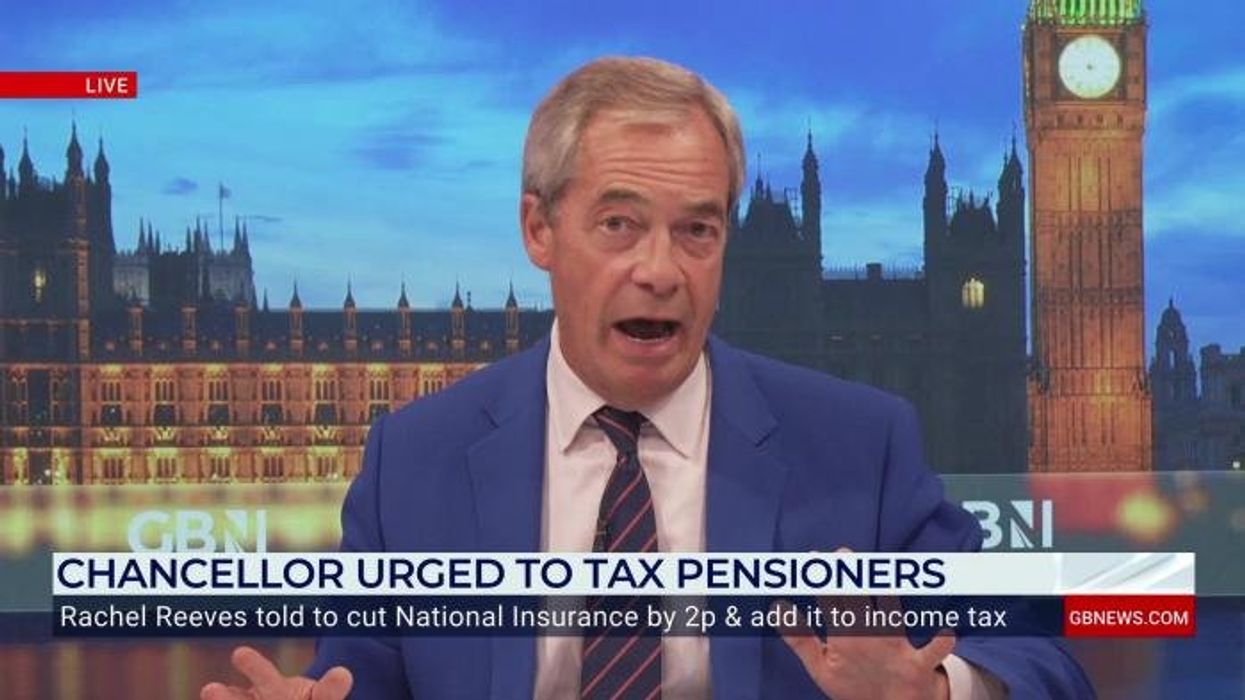

Nigel Farage explodes at 'direct attack on thrift' as Rachel Reeves mulls tax on pensioners |

GB NEWS

Research shows over-60s dipping into savings as cost of living pressures mount

Don't Miss

Most Read

A new financial worry is gripping Britain's over-60s, with nearly half concerned their nest eggs will not last through retirement.

Fresh research from Nottingham Building Society reveals that 42 per cent of older adults fear their savings will run dry — almost double the 22 per cent of those aged 18 to 44 who share similar concerns.

This "retirement squeeze" is forcing many to make tough choices.

Nearly half of people over 60 have already raided their savings just to keep up with everyday expenses.

TRENDING

Stories

Videos

Your Say

That is 45 per cent who have had to dip into money set aside for their later years.

The contrast with younger generations is striking.

Only one in five adults aged 18 to 24 and about a quarter of those aged 35 to 44 have touched their savings to cope with rising costs.

Harriet Guevara, chief savings officer at Nottingham Building Society, said: "Many older savers are finding themselves caught in a 'retirement squeeze' — worried about how long their pensions and savings will last while also feeling the pinch of rising living costs."

Nearly half of Britons over 60 fear their retirement savings won’t stretch far enough

|GETTY

She pointed out that while younger people grapple with rent and getting on the property ladder, those in their 60s and beyond face a different challenge.

Ms Guevara said: "Rising bills and the higher cost of living means that pensions often do not go as far as people thought they would when they were saving over the decades."

The research also shows clear differences in how generations handle their money.

Nearly half of over-60s keep their savings in Cash ISAs — 48 per cent compared to just 15 per cent of those aged 18 to 24.

Latest Development

Stocks and Shares ISAs are the top pick for younger savers

| GETTYYounger savers prefer Stocks and Shares ISAs instead, with 29 per cent of 25 to 34-year-olds choosing this option.

Looking back, many older adults wish they had done things differently with their money.

Almost a third of over-60s say they should have put more into their pension.

For anyone eligible for automatic enrolment, their employer is required to enrol them in a pension scheme and contribute to it.

Many pensioners would do things differently

| GETTYThe feeling is much less common among younger people, with only 14 per cent of 25 to 34-year-olds and 15 per cent of 35 to 44-year-olds sharing this regret.

The advice from those who have been there is to start early and keep at it.

Ms Guevara said: "What stands out is the advice older people would give their younger selves. Start saving sooner, prioritise your pension and commit to small but regular contributions."

She emphasised that even modest amounts can make a real difference over time.

LATEST DEVELOPMENTS

She said: "Keeping an emergency buffer for unexpected costs, reviewing pension drawdown regularly and making the most of tax-free allowances like ISAs, can all make a real difference."

The goal is finding the right balance between managing today's expenses and ensuring long-term financial security.

Ms Guevara concluded: "Ultimately, it is about balancing today's pressures with long-term security so that people can feel more in control of their financial future."

These generational differences in savings habits and financial worries highlight two very different money challenges facing Britain today.

More From GB News