Energy bill hikes to be PAUSED under new deal with EU as UK businesses at risk of £800m tax

Ed Miliband risks ‘disproportionately burdening’ families with energy bills shake-up |

GB NEWS

The European Union's carbon adjustment mechanism, which is expected to be an extra tax on firms, is currently set to come into effect from January 1

Don't Miss

Most Read

British businesses are to temporarily avoid paying a new tax impacting energy bills in 2026 as the UK Government is understood to have reached an agreement with the European Union regarding a looming levy.

Firms faced an £800million financial blow when Brussels implements its carbon border adjustment mechanism on January 1, with the new levy threatening to increase consumer costs and damage UK exports to Europe.

The impending tax targets energy-intensive imports from nations outside the EU's emissions framework, affecting British manufacturers of steel and other industrial products who currently operate under different environmental regulations.

Reports suggest Labour ministers are racing against time to secure interim measures that would shield UK companies from the full impact of these charges while negotiators work on a comprehensive agreement linking British and European emissions trading schemes.

Energy bill hikes to be paused under new deal with EU as UK businesses at risk of £800m tax

|GETTY

Nick Thomas-Symonds, the EU relations minister, is expected to request a provisional waiver from the carbon adjustment mechanism this autumn, with Chancellor Rachel Reeves reportedly worried about the consequences for British industry.

Although formal exemptions are not permitted under the existing EU legislation, Brussels appears ready to explore alternative approaches to minimise the burden on UK exporters during the transition period, The i Paper reports.

The temporary measures would only need to remain in place for several months while negotiators finalise the broader emissions trading agreement promised during the UK-EU summit in May.

Under carbon adjustment mechanism, firms which exporting to Europe are obligated pay the gap between the EU's higher carbon pricing and their home country's rates, creating immediate financial pressure on British manufacturers.

Reports suggest the UK and EU are close to deal

| PAEven when pricing aligns, exporters must navigate substantial administrative hurdles, calculating their products' carbon footprint and securing independent verification, adding layers of bureaucracy to cross-border trade.

Northern Ireland faces particular complications as its position within the EU's single market for goods means the carbon levy would apply directly, potentially creating fresh regulatory divisions on the island.

Without intervention, British companies would need to transfer payments directly to Brussels from the new year, affecting sectors from steel production to chemical manufacturing.

Adam Berman, the director of policy at Energy UK, stressed that finding a resolution before the January deadline serves mutual interests.

He warned: "Without a solution in place to exempt the UK from the CBAM during linkage negotiations, the design of the EU CBAM will result in higher energy bills and higher emissions in Northern Europe."

Mr Berman described this potential outcome as "bizarrely perverse" for a policy intended to combat climate change and boost European competitiveness.

Furthermore, he highlighted the particular risks for Northern Ireland, suggesting Brussels must be conscious of the political ramifications of establishing fresh regulatory barriers on the island and the potential impact on the Windsor Framework.

Trade expert David Henig confirmed both parties are developing technical "mechanisms" to prevent British companies from bearing the full weight of the carbon levy.

LATEST DEVELOPMENTS:

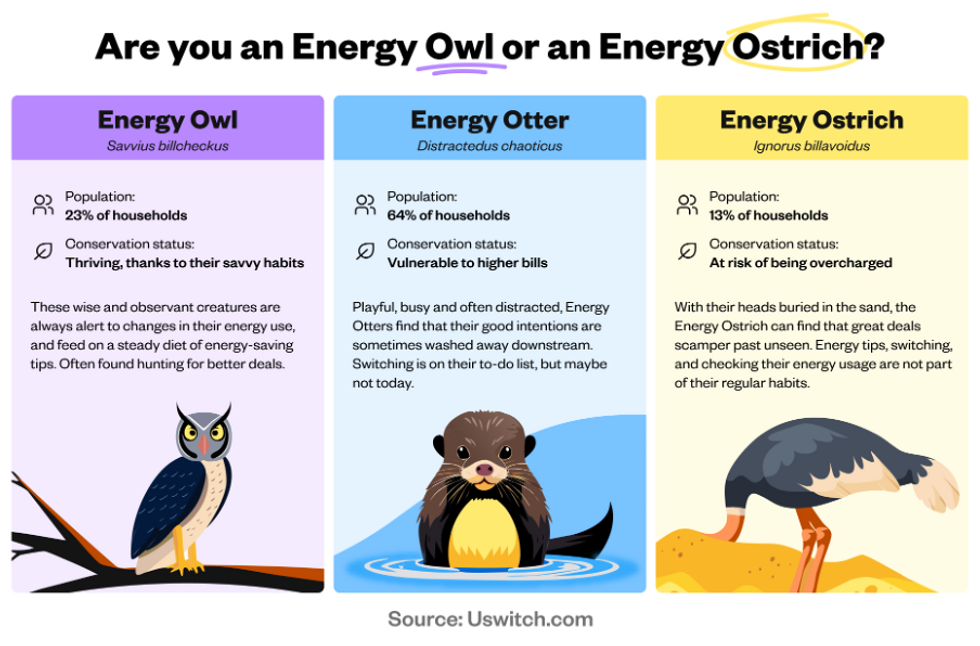

"Energy Owls" actively manage their energy usage, check tariffs, and track their bills. | Uswitch

"Energy Owls" actively manage their energy usage, check tariffs, and track their bills. | UswitchThe temporary carbon tax arrangement forms part of wider Brexit reset discussions, with a second major summit between London and Brussels scheduled for May or June next year.

During this gathering, officials aim to finalise agreements on food and drink commerce, youth mobility programmes and additional cooperation areas.

Britain is also expected to join the EU's €150billion defence investment initiative by mid-November, strengthening European security cooperation despite resistance from certain member states including France who seek to attach stringent requirements.

.A UK Government spokesperson said: “We aren’t going to provide a running commentary on negotiations.”

More From GB News