Recession alert: US economic downturn 'would be straw that breaks the UK's back' as stock market tumbles

GB NEWS

Investors are concerned about a potential AI stock market 'bubble' which analysts warn could trigger a recession on both sides of the Atlantic

Don't Miss

Most Read

Latest

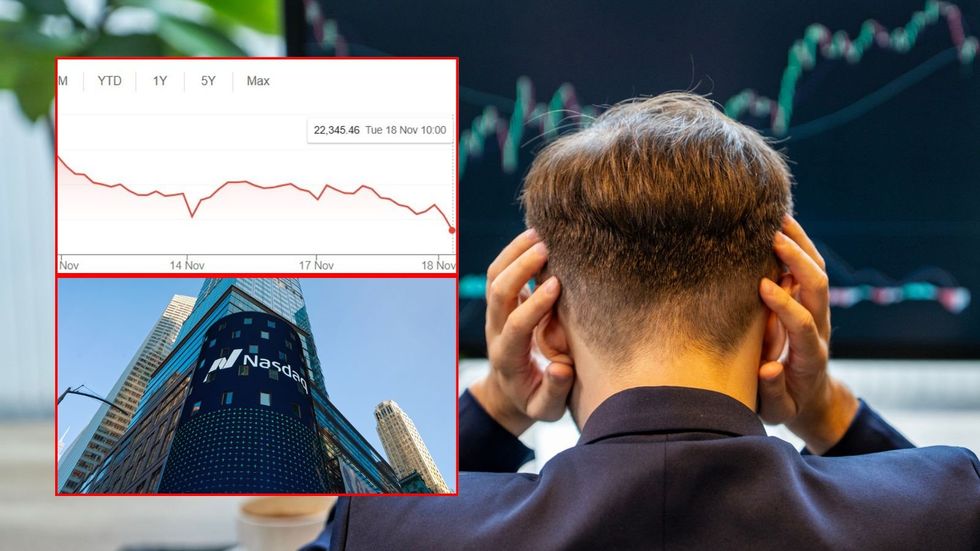

Economists and financial analysts are warning a recession in the US "would be the straw that breaks the UK's back" as the global stock market continues to slip into the red this week.

Markets plunged yesterday (November 17) as US Federal Reserve Governor Christopher Waller issued a dire warning about "eye-popping" redundancies looming across major American corporations in the wake of President Donald Trump's sweeping tariffs.

American equities tumbled whilst Asian markets experienced significant declines. Bitcoin suffered particularly badly, plummeting to its lowest point in seven months as investors fled risky assets.

The semiconductor manufacturer Nvidia, which sits at the heart of artificial intelligence investment fever, contributed to the downward pressure on American indices. The company's earnings announcement, scheduled for Wednesday, has become a focal point for nervous traders.

Could a US recession be on the way?

|GETTY / GOOGLE

Thursday's anticipated American employment figures have added another layer of uncertainty to already jittery markets with analysts signaling the US could be approaching recession territory.

A recession is defined as happening when a country's economy experiences two or more consecutive quarters of negative gross domestic product (GDP) growth.

Fnancial experts have issued stark warnings about Britain's vulnerability to an American economic downturn. Chris Barry, director at London-based Thomas Legal, told Newspage that "the US going into recession would be the straw that breaks the UK's back for sure".

Mr Barry suggested America would likely resort to monetary expansion to avoid crisis. "They will print themselves out of default and recession as they have done throughout most of history since leaving the gold standard," he explained.

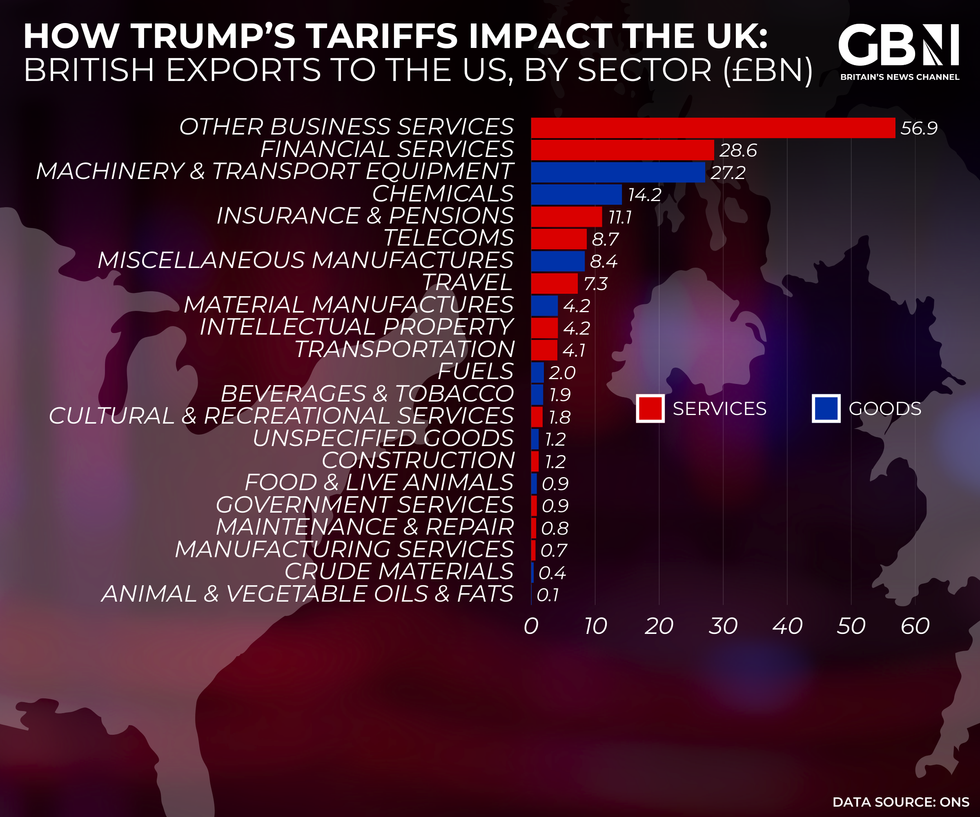

IN DEPTH: How could Trump's tariffs impact Britain? British exports to the US ranked | GB NEWS

IN DEPTH: How could Trump's tariffs impact Britain? British exports to the US ranked | GB NEWSPrem Raja, the head of trading floor at Currencies 4 You, observed that markets have shifted focus from inflation concerns to recession anxieties. "Waller's warning about large-scale redundancies has rattled sentiment because it hints that corporate America is preparing for a deeper downturn," Mr Raja noted.

Concerns about an artificial intelligence investment bubble have intensified amongst market analysts. Riz Malik, director at Southend-on-Sea-based R3 Wealth, questioned whether "the AI bubble about to burst", noting this has been the market's persistent worry.

Mr Malik highlighted that veteran hedge fund manager Michael Burry, who famously predicted the 2008 financial crisis, has taken a bearish position against AI investments.

"Given this bubble has been driving recent gains, fuelled by AI heavyweights such as Nvidia, an adjustment may be on the cards," the financial analyst warned.

James Chu, the founding director at Wisbech-based Tricio Investment Advisors, acknowledged that artificial intelligence optimism had delivered remarkable gains to large American technology shares since April.

However, he expressed concern about current valuations being "stretched", suggesting further market retreats could materialise during year-end portfolio adjustments.

Bitcoin's dramatic decline has exposed its failure to function as a defensive investment during market turbulence. Scott Gallacher, director at Leicester-based Rowley Turton, observed that "in theory, if it were truly a 'safe haven', it should rise when fear enters the market. Instead, it's fallen harder than equities".

Dariusz Karpowicz, the director at Doncaster-based Albion Financial Advice, echoed this assessment. "Bitcoin dropping like a stone rather proves it's not the safe haven some claim," he stated.

Bitcoin's value has plummeted in recent weeks

|COINBASE

The cryptocurrency's sharp sell-off alongside traditional risk assets has reinforced its status as a highly speculative investment. Mr Raja noted that Bitcoin "often trades like a high beta asset", demonstrating extreme volatility during periods of market stress rather than providing the stability some advocates have promised.

Several experts challenged the recession narrative despite market turbulence. David Belle, founder and trader at Fink Money, pointed to America's 3.8 per cent growth rate as evidence that "recession is very much far off."

Mr Belle suggested job losses stemmed from artificial intelligence enhancing productivity rather than economic weakness.

"Business margins are either being at least maintained or improved with the introduction of AI processes," he explained.