Rachel Reeves urged tax middle class instead of wealthy to plug £30billion black hole

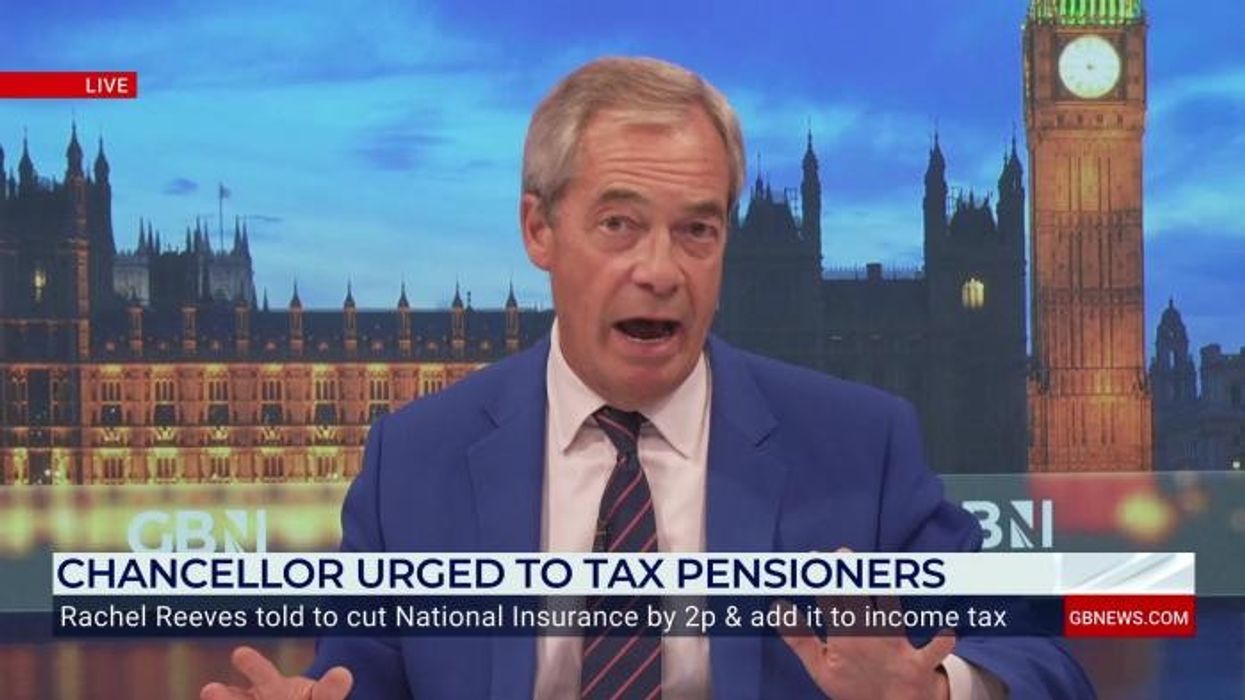

Nigel Farage explodes at 'direct attack on thrift' as Rachel Reeves mulls tax on pensioners |

GBNEWS

The think tank warned that taxing only the wealthiest would not raise enough revenue and called for measures to include typical earners

Don't Miss

Most Read

Chancellor Rachel Reeves faces pressure to impose tax increases on middle-income households instead of targeting wealthy individuals to close an estimated £30billion fiscal gap.

The Institute for Government has argued that broadening the tax burden across average earners would represent the "least economically damaging" approach to addressing the Treasury's financial shortfall.

The recommendation challenges Labour's election commitment to leave income tax, VAT and National Insurance untouched.

The IfG suggested that attempting to generate significant revenue exclusively from the wealthiest citizens would prove "difficult and risky", advocating instead for measures affecting those on typical salaries.

This marks the second such proposal within two days calling for the Chancellor to reconsider her tax strategy.

Treasury officials expect the Office for Budget Responsibility to cut its forecasts for productivity growth, a move that could leave the government needing to find an extra £20billion through tax rises.

On top of this, around £5billion is required to cover the cost of scaling back welfare reforms announced earlier this year, while another £5billion is likely to be needed for higher-than-expected interest payments.

The widening black hole is set to make it harder for ministers to pledge an end to the controversial two-child benefit cap, despite mounting pressure to scrap the policy.

The think tank, which receives funding from Lord Sainsbury's Gatsby Foundation, stated that tax increases should "fall on those with average incomes".

Tom Pope, the organisation's deputy chief economist, said: "This autumn, the Chancellor finds herself in a difficult position. With tax rises all but inevitable, she should reject the path of least resistance, often taken by her predecessors, of raising taxes in an inconsistent way based on what seems easiest."

The think tank cautioned that wealthy individuals possess greater mobility than typical workers, meaning even modest numbers relocating abroad could create tax revenue deficits.

LATEST DEVELOPMENTS:

The Chancellor finds herself in a difficult position

|PA

The Treasury has reaffirmed its position on protecting workers' pay packets.

A Treasury spokesman said: "We are protecting payslips for working people by keeping our promise to not raise the basic, higher or additional rates of income tax, employee National Insurance or VAT."

Despite these assurances, economic experts suggest maintaining such commitments may prove increasingly difficult.

Paul Johnson, former director of the Institute for Fiscal Studies, has proposed raising the basic income tax rate.

The former director of the Institute for Fiscal Studies has proposed the Chancellor should raise the basic income tax rate

| GETTYThe Resolution Foundation has also suggested Ms Reeves should hike income tax by two per cent - while slashing the National Insurance rate by the same amount.

The move could raise £6billion for the Government as income tax is also paid by pensioners and self-employed Britons, while workers on a salary would see the hike cancelled out by the NI drop.

The think tank pushing for the plans harbours strong ties with senior figures within the Government.

Chancellor Rachel Reeves is confronting mounting fiscal pressures | POOL

Chancellor Rachel Reeves is confronting mounting fiscal pressures | POOL Rain Newton-Smith, who leads the Confederation of British Industry, stated: "When the facts change, so should the solutions."

Lord Sainsbury, who previously chaired the Sainsbury's supermarket chain, has contributed more than £20million to Labour over the past thirty years.

Economists estimate Ms Reeves must secure between £20billion and £50billion when she presents her budget on November 26.

More From GB News