Rachel Reeves plotting new tax hike that could 'drive Britons into arms of criminals'

Rachel Reeves tax promise was 'fool hardy' as Chancellor 'boxes herself in' by rejecting further hikes |

GBNEWS

The survey found that 56 per cent of participants described these illegal products as "easy to get hold of"

Don't Miss

Most Read

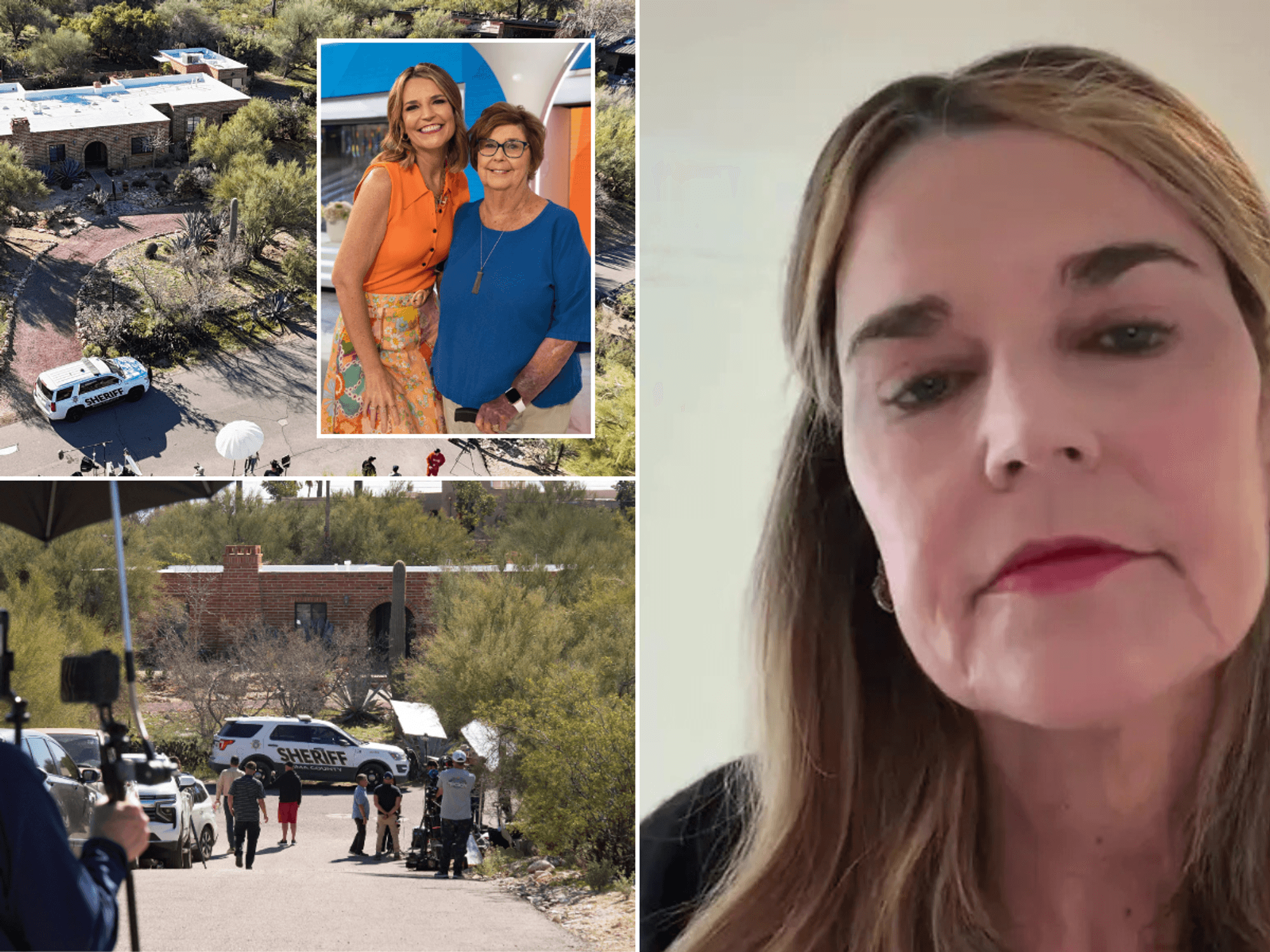

Chancellor Rachel Reeves is under fire over plans for fresh tobacco tax hikes that experts warn could backfire badly.

New figures suggest the move risks driving millions of smokers into the hands of smugglers and criminal gangs.

More than half of smokers say they would consider turning to the black market if Chancellor Rachel Reeves raises tobacco duty in November’s Budget.

Industry polling shows 51 per cent of smokers would be pushed towards illicit sales, where cigarettes can be bought for less than half the price of legitimate packs.

Experts warn the move could deepen the UK’s booming illegal trade, already costing the Treasury billions each year.

Around one in three smokers admit they are already buying from the black market, highlighting the scale of the problem.

With cheaper cigarettes widely available under the counter and even in pubs, campaigners say another tax hike risks driving more people away from legitimate retailers and into the hands of criminals.

Windsor MP Jack Rankin criticised the potential duty increases, stating: "These figures prove what we've been saying for years - punishing taxes on ordinary smokers doesn't stop demand, they just drive people straight into the arms of smugglers and criminals."

Rachel Reeves plotting new tax that could 'drive Brits into arms of criminals' |

Rachel Reeves plotting new tax that could 'drive Brits into arms of criminals' | GETTY

Non-duty paid cigarettes are available for approximately £4.50 per pack, making them roughly three times less expensive than their legitimate counterparts.

The survey found that 56 per cent of participants described these illegal products as "easy to get hold of."

HM Revenue and Customs acknowledged that £3.1billion in excise duties went uncollected in 2024 due to smuggling, counterfeiting and unauthorised sales.

The tobacco sector accounted for the largest portion of this tax gap at £1.4billion, whilst beer smuggling resulted in £700million in lost revenue.

Official figures show duty-paid cigarette sales have fallen by 45.5 per cent since 2021

| GETTYBritain has become Europe's third-largest market for illicit cigarettes, despite maintaining relatively low smoking rates.

These cigarettes are commonly sold through informal channels including public houses, vehicle boots and beneath shop counters.

The widespread availability and substantial price difference have made illicit tobacco increasingly attractive to consumers facing the high cost of duty-paid products, with rolling tobacco now costing more per pound than silver.

The Chancellor faces having to raise £20bn in taxes at this year’s Autumn Budget to restore her £9.9bn in headroom, according to experts

| PAMr Rankin added: "Instead of hammering Brits with sky-high excise, Labour should be fixing our borders and shutting down the black market that is costing the Treasury billions."

Official figures show duty-paid cigarette sales have fallen by 45.5 per cent since 2021, dropping from 23.6 billion to 13.2 billion.

However, University College London research indicates smoking rates have stopped declining and are increasing in certain English regions for the first time in almost two decades.

More From GB News