Britons beg Rachel Reeves to axe tax raid on savings as ISAs still at risk: 'Don't punish us!'

Savers urged to be careful of tax on savings interest |

GB NEWS

ISAs are popular vehicles for Britons to protect their savings from the tax man

Don't Miss

Most Read

Latest

Britons are overwhelmingly opposed to a potential stealth tax raid on a savings accounts, according to new polling. Chancellor Rachel Reeves is understood to have halted plans to slash the tax-free allowance attached to ISAs.

A new survey by Hampshire Trust Bank has revealed that 97 per cent of savers are opposed to potential cuts to the cash ISA allowance, with the challenger bank warning that customers want the proposals scrapped entirely rather than merely paused.

The research, conducted after news of possible reforms emerged, found overwhelming resistance among savers to any reduction in the current £20,000 annual limit.

More than 750 savers submitted personal messages to ministers urging them to abandon the plans, which could see the allowance slashed to as little as £4,000.

The Chancellor could target ISAs as part of a tax raid

| PAWhile the rumoured plans are on pause, concerns have been raised that the Chancellor could confirm a tax raid on the savings account in this year's Autumn Budget.

These proposals were designed to encourage more people to invest through stocks and shares ISAs, but HTB's research shows just nine per cent of savers would consider moving their funds into investment products.

Many of those surveyed are older savers who view the potential changes as an attack on their generation. One 80-year-old respondent said: "At the age of 80 years old, I am not going to gamble my life savings in stocks and shares. We've played by the rules don't punish us now."

Pensioners have described the proposed changes as "a betrayal" and "an attack on the older generation", with many expressing relief that the plans have been shelved but demanding permanent protection.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

ISAs are useful tools for those looking save and avoid paying tax | GETTY

ISAs are useful tools for those looking save and avoid paying tax | GETTYThe research revealed deep anxiety among older and risk-averse savers who feel they are being "nudged away from a savings product they understand and rely on, toward riskier options they're not comfortable with".

Respondents said they felt "targeted" or "left behind" by policy thinking that appears to favour investors over savers.

Many warned that even the suggestion of slashing cash ISA allowances risks undermining confidence in long-established financial products.

Stuart Hulme, the managing director of Savings at HTB, said the issue extends beyond a single policy to a matter of trust.

"Our Cash ISA savers feel they're being nudged away from a savings product they understand and rely on, toward riskier options they're not comfortable with," he said.

"The vast majority of our customers say they won't switch and they shouldn't be forced to."

LATEST DEVELOPMENTS:

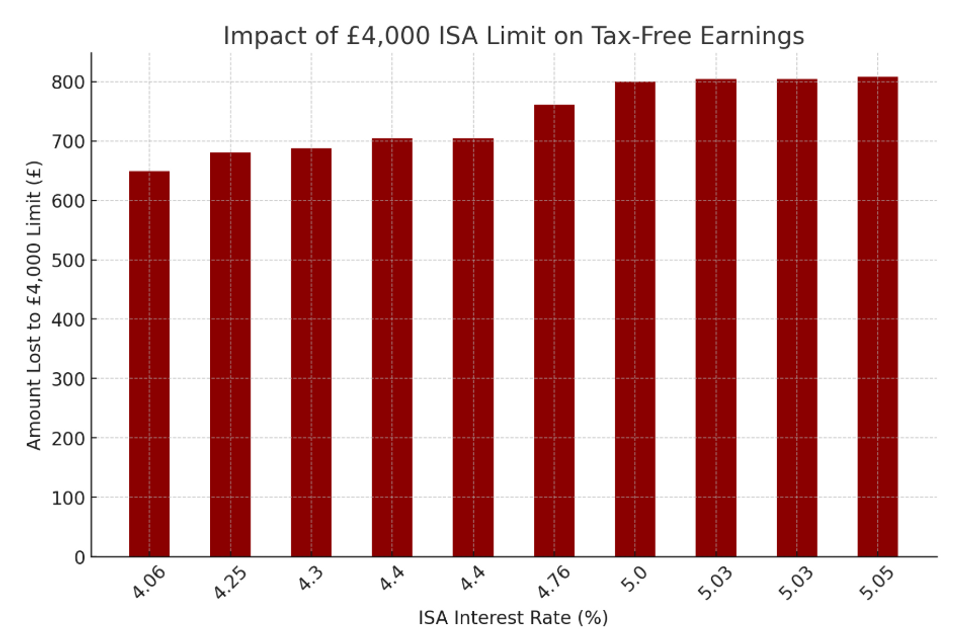

Amount lost to £4,000 limit on tax free earnings for different types of ISAs | GBN

Amount lost to £4,000 limit on tax free earnings for different types of ISAs | GBNHulme emphasised that a pause in policy fails to provide reassurance, adding: "Our customers are calling for long-term certainty, not short-term political optics.

He explained: "This is not just about one policy – it’s about trust.

“Cash ISA savers are typically older, cautious and financially responsible.

"These are people who’ve done the right thing for decades, and now feel punished for it. One respondent shared: ‘At 80, I’m not gambling my life savings.’ That’s not fear – it’s financial wisdom."

More From GB News