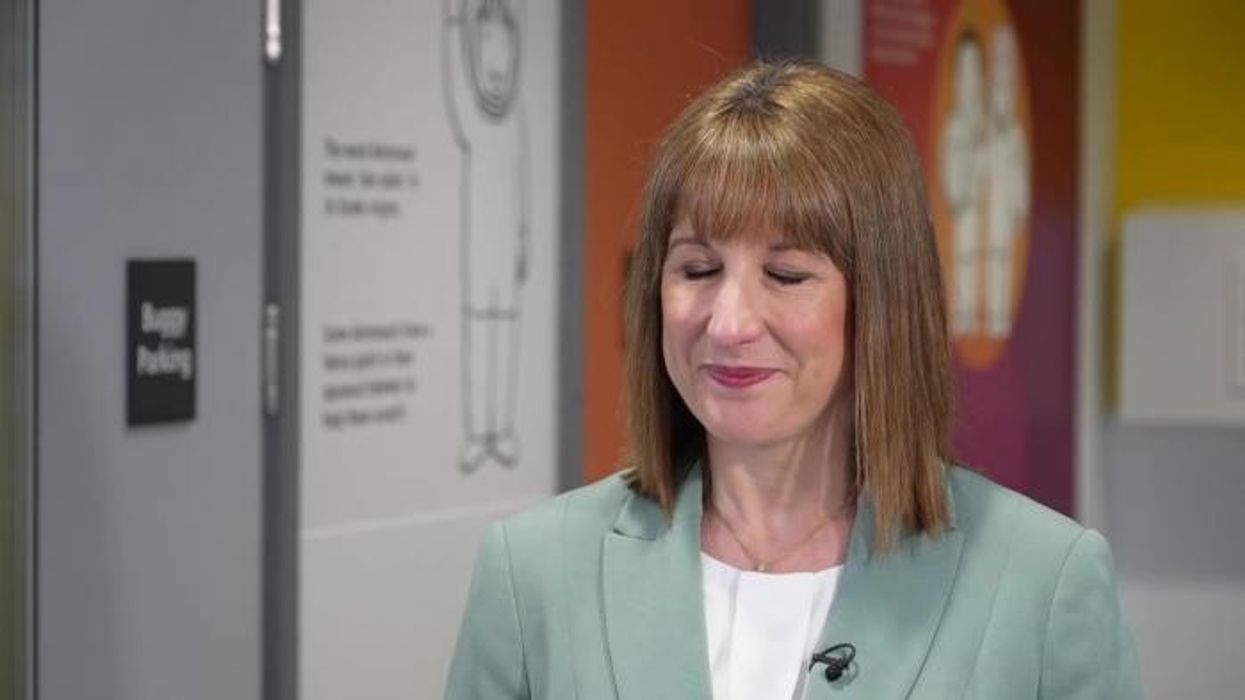

'Rachel Reeves's tax raid will drive unemployment to five-year high,' KPMG warns

Rachel Reeves speaks about potential tax rises and pledge to end asylum hotels on GB News |

GBNEWS

KPMG economists predict Rachel Reeves will opt for tax increases rather than public service spending reductions in the Autumn Budget

Don't Miss

Most Read

Latest

Britain's unemployment rate will climb to 4.9 per cent by 2026, marking the highest level in five years, consultancy firm KPMG has projected.

The forecast represents a significant increase from the current 4.7 per cent rate and would match levels last witnessed during the 2021 lockdown period.

The accountancy giant's UK Economic Outlook report anticipates modest economic expansion, with GDP expected to grow by 1.2 per cent in 2025 before slowing to 1.1 per cent the following year.

This represents a sharp downgrade from earlier projections, with the Office for Budget Responsibility having previously estimated 1.9 per cent growth for next year.

Yael Selfin, KPMG UK's chief economist, stated: "While the economy showed resilience at the start of the year, the second half looks more uncertain. Elevated tax burdens, weaker global trade and cautious consumers are likely to keep growth subdued into 2026."

Chancellor Rachel Reeves is confronting mounting fiscal pressures, with estimates suggesting she must address a budget gap ranging from £20billion to £50billion.

The shortfall stems from sluggish economic growth and expensive policy reversals, including abandoned welfare reforms and winter fuel payment reductions following parliamentary opposition.

The Chancellor implemented £40billion in tax increases during her October Budget, yet the deteriorating economic outlook has intensified speculation about further revenue-raising measures in November's autumn statement.

KPMG economists predict she will opt for tax increases rather than public service spending reductions.

The consultancy warned that fiscal challenges will persist beyond the immediate budget cycle. "The Government faces a tough balancing act. Mounting pressures on health and defence spending, combined with weaker growth, mean difficult fiscal choices ahead," Ms Selfin observed.

LATEST DEVELOPMENTS:

KPMG economists predict she will opt for tax increases rather than public service spending reductions

|GETTY

KPMG anticipates a "gradual ratcheting up of tax revenues over the next decade" as spending demands outpace economic growth.

The labour market faces continued deterioration, with KPMG predicting unemployment will "gradually rise further over the coming year" as businesses delay recruitment decisions.

The consultancy highlighted that vacancy numbers are expected to keep declining throughout 2025's second half.

Inflation remains a persistent concern, with KPMG forecasting it will stay above the Bank of England's two per cent target until late 2026, potentially reaching four per cent this autumn.

The report identified "domestic services inflation remains particularly stubborn" as businesses grapple with Labour's £25billion national insurance tax increase pushing up prices.

Chancellor Rachel Reeves is confronting mounting fiscal pressures

| POOLDespite inflationary pressures, KPMG diverges from other economists by predicting one additional interest rate reduction before year-end, bringing the base rate to 3.75 per cent. The consultancy projects two further cuts during 2026, potentially reducing rates to 3.25 per cent.

Business uncertainty ahead of November's Budget is expected to suppress hiring activity, with companies postponing recruitment until greater clarity emerges regarding potential cost increases.

The Chancellor faces limited options under Labour's manifesto commitments, having pledged to protect "working people" from income tax, VAT or employee National Insurance increases.

Potential revenue sources under consideration include extending income tax threshold freezes, which could generate £8 billion, alongside possible windfall taxes on gambling companies and inheritance tax reforms.

Experts believe tax rises are inevitable in Autumn Budget

| GETTYProperty taxation remains another avenue, with proposals including additional council tax bands for homes exceeding £1million or removing capital gains tax exemptions on primary residences valued above £1.5million.

Shadow Chancellor Mel Stride criticised the government's economic management, stating: "Rachel Reeves promised stability, but she's delivered spiralling debt and rising borrowing costs."

A Treasury spokesman defended the government's record, highlighting falling interest rates, major trade agreements with the EU, US and India, business rates reform and corporation tax capped at 25 per cent.

The spokesman emphasised wage growth since the election exceeded that of the previous parliament's first decade.

More From GB News