Rachel Reeves accused of 'slapping 300,000 workers in the face' with tax relief cut

Business leaders are speaking out over the Budget measure which will see the flat-rate working from home tax relief cut

Don't Miss

Most Read

Latest

Chancellor Rachel Reeves has been accused of being responsible for a "further slap in the face for workers" due to axing tax relief used by around 300,000 people across the UK.

The Treasury has announced plans to eliminate the flat-rate working from home tax relief starting in April 2026, a decision that will affect approximately 300,000 employees .

The abolition of the weekly £6 allowance will lead to annual tax increases of £62 for basic rate taxpayers and £124 for those in higher tax brackets, according to HM Revenue and Customs (HMRC) calculations.

Business leaders have condemned the Budget measure as "a further slap in the face for workers", particularly criticising its impact on employees who must work remotely due to lack of office space or disability-related adaptations.

The Chancellor confirmed working from home tax relief would be axed

|GETTY

Currently, employees required to work from home can choose between claiming the flat £6 weekly allowance or submitting claims for actual additional expenses, with the option to backdate claims for up to four years.

The "no questions asked" system will cease from April 2026, leaving only one route for tax-free reimbursement: employers must cover actual extra costs with supporting evidence.

Workers who have yet to claim but were mandated to work remotely in recent years still have the opportunity to submit backdated claims for the current tax year and the previous four years before the simplified system disappears.

Speaking to Newspage, business leaders broke down why this means for employees and why the Chancellor should reconsider getting rid of this particular example of tax relief.

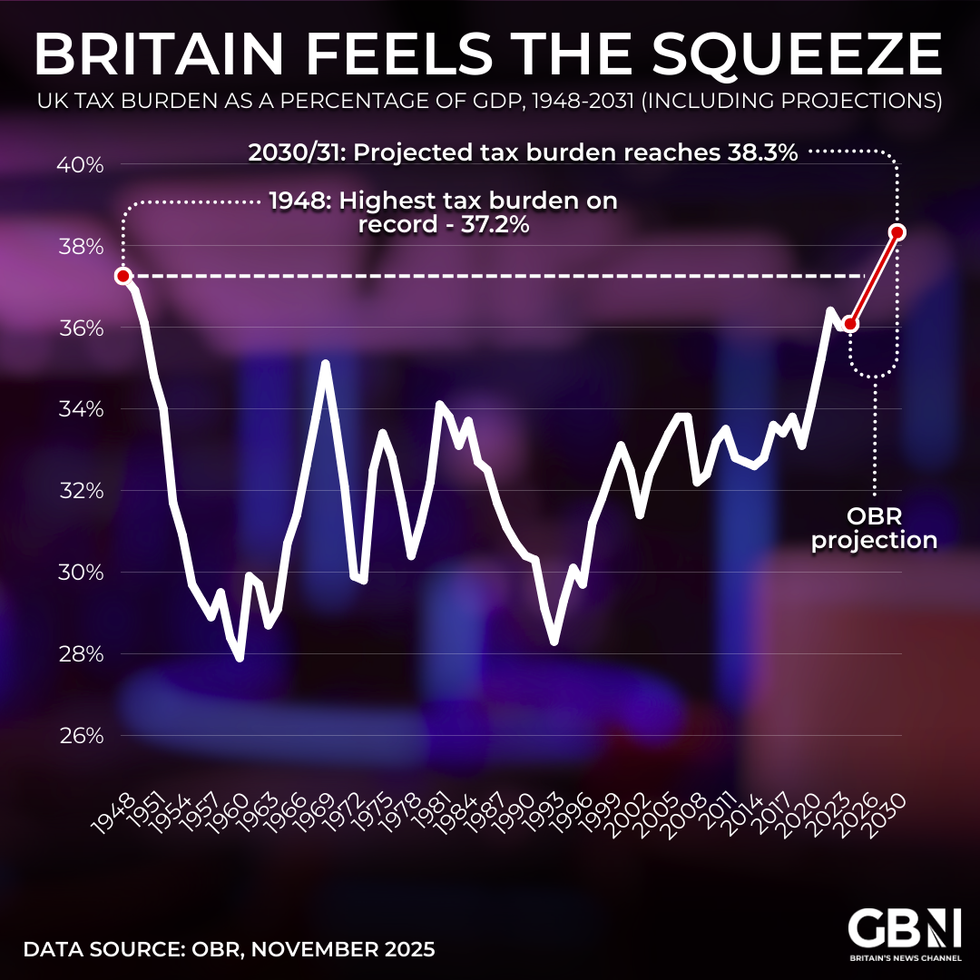

£26billion in tax raids has seen the UK's tax burden projected to rise to a post-war record 38 per cent of GDP by 2030, according to the OBR | GB NEWS/OBR

£26billion in tax raids has seen the UK's tax burden projected to rise to a post-war record 38 per cent of GDP by 2030, according to the OBR | GB NEWS/OBRKate Underwood, founder of Southampton-based Kate Underwood HR and Training, warned that the changes would particularly affect employees without access to office facilities.

"If you worked from your spare room to keep things going, the government's thank-you gift is basically: 'About that £6 a week, we'll have that back now'," she said.

"From April 2026, this hits for six people who have no office to go to or need adaptations just to work."

David Stirling, independent financial adviser Belfast-based Mint Wealth Ltd described the measure as "a further slap in the face for workers", noting that remote employees would face increased administrative burdens.

"Homeworkers will now need to provide receipts, face extra admin and the delightful task of proving they boiled the kettle," he said.

Colette Mason, an AI consultant at London-based Clever Clogs AI, called the decision "spectacularly short-sighted", warning that increased administrative complexity would push businesses towards automation.

"The small amount the Treasury saves by scrapping this relief will be dwarfed by the long-term loss of revenue from wages and payroll taxes as businesses automate office jobs they can no longer justify retaining due to bureaucratic friction," she said.

Samuel Mather-Holgate, independent financial advisor at Swindon-based Mather and Murray Financial urged the government to reconsider, particularly for disabled workers.

Working from home has become the norm following the pandemic

| GETTY"For fairness, there should be a carve-out for disabled people unable to work in the office and the government should look again at this cohort," he said.

On top of this, the Chancellor confirmed a further increase to the National Living Wage following last year's controversial rate hike

.From April 1, 2026, the National Living Wage will rise by 4.1 per cent from £12.21 weekly to £12.71 an hour for eligible workers aged 21 and over.

GB News has contacted the Treasury for comment.

More From GB News