Rachel Reeves warned cutting pension tax relief could spark new 'Omnishambles' Budget

Workers and retirees warned they could lose thousands if tax-free cash or salary sacrifice is cut

Don't Miss

Most Read

Rachel Reeves is under growing pressure over speculation she could target pensions in her next Budget.

Experts warn that any move to raid tax relief could backfire badly, with one report suggesting it risks becoming another political "Omnishambles."

Chancellor Rachel Reeves could face a political disaster comparable to the 2012 'Omnishambles' Budget if she attempts to reduce pension tax relief in her upcoming fiscal statement, pension consultancy firm LCP has cautioned.

The firm's new analysis suggests that whilst targeting pension tax relief might appear an attractive revenue source, such measures could backfire spectacularly within days of announcement.

Steve Webb, report co-author and partner at LCP said: "Raiding pension tax relief may look superficially attractive for a cash-strapped Chancellor.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

"But lying beneath the surface are multiple traps for the unwary, meaning that reforms might raise far less than expected, break manifesto promises to workers or put additional burdens on employers who are already under pressure."

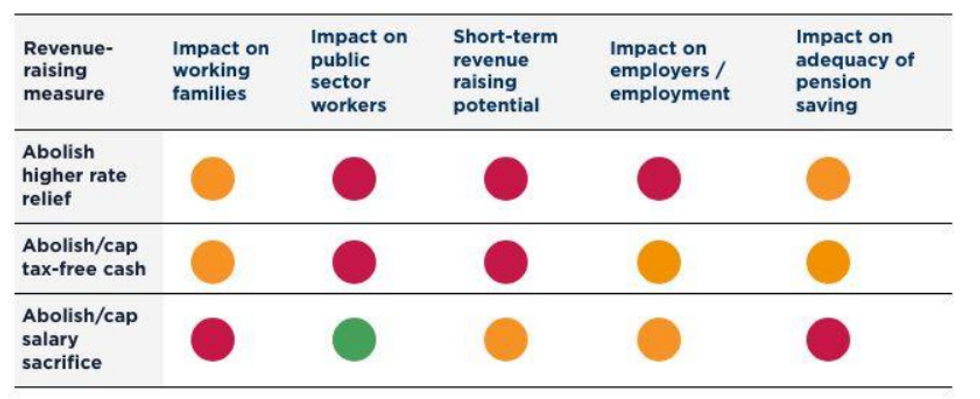

The consultancy examined three areas frequently mentioned as potential targets for Treasury savings: eliminating enhanced tax relief for higher-rate taxpayers, restricting or removing the 25 per cent tax-free lump sum entitlement, and curtailing salary sacrifice arrangements.

Their report, titled 'How to avoid an Omnishambles Budget', identified five major pitfalls associated with these reforms.

These include violating manifesto promises about not increasing taxes on workers, disproportionately affecting public sector employees during tense industrial negotiations, failing to generate substantial revenue within this parliamentary term, imposing additional costs on businesses already facing a £25billion National Insurance increase, and discouraging retirement savings when Government estimates indicate 14 million workers are already saving insufficiently.

Each potential reform received red ratings across multiple risk categories, indicating severe political and practical obstacles.

The most damaging aspect for ordinary employees would be the elimination of salary sacrifice schemes, which currently allow workers to reduce their National Insurance contributions by channelling earnings into pensions.

Each potential reform received red ratings across multiple risk categories

|GETTY

LCP’s analysis reveals that more than three million basic-rate taxpayers would face higher costs if this benefit disappeared.

The firm argues this would constitute a direct violation of Labour’s election commitment to protect working people from increased taxation.

Tim Camfield, report co-author and principal at LCP said: "Millions of people on modest incomes benefit from various features of the tax relief system, including the ability to sacrifice salary and benefit from a reduced National Insurance bill."

He cautioned that removing this provision would harm employees earning basic-rate tax who are attempting to save responsibly for retirement, whilst simultaneously increasing costs for employers offering workplace pension schemes.

LCP ranked three possible pension tax changes against five key risks, with red showing the biggest political and financial dangers

|LCP

Public sector workers would also bear a particularly heavy burden from any changes to higher-rate relief or tax-free cash limits.

LCP's assessment indicates that the generous pension provisions and high participation rates in public sector schemes mean these workers would suffer disproportionately, risking further strain on already fragile industrial relations.

The warnings deliberately invoke memories of George Osborne’s 2012 Omnishambles Budget, when controversial tax measures on pasties, caravans and charitable giving triggered public outrage and forced swift government U-turns. LCP suggests that pension tax raids could prove equally unworkable and politically toxic.

The consultancy also highlighted that eliminating higher-rate relief would necessitate extensive consultation, complex legislative changes, and significant adjustments to administrative and payroll systems. These implementation challenges mean the Treasury would see minimal additional income before the next general election.

Similarly, restricting tax-free cash would require comprehensive transitional arrangements to protect those nearing retirement who have based their financial planning on existing rules, further limiting any revenue gains during this Parliament.

He cautioned that removing this provision would harm employees earning basic-rate tax who are attempting to save responsibly for retirement

| GETTY

A basic-rate taxpayer earning £40,000 a year who currently pays £100 into their pension effectively contributes only £80 after tax relief

| GETTYFor ordinary savers, the stakes are high. A basic-rate taxpayer earning £40,000 a year who currently pays £100 into their pension effectively contributes only £80 after tax relief. If relief were cut, that saver could be paying the full £100, reducing take-home pay and potentially discouraging pension contributions altogether.

Meanwhile, someone earning £80,000 who currently benefits from higher-rate relief could see their tax advantage slashed, shrinking long-term pension pots by thousands over the course of a career.

Ms Reeves has pledged not to raise income tax, VAT or National Insurance, leaving pensions looking like "low hanging fruit." But LCP stresses that the political risks may outweigh the potential revenue.

As Mr Webb warned: "The political backlash against such reforms could easily echo previous Omnishambles Budgets where a U-turn was made within a matter of weeks."

Mr Camfield added: "Any such change could undermine pension saving and confidence in the system and should be avoided."

More From GB News