Rachel Reeves raid REVEALED: Britons paying more income tax than French and Americans, shocking figures claim

The OECD is breaking down the income tax and capital gains tax burden placed on hard-working Britons

Don't Miss

Most Read

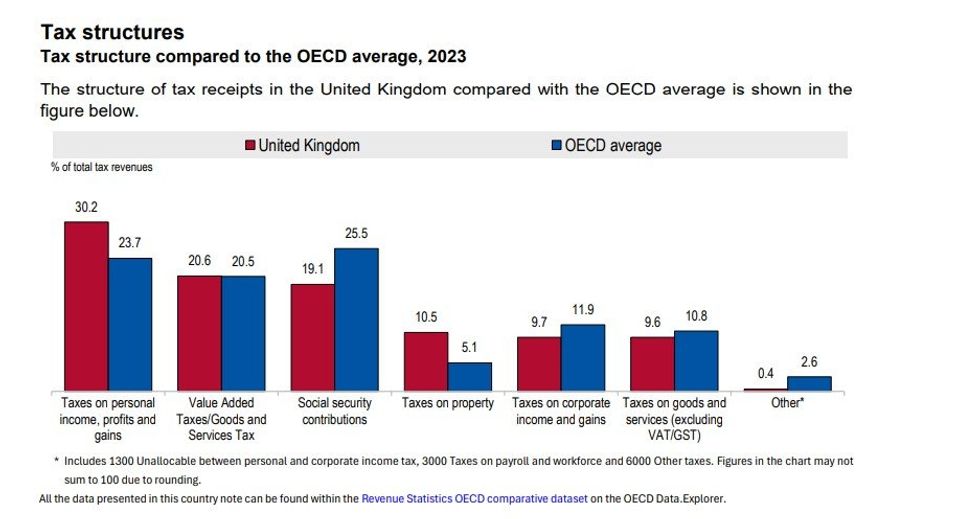

New analysis from the Organisation for Economic Co-operation and Development (OECD) reveals that British workers face a heavier income tax burden than their counterparts in France, Germany or the United States.

The OECD found that taxes on personal income and capital gains account for more than 10 per cent of gross domestic product (GDP) in the UK, placing Britain behind only Italy and Canada among G7 nations.

This comparison comes before the full impact of Chancellor Rachel Reeves's extended freeze on income tax thresholds takes effect. While Britain's income tax burden exceeds France's, the overall French tax take remains considerably higher at 43.5 per cent of GDP compared with the UK's 34.4 per cent.

The Chancellor's decision to extend the freeze on income tax thresholds for a further three years in her Budget will compound the financial pressure on working people.

Britons are paying more tax than other countries, OECD claims

|OECD/ GETTY

This prolongation follows an initial six-year freeze announced by former prime minister Rishi Sunak back in 2021. Together, these threshold freezes represent a significant stealth tax raid on British workers, as rising wages push more earners into higher tax brackets without any formal rate increases.

By the end of the decade, this policy of frozen thresholds is projected to generate an additional £66.6billion annually for the Treasury in what many view as a stealth tax.

The widening gap between UK and French income tax burdens is evident in the figures, with British taxes on individual incomes, profits and capital gains reaching 10.5 per cent of GDP in 2023, compared with 9.4 per cent in France.

Previously, the Office for Budget Responsibility (OBR) has cautioned the Labour Government that escalating taxation poses long-term risks of lasting harm to the UK economy.

People in the UK are paying more personal tax and capital gains tax than major nations

|OECD

"A higher level of the tax take increases the risk that incentives within the tax system distort or constrain economic activity by more than expected," the fiscal watchdog warned.

Ms Reeves is on track to oversee the largest tax-raising parliament in British history, with the official burden forecast to climb from 34.7 per cent of GDP to 38.3 per cent by the decade's close. This increase represents approximately £110billion in current terms.

The OBR's projections also indicate that living standards will show only marginal improvement between the start and end of this parliament as a consequence of the mounting tax burden.

Property taxes in Britain remain among the highest in the developed world, with further increases on the horizon following the Chancellor's announcement of a new £400rmillion levy on high-value properties in England.

Business rates are forecast to reach £42 illion by the start of the next decade, while council tax is expected to climb to £66.7billion, according to the OBR latest projections.

The hospitality sector has reacted with anger to Ms Reeves's sweeping changes to business rates in her second Budget, which raised taxes by an additional £30 billion.

Pubs and restaurants warn they will be forced to scale back investment and recruitment as a result. This comes after last year's hike to the employer National Insurance contributions

Despite the Chancellor's promise of permanently reduced rates for retail, hospitality and leisure properties, industry figures argue that transitional support following the end of Covid-era relief fails to compensate for rising rateable values.

Rachel Reeves delivered the Budget in the Commons last month

| PAFresh analysis suggests the business rates overhaul will actually lower bills for luxury department stores such as Selfridges and Harrods whilst increasing costs for independent hospitality venues.

Defending her Budget decisions after her statement to Parliament, the Chancellor said: "Anyone who thinks that there was no repair job to be done on the public finances, I just don’t accept that.

"We needed to build more resilience, more headroom into our economy. That’s what I did, along with that investment in the NHS and cutting bills for families."

More From GB News