Families urged to take action immediately to avoid 'eye-watering' inheritance tax bill from Rachel Reeves

The Chancellor confirmed pension pots will become liable for inheritance tax in April 2027 during last year's Autumn Budget

Don't Miss

Most Read

Thousands of families are being urged to take immediate action regarding inheritance tax (IHT) planning strategies ahead of significant pension rule modifications scheduled for April 2027.

Financial advisers are sounding the alarm that retirement savings will become liable for the levy in less than two years time time, which is expected to dramatically increase the number of households facing a charge on their estates.

IHT is imposed on the estates of individuals who have passed away at a rate of 40 per cent on their combined assets if they are valued above the £325,000 threshold, with some relief being available.

During last year's Autumn Budget, the Chancellor confirmed inheritance tax would now be applied to pension pots and agricultural assets in a major overhaul of the HM Revenue and Customs (HMRC) regime.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

Tax experts are sounding the alarms over the Chancellor's looming overhaul to HMRC rules

|GETTY

Speaking to Newspage, analysts anticipate a substantial surge in the implementation of Deeds of Variation as families seek to mitigate the impact of these new regulations.

Leicester-based financial director Scott Gallacher emphasises the urgency of beginning these discussions immediately with clients. The new pension inheritance tax provisions represent what advisers describe as a Government raid that will affect significantly more families than current arrangements.

This legal mechanism enables beneficiaries to redirect inherited assets they receive, such as from deceased parents, typically into discretionary trust arrangements. The process must be completed within a two-year timeframe following the original death.

Mr Gallacher, who currently works for Rowley Turton, reports discussing these arrangements with nearly every client due to the Government's new pension inheritance tax measures.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

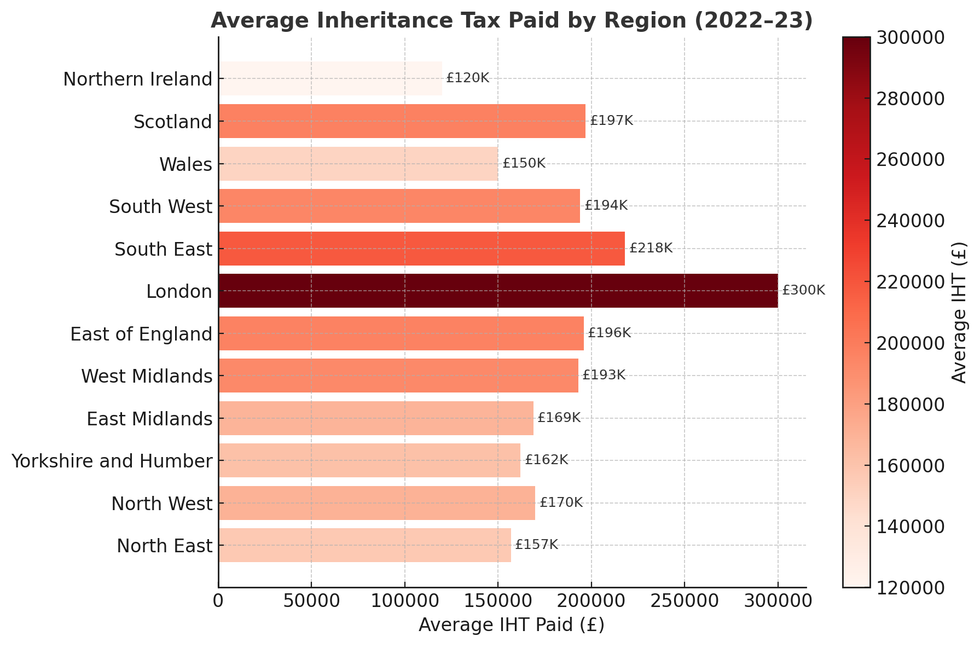

How much is London paying in inheritance tax compared to the rest of the country | GETTY

How much is London paying in inheritance tax compared to the rest of the country | GETTY "In many cases, this approach is creating six-figure IHT savings, as well as providing valuable protection against divorce settlements and long-term care fees for future generations," he said.

Samuel Mather-Holgate from Swindon-based Mather and Murray Financial suggests these instruments could preserve millions of pounds. He describes IHT as "compound interest in reverse and pound cost savaging" when applied across multiple generations.

The strategy prevents inherited assets from being added to beneficiaries' own estates, reducing future inheritance tax exposure. Family conversations about inheritance planning present significant obstacles, with some discussions proving particularly contentious.

Notably, Mr Gallacher acknowledges these exchanges can be extremely difficult to navigate between generations."Ideally, clients should be talking to their parents about leaving inheritances directly into a Discretionary Trust from the outset, avoiding the need for a Deed of Variation later.

MEMBERSHIP:

- A mere 36 seconds in this hellhole made my heart sink. A snapshot of what's coming — Peter Bleksley

- REVEALED: How one 'dreadful' secret email risks Tory defection deluge to Nigel Farage's Reform UK

- We are ruled by an 800-pound gorilla that shields sex offenders, activist lawyers and open borders - Chris Philp

- REVEALED: The eight ex-Tory MPs on ‘defection watch’ as Nigel Farage eyes up big hitters to join Reform UK

- POLL OF THE DAY: Should we follow Trump’s lead and sentence flag burners to one year in jail? VOTE NOW

"But in reality, these conversations can be challenging some parents have even threatened to disinherit children who raise the idea," he said.

Professional advisers are issuing strong warnings against attempting do-it-yourself approaches to implementing Deeds of Variation. David Robinson from London-based Wildcat Law cautions that DIY probate has become increasingly hazardous under the new rules.

LATEST DEVELOPMENTS:

Rachel Reeves has came under fire over her decision to make pension pots liable for inheritance tax

| Getty"A probate expert will be able to set up a Deed of Variation without risking the RNRB, carving out assets outside the property. However we expect to see a flood of botched deeds as people try to cut corners and do it themselves or turn to unregulated 'advisers'," Mr Robinson said.

Families must carefully consider the residential nil rate band implications when redirecting assets away from direct descendants.

Mr Gallacher warns that moving inheritances into discretionary trusts may result in estates losing some or all of their RNRB allowance, potentially increasing inheritance tax liability.

Notably, Mr Robinson highlights growing concerns about wealth inequality in inheritance tax planning access. He notes that affluent families can afford necessary professional advice to minimise inheritance tax impact, while the poorest would welcome having such financial concerns.

"The increasingly-pressed middle will be left with a tough choice of paying for expensive advice or their beneficiaries paying a potentially eye watering IHT bill," Robinson said.