Rachel Reeves could 'cause chaos' in Budget if ISA savers slapped with tax hit

GB NEWS

The Chancellor is preparing to unveil her plans for the economy during next week's fiscal statement

Don't Miss

Most Read

Latest

Chancellor Rachel Reeves could "cause chaos" if she opts to slash the ISA tax-free allowance in her upcoming Budget, experts warn.

The number of cash ISA products has experienced its steepest monthly decline since January 2024, falling from 658 to 640 deals, according to Moneyfacts UK Savings Trends Treasury Report data.

This contraction comes as speculation mounts that the Labour Government may slash the annual ISA allowance from £20,000 to £12,000.

Despite the shrinking product range, savers have poured nearly £30billion into cash ISAs since April's start, Bank of England figures reveal.

Cutting the ISA allowance could 'cause chaos' if the Chancellor announces the policy during the Budget

|GETTY / PA

The reduction marks a retreat from September 2025's record peak of 662 available deals, though the total number of savings providers remains at an all-time high of 156.

Interest rates across cash ISA products have plummeted to their lowest points in two years.

Easy access ISA rates dropped to 2.69 per cent marking their weakest level since July 2023, while one-year fixed ISA rates stagnated at 3.89 per cent, also a two-year low.

Notice ISA rates declined to 3.41 per cent, and longer-term fixed ISA rates fell to 3.82 per cent.

ISAs are useful tools for those looking to save more than the personal savings allowance threshold without having to pay tax | GETTY

ISAs are useful tools for those looking to save more than the personal savings allowance threshold without having to pay tax | GETTYThe broader Moneyfacts Average Savings Rate decreased to 3.42 per cent from 3.44 per cent the previous month.

Cash ISAs maintain their appeal among British savers, with 44 per cent of consumers utilising them for savings compared to just 23 per cent who opt for stocks and shares ISAs, Moneyfacts survey data shows.

Rachel Springall, finance expert at Moneyfacts, warned that "cash ISAs are under threat, with rumours persisting of a cut to the £20,000 yearly allowance, a futile attempt to push risk-averse savers to invest".

She highlighted that whilst this year marked significant achievements for cash ISAs with record-breaking provider numbers and product variety, the sector now faces its largest monthly decline since January 2024.

"If the cash ISA allowance gets cut down to £12,000, not only will it cause chaos from a retail funding perspective, but it will give savers less reason to use a cash ISA in the first place," Ms Springall cautioned.

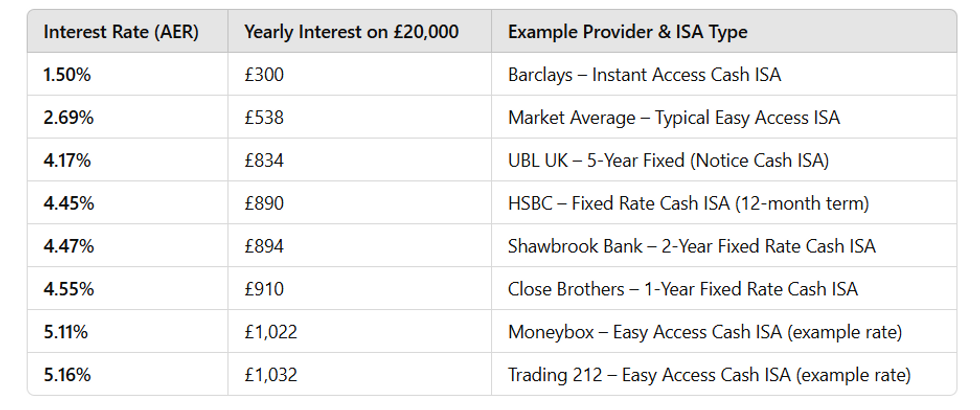

Ms Springall's calculations demonstrate how the proposed reduction would undermine cash ISAs' tax benefits.

A £20,000 investment in a one-year fixed cash ISA at 3.89 per cent generates £778 tax-free, while the same sum in a standard bond at 3.95 per cent yields £790 but breaches higher-rate taxpayers' £500 Personal Savings Allowance.

With a £12,000 cap, maximum annual interest would fall below £500, eliminating the tax advantage for most savers.

Examples of tax free Isa earnings in the UK if you had £20,000 in the Isa | GBN

Examples of tax free Isa earnings in the UK if you had £20,000 in the Isa | GBNMs Springall noted that economists anticipate further Bank of England base rate cuts in December.

She advised: "Taking time to review and switch any savings account will be essential over the coming months, as will be maximising the use of any tax-free allowances."

The Chancellor is expected to announce a freeze to the existing tax thresholds until 2030 in what will be considered an additional stealth tax.

Ms Reeves will announce her Budget reforms to the House of Commons on November 26.