One in four workers to pay higher rate tax under Rachel Reeves's freeze extension

GB News

Study says nearly one million more people would be pulled into the tax system by 2030

Don't Miss

Most Read

A quarter of workers in England and Wales are on course to pay the higher rate of income tax by the end of the decade if Chancellor Rachel Reeves extends the current threshold freeze until April 2030, new analysis from the Institute for Fiscal Studies (IFS) shows.

The measure would significantly widen the tax base whilst generating billions for the Treasury.

Extending the freeze would raise £8.3billion for the Government in 2029-30.

The policy would also bring nearly one million extra people into the tax system.

The IFS findings indicate that pensioners, benefits claimants and low-wage workers would be pulled into paying income tax under the prolonged freeze.

Minimum wage earners working just 18 hours a week would become liable for income tax.

The institute’s projections show that the number of income taxpayers would reach 42.1 million by 2030, accounting for 73 per cent of adults aged over sixteen.

This figure is 960,000 higher than under existing plans and 5.1 million higher than if thresholds had risen with inflation since 2021.

Personal tax thresholds have remained fixed in cash terms since 2021.

The basic rate is charged at 20 per cent, whilst the higher rate of 40 per cent applies to earnings above £50,271 outside Scotland, with a 45 per cent additional rate for the highest earners.

The IFS described the prolonged freeze as "one of the most significant changes to the personal tax system in recent decades fundamentally reshaping who pays tax and at what rate."

Study says nearly one million more people would be pulled into the tax system by 2030

|GETTY

Its analysis highlights the scale of the shift caused by fiscal drag.

Rachel Reeves previously committed to uprating thresholds with inflation from April 2028.

However, she is now expected to extend the freeze until 2030 to address public finances showing a gap estimated between £20billion and £30billion.

Reports indicate the Chancellor has ruled out increasing the basic or higher rates of income tax.

She is instead examining options that raise revenue without altering headline rates.

The freeze will especially affect pensioners as the state pension rises towards the frozen personal allowance of £12,570.

LATEST DEVELOPMENTS

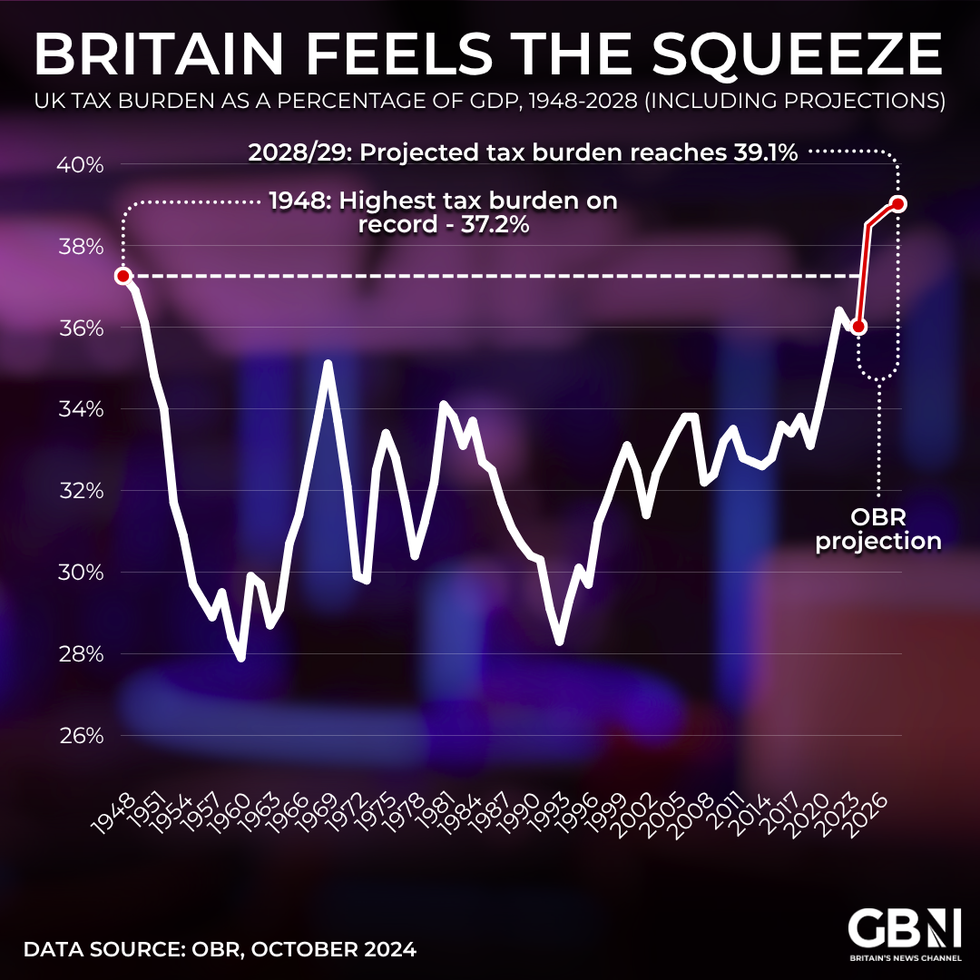

UK tax burden as a percentage of GDP | GB News

UK tax burden as a percentage of GDP | GB NewsState pension recipients receiving the full new amount are expected to exceed the allowance by 2027-28, pushing millions into income tax liabilities.

This shift means many pensioners will become required to file tax returns.

It would also increase the number of retirees qualifying for means-tested benefits as tax deductions reduce their net incomes.

Low earners will also face significant changes.

Minimum wage employees will begin paying income tax after eighteen weekly hours of work, far fewer than in previous years.

The IFS warns that the freeze will have particularly sharp effects on those receiving in-work benefits.

An additional 110,000 people on benefits would face steep marginal tax rates as both taxes and benefit withdrawals reduce the return on extra earnings.

These individuals would keep only 32p of each additional pound earned on average.

The combined impact of the freeze and benefit tapering narrows the financial gain from wage increases.

The policy also means future minimum wage rises will deliver less benefit to workers, with a larger share flowing to the exchequer.

The institute notes that freezes change the distribution of tax burdens in ways that depend heavily on inflation trends.

Matthew Oulton, research economist at the IFS, said the policy would increase tax "on all employees working full-time, most working part-time, most minimum wage workers and many low-income pensioners."

Labour pledged not to raise taxes on working people

| GETTY / PAHe said adjusting thresholds could be "a reasonable tool" but warned freezes meant outcomes depended on inflation.

Under the extended freeze, 10.1 million people would pay income tax at 40 per cent or above by 2029-30.

This represents 790,000 more than under current plans and 4.8 million more than if the freeze had never been introduced.

The higher rate threshold last saw a real-terms rise in 2019-20, when around one in ten employees paid the higher rate.

By 2029-30, the IFS expects it would apply to one in four workers in England and Wales.