Premium Bonds holders could do 'worse or better' than regular savers with NS&I cash prize draw

Premium Bonds is the most popular savings product in the country

Don't Miss

Most Read

Premium Bonds holders could either “do worse or better” than regular savers thanks to the product’s cash prize draw, experts claim.

Government-backed savings provider National Savings and Investments (NS&I) is popular with Britons for its unique way of administering returns but the savings product does guarantee interest the same way traditional accounts do.

This is primarily due to the prize lottery which is attached to Premium Bonds which sees savers in with the chance to win up to £1million.

While this “life-changing” amount is on the table, bond holders are more likely to win smaller sums of money.

Despite this, experts are noting that Premium Bonds being tax-free will likely continue to attract prospective holders.

Henrietta Grimston, the director of financial planning at wealth manager Evelyn Partners, outlined who will likely benefit from Premium Bonds the most.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Experts are sharing who will benefit from Premium Bonds

|GETTY

Mrs Grimston explained: “That is a very handy tax-free return.

"But an individual holder might do worse or better with their annual prize haul.

“Many savers like the fact that they have a chance of winning a big potentially life-changing prize while still receiving smaller prizes, and that bonds are essentially ‘easy access’.

“It can be an attractive option for those who are using up their personal savings allowance and can’t or don’t want to use their ISA allowance for cash savings.”

What are Premium Bonds?

Unlike most savings accounts, the NS&I product does not award bond holders returns based on a set interest rate.

Premium Bonds holders are automatically enrolled into a monthly prize draw where they have the opportunity to take home a prize, including the £1million jackpot.

There are other cash prizes up for grabs with the smallest amount that could be won being £25.

Other larger Premium Bonds prize amounts which could be won include amounts of £25,000, £50,000 and £100,000.

When are Premium Bonds winners announced?

Bond holders are reminded to log onto the NS&I website at the beginning of every month to see if they have been luck.

Two winners earn the £1million prize every month with the next announcement expected on May 2, 2024.

LATEST DEVELOPMENTS:

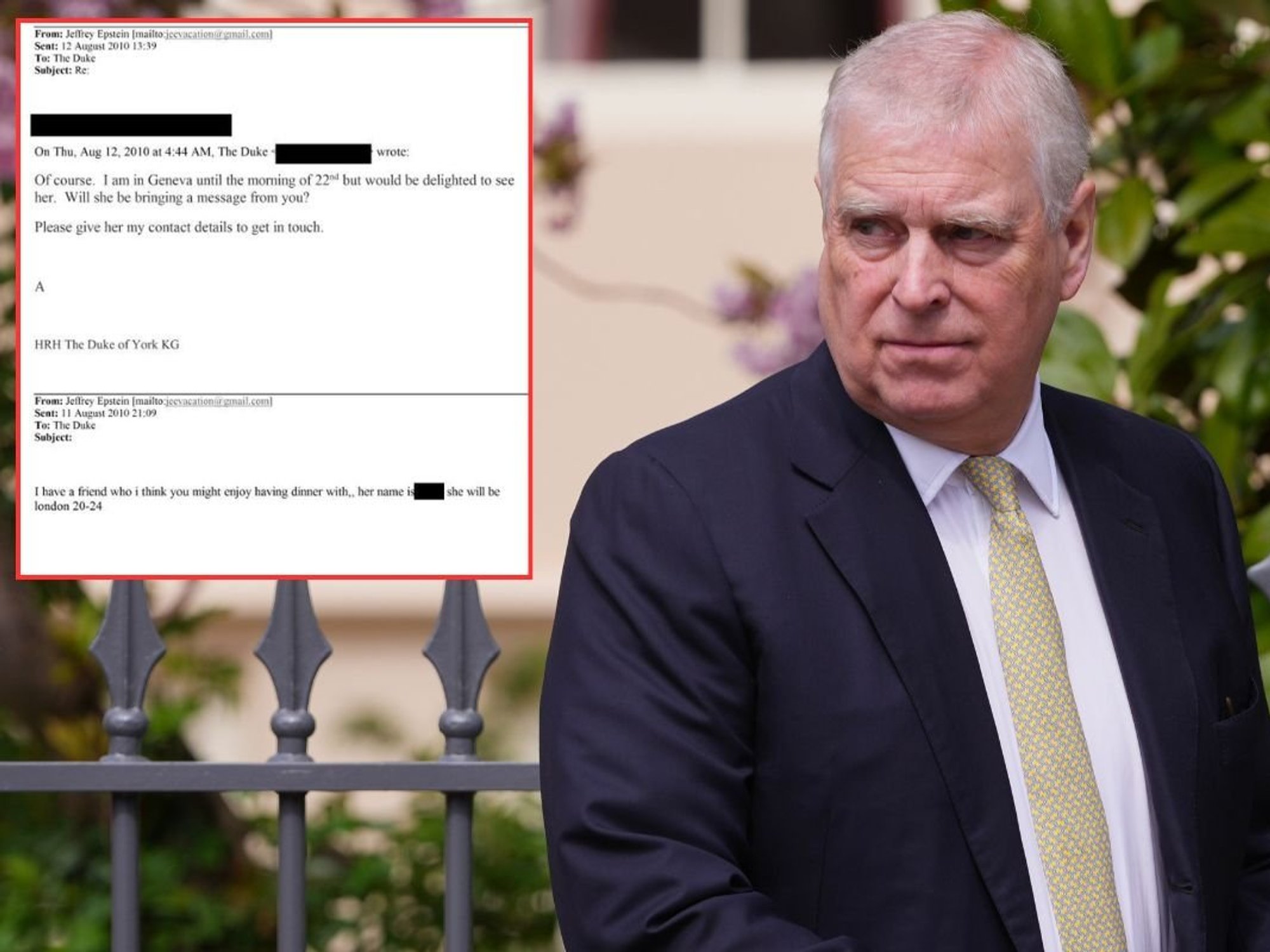

Premium Bonds savers can check if they have won via the NS&I Premium Bonds prize checker app or website | NSI

Premium Bonds savers can check if they have won via the NS&I Premium Bonds prize checker app or website | NSIThis month, Premium Bonds celebrated 30 years of the £1million jackpot with the first winner being chosen on April 1, 2024.

Since then, 528 people have now won the savings product’s top prize with more than £30billion being won by Premium Bonds holders since the first prize draw in 1957.

Andrew Westhead, the NS&I’s Retail Director, said: “Celebrating the 30th anniversary of the Premium Bonds £1 million jackpot is testament to the love the nation has for this iconic way of saving, with over £30 billion in prizes of all sizes being paid out since the draw started back in 1957.

“A huge congratulations to our 528 £1 million jackpot winners over the last 30 years, including this month’s winners from London and the Highlands and Islands.

“At NS&I we couldn't be prouder to bring excitement and opportunity to the nation’s savers every month, and we look forward to many more decades of Premium Bonds winners to come.”