Pensioner, 72, terrified over 'draconian' new laws that could see DWP 'raid personal accounts'

WATCH: Richard Tice addresses a Reform UK press conference on pensions |

GBNEWS

The government insists the plans will save £1.5billion while protecting the taxpayer

Don't Miss

Most Read

Latest

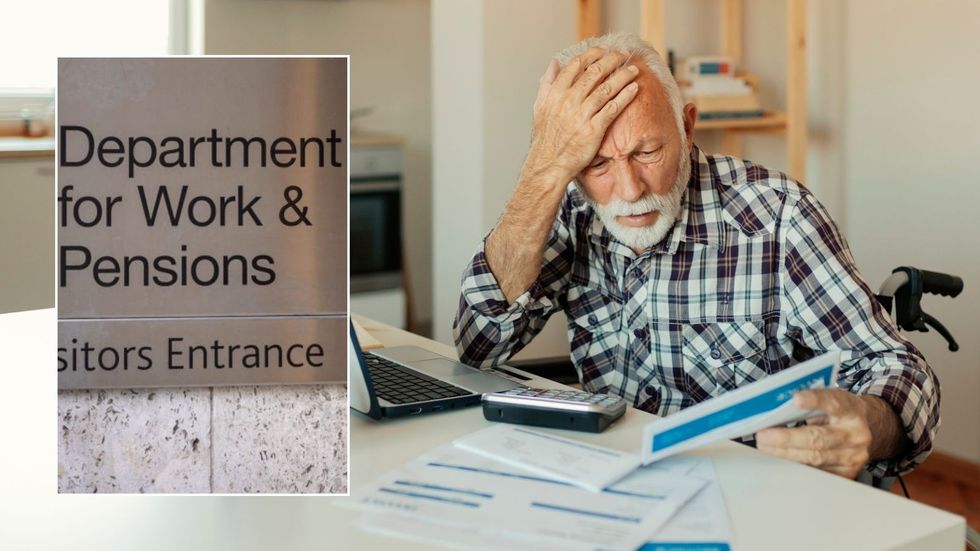

Older people on benefits are growing worried about new legislation that could let authorities access their bank details, a pensioner campaign group has warned.

Silver Voices says the Public Authorities (Fraud, Error and Recovery) Bill, currently making its way through the House of Lords, risks reversing the recent rise in pension credit claims.

Under the proposals, banks and building societies would be required to check customer accounts and hand over information to confirm whether people qualify for benefits.

The group’s director has branded the plans heavy-handed, warning they could put vulnerable pensioners off applying for the support they badly need.

The new law would force banks and building societies to scan their customer records and pass on details to officials to check if people meet benefit rules. But many older claimants fear this extra level of surveillance, with some saying they feel "terrified" about what lies ahead.

One 72-year-old from Dorset, who relies on Pension Credit and the state pension, said the proposals had left them feeling increasingly vulnerable.

"I am single, live alone, receive Pension Credit, and the old state pension. I am terrified of these new powers in this new legislation. I feel vulnerable enough now without facing the dread of this," the pensioner told The i Paper.

Another member expressed deep unease, stating: "I am truly concerned about this intrusion by the Department for Work and Pensions."

LATEST DEVELOPMENTS:

Beneficiaries worry legitimate financial transactions might trigger investigations

| GETTYDennis Reed, who leads Silver Voices, described the proposed powers as "draconian" and warned they were "terrifying many recipients of pension credit and will act as a disincentive for future claimants."

He explained that beneficiaries worry legitimate financial transactions might trigger investigations, potentially resulting in frozen benefits or account scrutiny.

"Pensioners are worried that any unusual, but perfectly legal, transactions will flag up their accounts for investigation, and they may have their benefits frozen or their personal accounts raided," Mr Reed said.

Pensioners are missing out on support | GETTY

Pensioners are missing out on support | GETTYThe Department for Work and Pensions maintains that the measures won't provide access to individuals' financial accounts or spending details, emphasising that banks cannot share transaction data under the proposed rules.

A DWP spokesperson said: "We have a duty to the taxpayer, and this Bill is set to save £1.5bn over the next five years, which together with wider reforms will save £9.6bn by 2030 according to Office for Budget Responsibility estimates."

The new measures include driving bans of up to two years, for benefit cheats who repeatedly fail to pay back money they owe, powers enabling the DWP to recover money directly from fraudsters’ bank accounts and Eligibility Verification, which will allow third-party organisations such as banks to flag potential fraudulent benefit claims.

In a series of 11 new factsheets published by the DWP, giving more insight into how the new measures will work safely and be monitored, it confirms the UK Government will begin implementing the proposed measures from April 2026.

Households could get £300 cost of living payment | GETTY

Households could get £300 cost of living payment | GETTY The DWP will work with banks to identify people who may have exceeded the eligibility criteria for means-tested benefits, such as the £16,000 income threshold for Universal Credit - and get that information to then investigate that claimant to prevent possible overpayments and potential cases of fraud.

Pension Credit boosts weekly income to £227.10 for single pensioners and £346.60 for couples. It also unlocks a range of extra help, including cold weather payments and a free TV licence for those aged 75 and over.

Last winter, only people on Pension Credit qualified for the winter fuel payment, after the scheme was cut back from being universal. This year the rules have been widened again, though some better-off pensioners will still miss out.

The payments are designed to help cover soaring heating costs during the colder months.

More From GB News