Pension tax raid EXPOSED as Rachel Reeves's £2bn gambit could result in 'benefit reduction' for workers

Lizzie Cundy says Rachel Reeves has taken the 'last roll of the dice' and 'owes Rishi Sunak an apology' |

GB NEWS

Changes to salary sacrifice rules could impact the pension savings of future retirees, analysts warn

Don't Miss

Most Read

Young workers could be penalised under Chancellor Rachel Reeves's rumoured tax raid on pension savings, which could impact how much they will receive once they eventually retire, according to analysts.

The Chancellor is understood to be exploring changes to employer salary sacrifice arrangements; a move projected to generate approximately £2billion annually for the Treasury.

This initiative would exclusively impact private sector workers, particularly those with earnings exceeding £50,000, whilst leaving public sector employees such as educators, government workers and parliamentarians completely unaffected.

The measure forms part of the Chancellor's broader fiscal strategy aimed at addressing a £30billion funding gap. Industry specialists have characterised these proposals as potentially damaging to retirement planning, warning they could diminish pension accumulations and reduce workers' disposable income.

Young workers could be impacted by the Chancellor's rumoured £2billion tax raid

|GETTY / PA

Notably, the Chancellor's scheme would establish a £2,000 yearly ceiling on pension contributions that can be made through salary sacrifice without attracting national insurance charges. This represents a dramatic reduction from the existing £60,000 threshold for tax-advantaged contributions.

Workers who contribute beyond this new limit would face National Insurance charges of eight per cent on earnings up to £50,000 and two per cent on income exceeding that amount.

Those in the £100,000 to £125,000 salary range could be particularly affected, as many have increasingly utilised these arrangements to mitigate the effects of marginal tax rate complexities.

The Treasury anticipates these modifications could prompt some companies to discontinue their salary sacrifice programmes entirely, whilst others might reduce the generosity of their pension offerings.

Pensioners are concerned about the rising tax burden | GETTY

Pensioners are concerned about the rising tax burden | GETTYSteve Webb, a partner at pensions consultancy LCP, has strongly criticised the proposals, describing them as "a seriously backward step" that would penalise companies supporting their workforce through quality pension provision.

He warned that introducing such a cap would primarily increase National Insurance costs for employers who are "doing the right thing" by offering robust workplace pensions.

Mr Webb expressed concern that any initial cap would likely represent "the thin end of the wedge", with complete abolition potentially following. He emphasised that these changes come at a particularly inopportune moment when both workers and businesses need encouragement to prioritise pension savings.

Companies currently benefit from avoiding the 15 per cent National Insurance levy on the portion of wages directed into employee pensions through salary sacrifice arrangements.

Under the proposed reforms, a business with an employee earning £50,270 who allocates 10 per cent to their pension would face increased annual costs of £450.

Steve Hitchiner, who chairs the Society of Pension Professionals tax group, indicated that numerous employers would likely reduce pension scheme benefits to offset these additional tax burdens.

Research conducted by HM Revenue and Customs (HMRC) revealed widespread corporate resistance to any modifications, with businesses cautioning that changes would lead to "reduction of benefits" for employees and could "disincentivise saving into a pension".

The tax authority's findings also highlighted concerns about potential negative impacts on workforce morale.

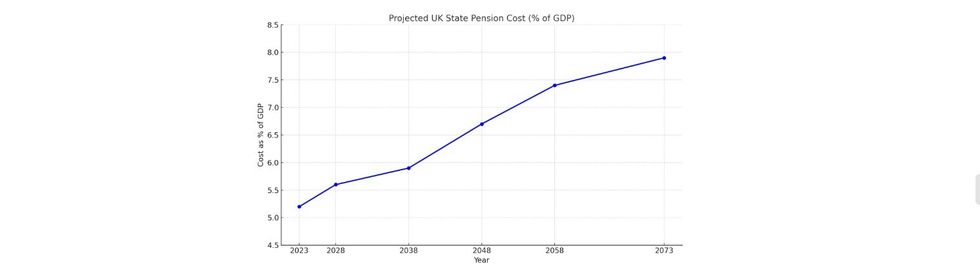

How much will the state pension cost as a percentage of gross domestic product (GDP) ? | ONS / CHAT GPT

How much will the state pension cost as a percentage of gross domestic product (GDP) ? | ONS / CHAT GPT Steven Cameron, the pensions director at Aegon UK, has cautioned against hasty modifications to pension taxation ahead of the Budget.

He emphasised that retirement savings currently provide "a range of valuable tax perks" and urged the Chancellor to "remember the positives of pensions" for both savers and the broader economy.

Mr Cameron highlighted that workplace pensions remain "a fantastic deal" due to employer contributions, noting that any increase in income tax rates would correspondingly enhance the value of pension tax relief.

He stressed the importance of maintaining "long-term policies for long-term pension planning, not short-term tax tinkering".

More From GB News