Pension savers at risk of losing £33,000 unless they make account change

GB News

Authorities launch urgent campaign as pension crime hits £17.5million in 2024

Don't Miss

Most Read

Latest

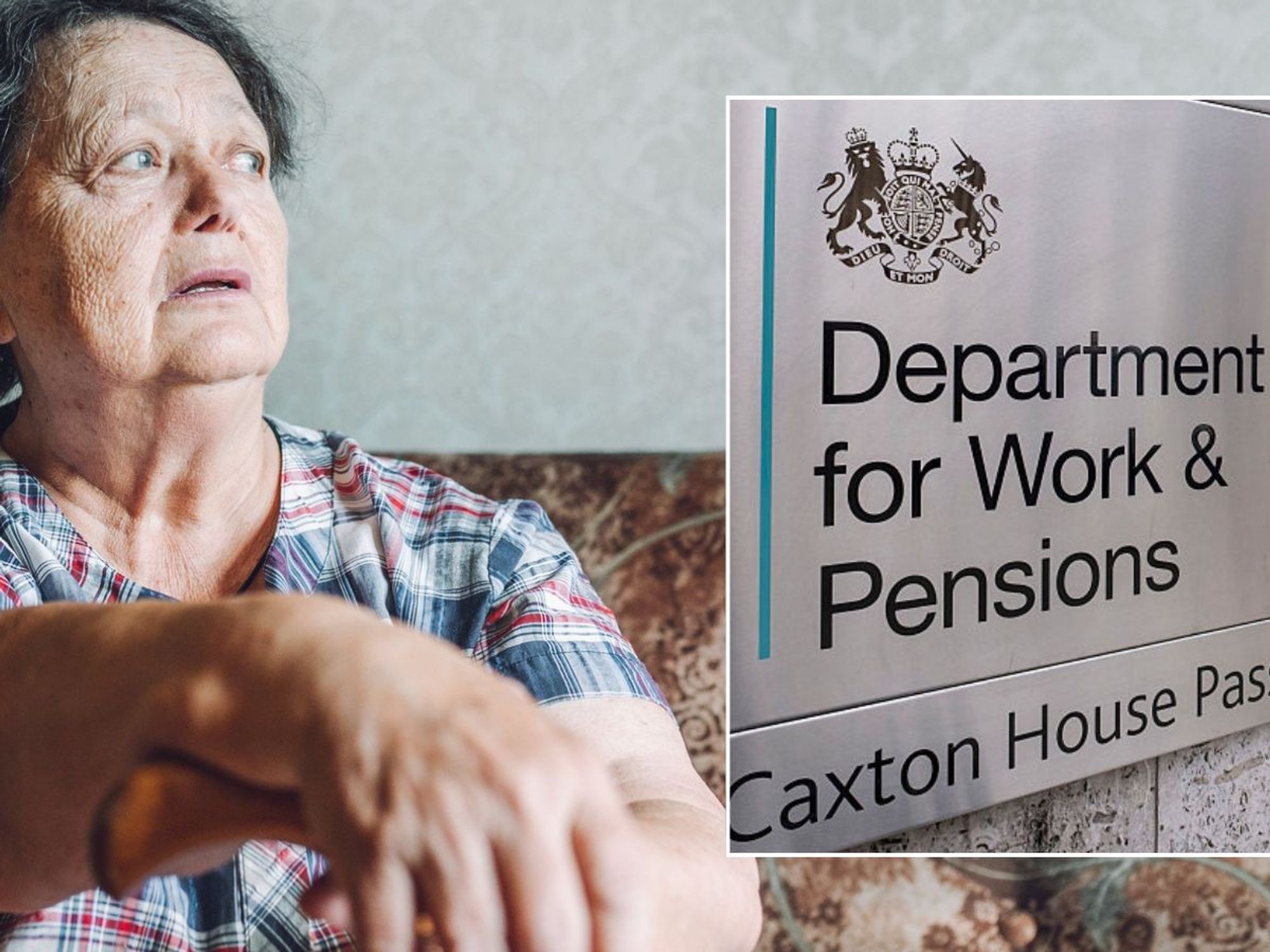

Retirement savers face potential losses of more than £33,000 each if they fail to tighten security on their pension accounts, officials have warned.

Action Fraud has issued a critical alert as criminals step up attacks on retirement savings, with scams stripping more than £48,000 a day from accounts across Britain.

New figures show pension fraud has already cost victims over £17.5million in 2024, with each case averaging losses of £33,848.

Authorities say both current retirees and workers still paying into pensions are being targeted by increasingly sophisticated scams, leaving many unaware until it is too late.

Officials have described pension fraud as one of the most financially devastating crimes affecting older Britons.

In response, Action Fraud has joined forces with the Pension Scams Action Group to launch a public awareness campaign.

The initiative aims to warn savers of common vulnerabilities, explain how criminals exploit pension systems, and provide practical steps for account protection.

Authorities said the campaign represents a major escalation in the fight against retirement crime, combining fraud prevention expertise with pensions industry knowledge.

Fraudsters are after retirement savings

|GETTY

Fraudsters are targeting people at all stages of retirement, from those still contributing to schemes to those already drawing down their savings.

Tactics include convincing victims to share personal details, redirect pension withdrawals, or invest in fake schemes.

Security experts say criminals adapt their approach depending on whether the victim is still saving or already accessing their funds, making vigilance essential for everyone.

Officials stress that every pension holder must review their account security immediately.

Authorities say swift action now could prevent thousands of older Britons from joining the growing list of victims.

| PARecommended actions include updating passwords and login details, monitoring account activity regularly, contacting providers directly over any unusual requests, and avoiding unsolicited pension offers.

Authorities say swift action now could prevent thousands of older Britons from joining the growing list of victims.

Campaign organisers are working with pension providers to distribute information directly to customers.

Guidance will also be available through online portals and financial advice services.

The government has urged all savers to report suspicious approaches through official fraud reporting channels.

Industry bodies have warned that the true scale of pension crime could be far higher than reported figures.

Many victims do not come forward due to embarrassment or lack of awareness that they have been scammed.

Officials said increased reporting is essential to disrupt organised crime groups behind the fraud.

The government has urged all savers to report suspicious approaches through official fraud reporting channels.

| GETTYThe crackdown is expected to include closer cooperation between regulators, banks and law enforcement.

Experts believe raising awareness quickly is the best way to prevent further large-scale losses.

Consumer watchdogs have also urged pension schemes to strengthen authentication systems.

They argue that providers must take greater responsibility for safeguarding members’ savings.