Pension disaster ahead as retirement savings face 87% tax bill under Rachel Reeves's 'substantial' reforms

Finance expert discusses how Reeves should deal with rising pension costs.mp4 |

GB NEWS

Inheritance tax is a levy imposed on the estates of individuals who have passed away with pension savings set to become liable for the HMRC in the years ahead

Don't Miss

Most Read

Pension savings for some families could be hammered with tax bills charged at 87 per cent under reforms announced by Chancellor Rachel Reeves in last year's Autumn Budget.

Last year, the Chancellor confirmed pension pots would be made liable for inheritance tax (IHT) in April 2027, bringing unspent defined contribution pension funds into estates and ending their current exempt status.

Estates which are passed down to the beneficiaries of those who have passed away already exceeding the £325,000 tax-free threshold will face a 40 per cent levy on remaining pension assets.

The burden intensifies for high-value estates above £2million, where the residence nil rate band reduction combines with standard IHT to create particularly severe charges on pension wealth passed to beneficiaries.

Pension savings face a 87 per cent tax bill under the Chancellor's plans

|GETTY

For pensioners dying after age 75, beneficiaries must pay income tax on withdrawals at their personal rates, which can reach 45 per cent for higher earners. This income tax applies alongside the 40 per cent inheritance levy, creating a double taxation effect that can consume 67 per cent of the pension value.

The situation deteriorates further when pension assets push estate values beyond £2million. Each pound above this threshold reduces the residence allowance by 50p, effectively adding another layer of taxation.

A £350,000 pension pot in such circumstances could generate £304,500 in combined taxes, representing an 87 per cent effective rate.

Government projections indicate approximately 10,500 additional estates will face inheritance tax charges annually once these pension rules commence.

Older Britons are already concerned about the rising tax burden | GETTY

Older Britons are already concerned about the rising tax burden | GETTYJonathan Watts-Lay, the director at WEALTH at work, warned: "The introduction of IHT on pensions could result in substantial tax charges for some.

"Those most likely to be affected are individuals with larger pension pots, especially if those savings were intended to be passed on to family."

He notes that escalating living expenses, extended retirement periods and care costs might deplete many pension funds naturally during retirement, limiting the impact.

"However, people will need to review their individual circumstances," he cautioned.

Financial planning approaches require fundamental revision before the 2027 deadline arrives.

Mr Watts-Lay explained: "From an IHT perspective, it could now be better to spend pension savings first and preserve other assets for later on.

"This is the opposite approach to what has previously been the case."

Currently retired individuals with substantial non-pension assets should reassess their withdrawal strategies. Those yet to retire need not act immediately, as draft regulations remain subject to potential amendments.

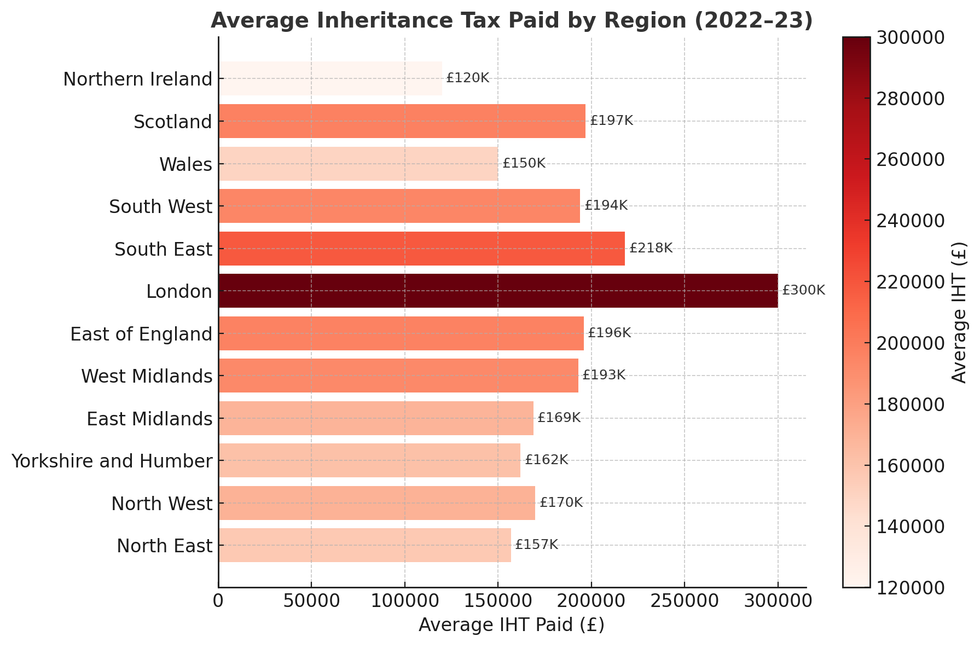

Average Inheritance tax paid by region | CHATGPT/ONS

Average Inheritance tax paid by region | CHATGPT/ONSMr Watts-Lay recommends exploring workplace financial education programmes and regulated advisory services through employers.

"It's always worth speaking to your employer to find out what support they provide to help staff improve their finances," he advises.

Earlier this week, Ms Reeves said: "Under this Government, we have seen five interest rate cuts that have helped bring down costs for families and businesses and today’s forecast shows that inflation is due to fall faster than previously predicted.

"At the Budget later this month I will take the fair choices that are necessary to build the strong foundations for our economy so we can continue to cut waiting lists, cut the national debt and cut the cost of living."

More From GB News