Pensioners to get ‘headroom’ for retirement savings but millions face paying more taxes

Fiscal drag is expected to pull pensioners into higher tax brackets

Don't Miss

Most Read

Pensioners are expected to benefit from the recent drop in inflation with there being more “headroom” to navigate the cost of living crisis, experts claim.

The Consumer Price Index (CPI) rate of inflation for the 12 months to March 2024 eased to 3.2 per cent.

This is a far cry from the heights of the record high rates of 11.1 per cent seen in October 2022 and indicates the UK economy is improving.

Older people are been forced to contend with inflation-hiked prices for goods and services, as well as soaring energy bills in recent years.

While the triple lock has resulted in pensioners being awarded sizable boosts to their retirement payments, the impact of inflation on peoples’ incomes has slashed any benefit to this hike.

However, with inflation falling close to the Bank of England’s desired target of two per cent, experts are suggesting that the cost of living struggles of older people could soon be over.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Pensioners will benefit from inflation falling but many will be hit by a tax

|GETTY

Becky O’Connor, the director of Public Affairs at PensionBee, said there is more “headroom” for retirement incomes going forward, explaining: “Inflation is edging closer to normality, but it remains slow progress.

“For savers and investors, any nudging down in inflation while interest rates and investment growth remain higher on the whole, means greater rewards over time.

“In the context of average wage rises, if this dynamic continues, this could mean people feel more able to build savings back up and boost overall household resilience once again.

“Pensioners have just received a boost to state pension income of 8.5 per cent as a result of April’s triple lock rise.

“So this should mean enough headroom for older people, especially those who are dependent on their state pension for retirement income, keep on top of their bills.”

This “headroom” will be needed as recent research suggests that 1.6 million more pensioners will be dragged into paying income tax within the next four years.

This is due to fiscal drag which could have been avoided if the personal allowance had risen with inflation.

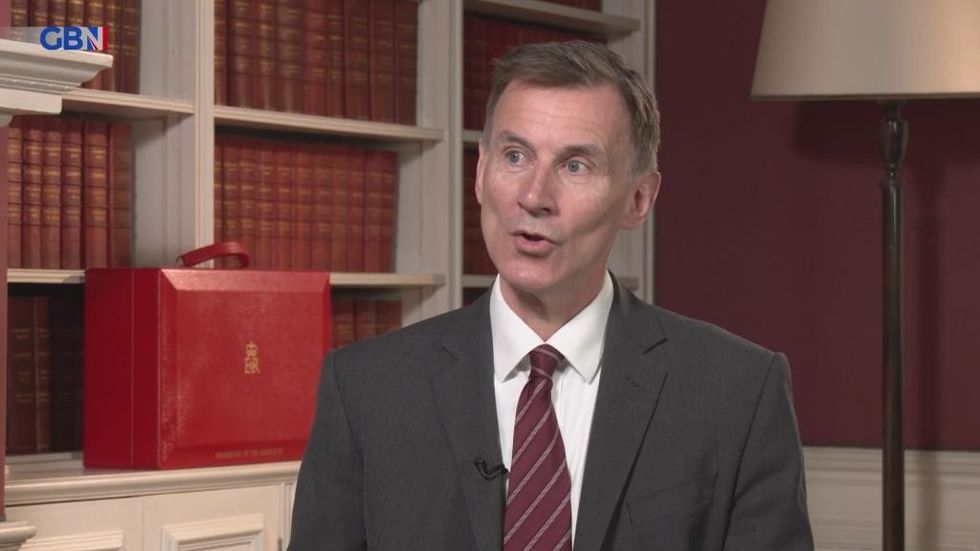

Last year, Chancellor Jeremy Hunt revealed the Government’s decision to freeze tax allowances until 2028 in what is being referred to as a “stealth tax”.

LATEST DEVELOPMENTS:

Jeremy Hunt confirmed tax allowances would be frozen last year

| GB NewsHenrietta Grimston, the director of financial planning at leading UK wealth manager Evelyn Partners, explained: “Not many pensioners will be complaining about a boost to their weekly state pension payments.

“But as this latest increase - like those of the last couple of years - comes against a background of frozen tax thresholds, it does mean increasing numbers will be pushed into paying income tax, or into a higher tax band.

“Most of those receiving the new full rate state pension will only be able to draw £1,068 in income that is not covered by other allowances before they start paying income tax at the basic rate of 20 per cent in the new tax year.

“And those with more substantial sources of private income who are close to the higher rate threshold of £50,270 could be pushed into paying tax at 40 per cent on some of their income.”